Column: JPMorgan tweet is a reminder that its personal finance advice is worthless

Apparently mistaking itself for a stand-up comic — or perhaps a granite-and-mortar version of Suze Orman — JPMorgan Chase took to Twitter on Monday to offer customers some jokey personal finance advice.

Our advice to JPMorgan: Stay off Twitter.

JPMorgan’s tweet drew immediate rebukes from critics such as Sen. Elizabeth Warren (D-Mass.) and Rep. Katie Porter (D-Irvine) as well as ridicule from a vast audience online. Within hours, the bank had deleted the tweet. But like almost everything on social media, it lives on.

The tweet was cast in the form of a dialogue between a customer and his or her bank account. It was one of a series of “#MondayMotivation” tweets the bank evidently offers every week.

“You: Why is my balance so low?”

The “bank account” responds, “make coffee at home...eat the food that’s already in the fridge...you don’t need a cab, it’s only three blocks.”

My question for you, Mr. Dimon, is how should she manage this budget shortfall while she’s working full-time at your bank?

— Rep. Katie Porter asks Morgan’s CEO about the plight of a Morgan employee

This genre of personal finance advice has long been discredited. Personal finance expert Helaine Olen calls it “completely fallacious.”

It’s a scam perpetrated by finance gurus like Orman and banks such as, well, JPMorgan Chase, obscuring that “the real issue is the continuing hollowing out of the middle class,” Olen writes. Instead, average consumers are prompted to blame themselves for indulging in trivial luxuries.

In that vein Warren, in a reply tweet, helpfully rewrote Morgan’s version:

“@Chase: why aren’t customers saving money? Taxpayers: we lost our jobs/homes/savings but gave you a $25b bailout.”

JPMorgan’s tweet demonstrated a stunning tone-deafness about the economic realities facing ordinary Americans — including the big bank’s own minimum-wage employees.

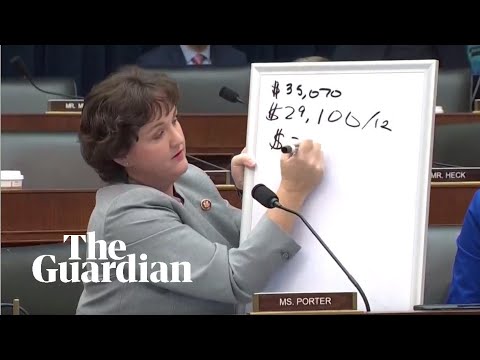

Porter had made that point with Morgan CEO Jamie Dimon during a congressional hearing April 10, when she outlined the household budget of a JPMorgan low-wage worker, based on a want ad she found on Monster.com for a starting position in Irvine as a teller for Morgan — $16.50 an hour, or about $34,000 a year, $29,000 after tax.

After paying rent for a one-bedroom apartment for herself and a daughter, a payment on a 2008 car, utilities, phone, gas, after-school child care and a minimal food budget, Porter’s sample employee is nearly $600 in the red every month.

“My question for you, Mr. Dimon, is how should she manage this budget shortfall while she’s working full-time at your bank?”

“I don’t know,” Dimon replied. “I’d have to think about that.” He repeated the line twice more, robotically, under Porter’s questioning.

Dimon, by the way, collected $30 million in compensation last year. That sum included personal use of company planes and cars, company-paid home security and travel for his spouse “to attend business-related events where spousal attendance is expected or customary,” whatever those are.

JPMorgan’s tweet was part of a stream of personal finance advisories with which the bank fills its Twitter feed and customer service web pages. The advice is offered for free, which is about what it’s worth.

How to finance a “gap year” between high school and college? Among Morgan’s suggestions are crowdfunding and looking for “lower-cost programs.” How to finance a home improvement project? Morgan suggests that instead of cash, a homeowner use a credit card or a home equity line of credit (both of which can be acquired from JPMorgan Chase).

The bank advises you to “give your wallet a weekend off” by “volunteering your time,” checking out free entertainment (“local festivals and block parties”) or just staying home: “When was the last time you sat down with your family for a night of relaxing conversation? Or had a friend over for coffee just to chat? Or snuggled up with a favorite book?”

As Porter reminded Dimon, none of these options would work for a JPMorgan Chase bank teller who ends every month in the red.

JPMorgan Chase responded to the tide of vituperation generated by its Monday tweet with a sheepish mea culpa: “Our #MondayMotivation is to get better at #MondayMotivation tweets. Thanks for the feedback Twitter world.”

It sounds as though Morgan isn’t getting the message, which was: Pay your workers more, so they don’t need your advice on how to make ends meet.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email michael.hiltzik@latimes.com.

Return to Michael Hiltzik’s blog.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.