Merger of Aecom and URS to create giant L.A. construction firm

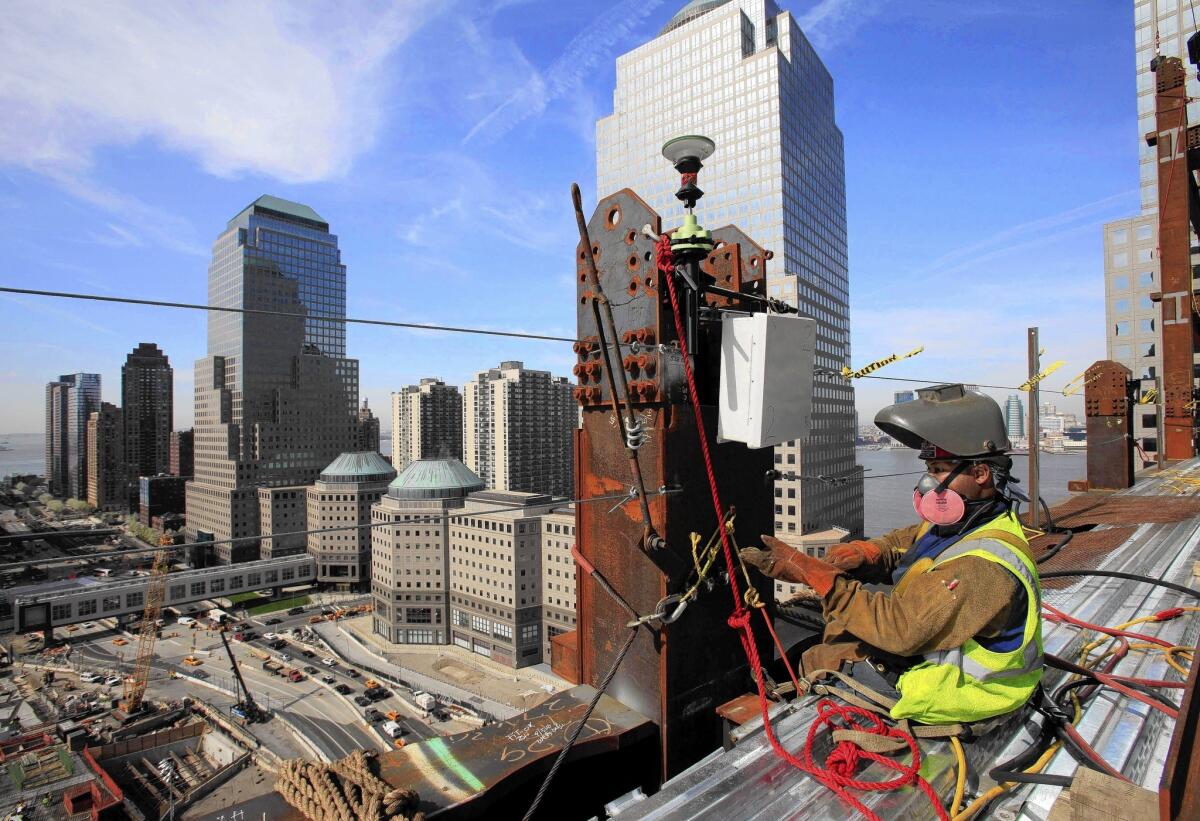

Los Angeles construction giant Aecom Technology Corp. — which has worked on downtown L.A. high-rises, World Cup stadiums and New York’s new World Trade Center — will buy its San Francisco rival, URS Corp., in a $6-billion deal.

The merged company will be among the world’s largest firms in the construction and engineering sectors, in which Los Angeles already boasts substantial clout and expertise. It will also be the largest public company within the city limits.

The companies had a combined $19 billion in revenue last year and employ about 95,000 people in 150 countries.

“It will revitalize the Los Angeles region as being a place of intellectual capital, much like it was during the heyday of the aerospace years,” said C. Kerry Fields, a professor at USC’s Marshall School of Business and an expert in construction and engineering. “It has a dramatic and dynamic impact on our economy.”

Aecom announced Sunday that it would pay about $4 billion for URS and assume about $2 billion in debt.

URS has a strong foothold in the energy sector. It has also designed or managed several key Southern California projects, including the 22 Freeway, the new UCLA Ronald Reagan Medical Center, the Gold Line eastside extension and several Los Angeles community colleges.

The deal comes as some worry about companies moving out of California. Toyota Motor Corp. announced in late April that it would close its Torrance headquarters and ship 3,000 jobs to Texas. In February, Occidental Petroleum announced it was moving its headquarters to Houston after nearly a century in Los Angeles, where the energy giant was founded.

Michael S. Burke, Aecom’s president and chief executive, said he expects to add to the more than 1,300 employees both companies employ in Los Angeles, most of them high-paying engineers, architects and construction managers. He declined to specify how many positions could be added but said the Los Angeles operations would see significant growth.

Aecom has 577 employees in Los Angeles and URS has 735.

“The corporate team that’s been running this business will now be twice the size,” Burke said. “We’ll be hiring more and moving more people here.”

The company operates out of offices in downtown’s City National Plaza and is committed to the city, Burke said.

“Los Angeles is one of the most exciting cities in the world,” Burke said. “It has a great pool of talent. It’s a gateway to the Pacific. It’s a cosmopolitan city that is starting to grow rapidly.”

Aecom generates revenue through architecture, construction, management and finance. Its business includes marquee projects around the globe, including construction management for the new World Trade Center and the design for a new subway in Manhattan.

Aecom is overseeing the planning of the complex for the 2016 Summer Olympics in Rio de Janeiro, after having recently designed stadiums for Brazil’s World Cup soccer championships. Aecom is also working on the design and management of a 42,000-seat stadium for the 2018 World Cup in Moscow.

Locally, Aecom designed the new Los Angeles Police Department headquarters and is managing the expansion of the international terminal at Los Angeles International Airport.

Still, Burke acknowledged, many people outside the engineering and construction world have never heard of his company.

“We should be a little more known than we are, but not many people are buying bridges and super-tall buildings,” Burke said. “The people that buy bridges and subways certainly know us.”

Under terms of the deal, Aecom will pay $56.31 a share for URS. Stockholders of URS will receive $33 in cash and 0.734 shares of Aecom stock for each share of URS Stock. The deal has been approved by the boards of both companies and is expected to close in October.

With the acquisition, Aecom will have the highest revenue of any publicly traded company in the city of Los Angeles. Outside of the city limits, Walt Disney Co., in Burbank, and Amgen Inc. in Thousand Oaks had significantly higher revenue last year.

Aecom will be the second-largest engineering and construction company in the United States, behind Fluor Corp. of Irving, Texas.

Los Angeles Mayor Eric Garcetti was thrilled at the massive expansion of a local company. “This is a strong signal of confidence in L.A.’s economy and in our brand as a place to do business,” the mayor said in a statement.

Aecom saw an opportunity in the recent troubles of URS. The company has had a rough run since February, when executives forecast lower-than-expected revenue growth, largely because of poor performance in its oil and gas business. URS’ president and chief operating officer, Bill Lingard, resigned at the time.

The company was also struggling with federal cutbacks on a major chemical weapons demilitarization project, which led to a projected $355 million hit to annual revenue.

The hedge fund Jana Partners began acquiring a larger stake in URS last year, which led to a shake-up on the board of directors in March. At the time, Jana and URS agreed to a strategic review of the company’s operations, intended to evaluate “all options for enhancing shareholder value.”

“There was a disconnect between the way the public was valuing that company versus the cash it was generating,” said Will Gabrielski, a senior analyst with Stephens Inc. who follows the construction and engineering sector.

Aecom has benefited from the global economic recovery, generating about 60% of its business outside the United States. Burke said he expects the company to continue to benefit from a revitalized U.S. economy.

“The U.S. market is rebounding, especially private-sector construction,” Burke said. “We’re getting orders for more new tall towers than we ever have.”

Although the two companies have competed for years, the merger gives Aecom a stronger foothold in the power distribution and oil and gas sectors, which made up nearly 40% of URS revenue last year, according to government filings.

Aecom will also take on URS’ expertise in federal contracting. URS gets 34% of its revenue from government work, largely through contracts with the U.S. Energy Department and the U.S. Army, according to the filings.

URS has been involved in massive government projects to decommission nuclear weapons sites, including at the Hanford Nuclear Reservation in Washington state, one of the nation’s most polluted nuclear production areas.

Government spending on construction is a solid, reliable source of revenue, USC’s Fields said.

“This type of industry is one that excites everyone, because it produces tangible things like buildings and government centers and highways,” he said. “These are things we can touch and feel, and as taxpayers we recognize the value proposition.”

Engineering and construction management has long been a key contributor to the Southern California economy. Jacobs Engineering Group Inc. of Pasadena, another global engineering and construction firm based in Southern California, reported nearly $12 billion in revenue last year.

“This is the driver of high-paying professional services jobs in our area,” Fields said. “These are solid service-industry jobs that provide high wages, and they’re not the ones that we can outsource.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.