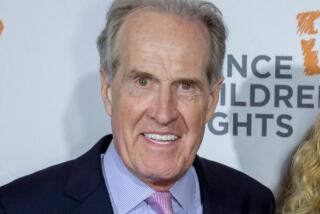

How I Made It: Attorney Hal Rosner

The gig: Hal Rosner is a partner at San Diego’s Rosner, Barry & Babbitt, one of the largest law firms in the country specializing entirely in consumer auto fraud cases. Founded by Rosner in 1985, the firm employs 10 full-time attorneys and reviews 200 to 400 potential cases a month, taking on about 10% of them. To date, Rosner has handled more than 1,000 auto fraud cases in the Golden State, winning millions of dollars for his clients. It has won him begrudging respect from the auto industry; last year the head of the California New Car Dealers Assn. said Rosner “has about every car dealer in the state scared silly.”

Born to litigate: Some boys like baseball, some like comics. Rosner went in for arguing. The cake for his fifth birthday party said: “Happy Birthday Lawyer Hal.” While other kids read Hardy Boys mysteries, Rosner was diving into biographies of his hero, Clarence Darrow. And when he graduated from high school in San Jose, friends wrote, “good luck suing companies” in Rosner’s yearbook. So it came as a surprise to no one when, after graduating from UC Berkeley with a double major in rhetoric and economics, he enrolled in law school at the University of San Diego.

A new mentor: In law school, Rosner traded in his dreams of handling the next Scopes Monkey Trial. Under the tutelage of Bob Fellmeth, a consumer attorney known for his pioneering work with Ralph Nader in the 1960s and ‘70s, Rosner became captivated with the idea of representing regular folks in fights with big companies. The two were inseparable and even went into practice together, briefly, after Rosner graduated. Fellmeth helped Rosner take on his first auto case, using California’s landmark 1983 lemon law. The car in question: Rosner’s own.

Today, Rosner is an adjunct professor at UC San Diego and also instructs Marine Corps and Navy attorneys at Camp Pendleton on consumer protection issues. “It’s upsetting that almost no law schools teach consumer law these days,” Rosner said. “You can get pet law classes, but nothing for consumers.”

A breakthrough: For years, Rosner ran a fairly broad practice, taking cases against banks, telephone companies and other utilities. That all went out the window about a dozen years ago, when Rosner took on Thompson vs. 10,000 RV Sales Inc., which involved improper disclosure by the dealer of trade-in value in the sale of a recreational vehicle.

In the case, Rosner dusted off the law books to try an innovative — and risky — strategy, applying California’s Automotive Sales Finance Act, a decades-old statute that grants unusually large attorneys’ fees and damages with a favorable verdict. If Rosner lost, it could cost him a lot of money, but if he won, he’d be opening the door to take on countless fraud cases involving sums normally too small for lawyers working on contingency to handle. Rosner prevailed. “That changed everything,” he said. “It tipped me off to focus my practice on the way vehicles are financed.”

At ‘war’: A huge portion of dealership profits — and some say shenanigans — take place in the windowless finance rooms in the back of every lot. Known as the “F&I; Office” or “the box,” it’s where insurance policies, extended warranties and undercoat are packed into deals, and where Rosner contends that consumers can get robbed blind without realizing it if they’re not careful. Few lawyers take on such cases because they’re technical and the laws are arcane, but it’s fertile terrain for the right lawyer. And that just happens to be Rosner’s sweet spot.

“In the last decade I’ve been in a massive war with the auto industry when it comes to finance issues,” Rosner said. “I’m willing to bet that I can find something illegal in 10% to 20% of all car sale contracts.”

Making friends: Rosner’s aggressive tactics haven’t won him many fans among dealers. After a lengthy dispute with a San Diego area dealership over backdated sales contracts, Rosner took the same argument to court against a sister lot owned by the same company in Riverside County. That case, now on appeal, provoked the dealership’s general manager to launch a website criticizing Rosner and his tactics: https://www.halrosner.com. Rosner acknowledged he should have grabbed that URL a long time ago, but shrugs off the site. “It goes with the territory,” he said.

When court is not in session: The 6-foot-2 Rosner calls himself a “basketball addict” and, at 54 years old, still plays in two tournaments a year. A bruising small forward who likes a lot of contact, he said he “can still touch rim” and works out regularly with his 14-year-old son — when he isn’t taking his 12-year-old daughter shopping. Rosner’s other hobby is poker; the game has taught him a lot about his day job, which he said benefits from poker-style analysis of changing odds.

“Cases are like Texas hold ‘em. I know what my first two cards are, but a bad card can come at any time,” Rosner said. “I play poker for fun but I gamble for a living.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.