Data Depict a Solidly Growing Economy

The nation’s employers added a net 146,000 jobs in June, the government said Friday in a report generally seen as evidence of an improving labor market and a solidly growing economy.

Although the gain fell short of consensus predictions of 200,000 jobs, any disappointment was tempered by revisions raising the previous two months’ increases by 44,000 positions. Further, the unemployment rate fell to 5%, down from 5.1% in May and the lowest level since September 2001, the Labor Department reported.

“It’s a solid but not robust or spectacular labor market,” said Allen Sinai, chief economist for Decision Economics.

With labor-force growth slowing because of the aging of baby boomers and other demographic trends, the country needs 130,000 additional jobs a month to absorb new workers, Sinai said. Job growth this year has averaged about 181,000 a month -- enough to drive down unemployment.

“That trend is good for American workers,” Sinai said, adding that workers also were enjoying strong growth in average compensation. Although average hourly earnings rose only 0.2% in June, for an annualized increase of 2.7%, total compensation -- including benefits, bonuses and other nonwage gains -- was up 5%, Sinai said.

Stock market indexes rallied broadly on Friday’s report, as investors saw it as more evidence of a “Goldilocks” economy: strong enough to fuel continued consumer spending but not so robust as to prompt the Federal Reserve to raise interest rates more aggressively.

Analysts have been heartened by the strengthening of the job market despite higher oil prices. A stronger employment picture has boosted consumers’ incomes and confidence. Meanwhile, corporate profits have continued to rise, helping companies accumulate huge cash hoards.

The economy grew at an annualized 3.8% rate in the first quarter, and is generally expected to stay above a 3% pace for the rest of the year. However, employers continue to be cautious about hiring amid soaring energy and healthcare costs as well as intense competition that limits their ability to raise prices.

And inflation continues to be a concern, prompting the Fed to continue its yearlong program of raising interest rates, analysts said. Unit labor costs -- compensation per unit of worker output -- surged 4.3% in the first quarter, said Michael Swanson, senior economist for Wells Fargo Bank. That measure has been higher only twice since the early 1990s -- for two quarters in 2000, he said.

“The Fed has to be concerned about that,” Swanson said.

June’s job growth followed revised gains of 104,000 in May and 292,000 in April. The latest gains were spread across many industries, with some of the biggest increases in sectors that tend to pay higher wages. Professional and business services added 56,000 jobs while education and health services gained 38,000. Riding the sizzling housing market, construction jobs rose 18,000 to a record high.

Manufacturing jobs, however, tumbled by 24,000 to a 55-year low. It was the fourth straight monthly decline as factories continued to boost productivity while auto assembly and parts plants cut production.

However, if recent growth in factory orders is any indication, manufacturing employment could pick up the rest of this year, said David Huether, chief economist for the National Assn. of Manufacturers. “Faster output is just around the corner,” he said.

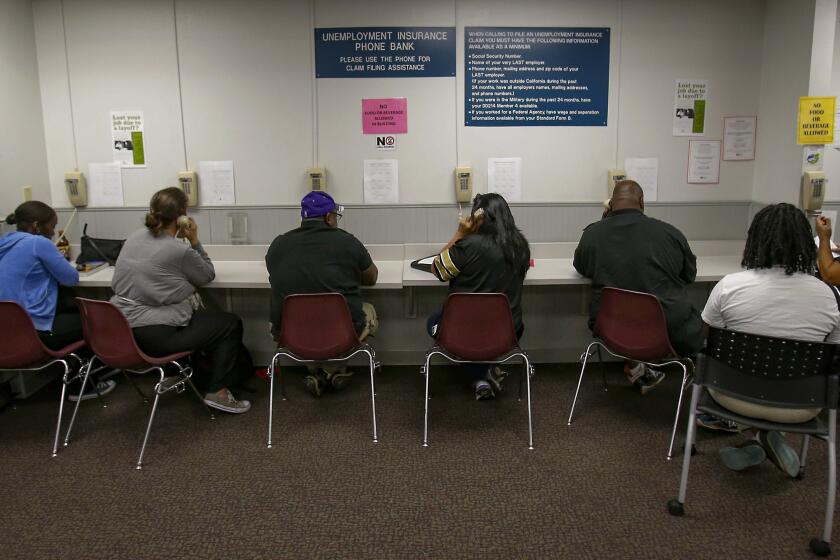

In another promising development, the number of long-term unemployed -- those jobless six months or longer -- fell to 1.33 million in June from 1.52 million in May. Persistent joblessness for many college graduates and others since the 2001 recession has been a sore thumb for the economy.

The Bush administration put the best face on the latest report.

“Today’s strong employment numbers are a reminder that the American economy is thriving,” Treasury Secretary John W. Snow said in a statement, adding that more than 1 million jobs have been created this year.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.