Will Malaysia Airlines survive the loss of Flight 370?

Even before the disappearance of its Boeing 777, Malaysia Airlines faced financial turbulence and stiff competition from low-cost carriers in Asia.

Still, airline experts say Malaysia’s flagship carrier could survive the economic blow of the disaster by responding with new management and a safety campaign, among other changes.

“The airline needs to show it is committed to safety, security and reliability,” said Henry H. Harteveldt, a travel industry analyst for advisory firm Hudson Crossing. “It has to focus on its fundamentals.”

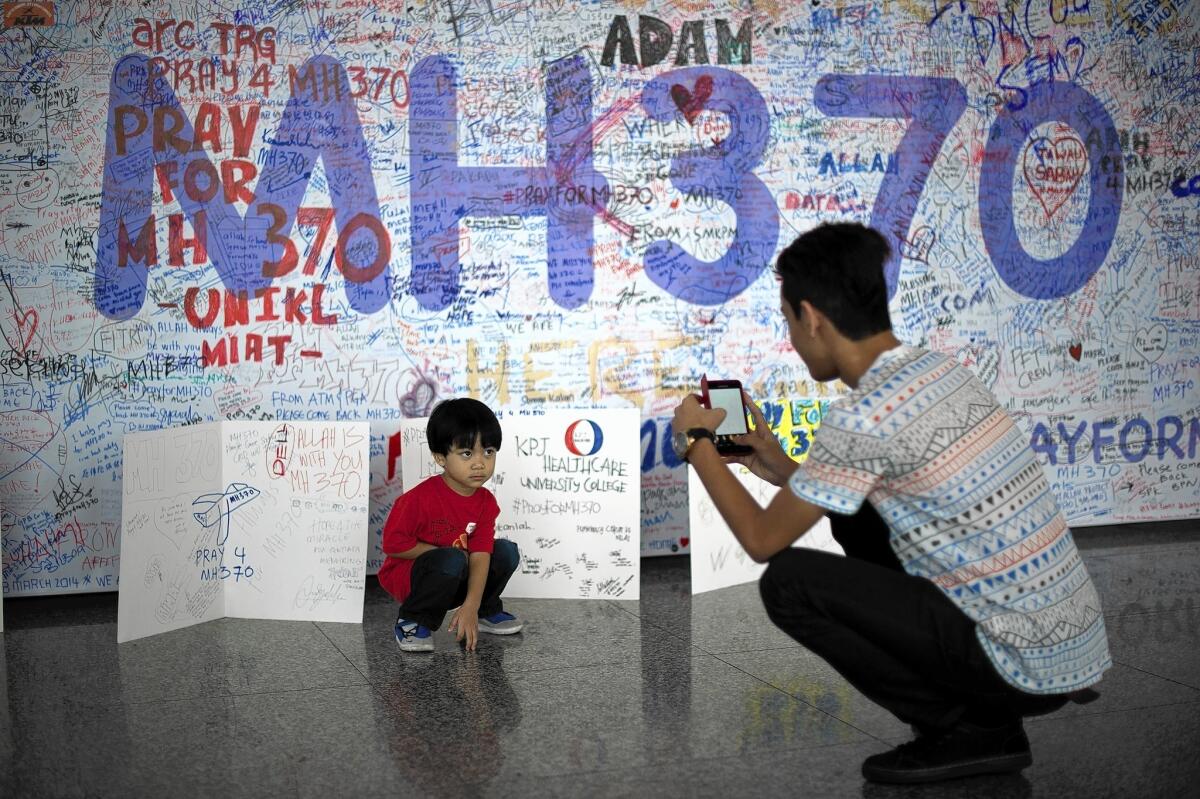

PHOTOS: The disappearance of Malaysia Airlines Flight 370

More than three weeks since Flight 370 took off from Kuala Lumpur carrying 239 people, the cause of the plane’s disappearance remains a mystery. Planes and ships from several countries are searching the Indian Ocean for wreckage.

In the past, other carriers have gone out of business after airline disasters. But industry experts say previous accidents may offer few clues on the future of Malaysia Airlines because the case of Flight 370 is so unusual.

“This is the strangest situation that I’ve ever been aware of,” said Richard Gritta, a professor of finance at the University of Portland and an expert on airline bankruptcy.

Before the plane disappeared, Malaysia Airlines had reported losses for the last two years, including $355 million for 2013. The government-backed carrier attributed the latest losses to higher depreciation and finance charges and unrealized foreign exchange losses. Competition from low-cost airlines has also cut into the carrier’s business.

Since 2011, Malaysia Airlines has been pushing a plan to turn the airline around with the addition of eight new planes, including six giant A380s. The airline didn’t respond to a request for comment on its financial future.

The airline, based in Kuala Lumpur, has offered $5,000 to the family of each passenger of Flight 370 and could pay out millions more, depending on any legal settlements of lawsuits filed by the families, experts say. The airline and Boeing Co. have been named in at least one lawsuit filed by family members.

But industry experts say the biggest financial blow to the carrier could be the long-term decline in ticket sales because of a loss of faith in the airline.

“They really need to be in the public sphere, explaining what they are doing systemically to make sure this doesn’t happen again,” said Ted Gavin, founding partner of Gavin/Solmonese, a corporate restructuring and public relations firm based in Wilmington, Del.

Malaysia Airlines could rebound from the incident much faster if investigators ultimately determine that terrorism or an airplane manufacturing flaw — and not errors by the airline or its crews — was the cause of the disaster.

“Since there is still no hard evidence of incompetence or malfeasance on the part of the airline and its workers, passengers may not automatically shun the carrier, although some clearly will,” said Jan Brueckner, an economics professor at UC Irvine.

The history of aviation disasters suggests that carriers already teetering on bankruptcy’s edge are more likely to fail after an airline disaster, while carriers on solid financial footing can go on to prosper.

Pan American World Airways ceased operations in 1991, three years after Pan Am flight 103 was destroyed by a terrorist bomb over Lockerbie, Scotland, killing all 259 people on board and 11 more on the ground.

Trans World Airlines was purchased by AMR Corp. and merged with American Airlines in 2001, five years after TWA Flight 800 exploded over the Atlantic Ocean near New York, killing all 230 people on board. Investigators concluded that the most likely cause of the disaster was an exposed wire that sparked a fuel tank explosion.

Both airlines had been struggling financially at the time of the accidents, Harteveldt said.

“In Pan Am and TWA, both suffered catastrophic loss of aircraft that were the nails in the coffin that led to their deaths,” he said.

More recently, Asiana Airlines Flight 214 clipped a sea wall and slammed into a runway at San Francisco International Airport in July, killing three people and injuring more than 180 of the 307 passengers and crew members.

Asiana now faces a grim financial future. The South Korean airline last month reported a loss of $107 million for 2013, compared with a profit of $58 million the previous year.

Meanwhile, other airlines continue to thrive even after a major airline disaster.

PHOTOS: The disappearance of Malaysia Airlines Flight 370

Air France Flight 447, carrying 228 people, was lost over the Atlantic Ocean in 2009. It took investigators nearly two years to find the plane’s black box. The carrier merged with KLM in 2003 and now operates a fleet of more than 240 planes. It recently ordered 25 long-haul aircraft from Airbus.

Malaysia Airlines may have an advantage over other privately owned carriers. Its largest shareholder is Khazanah Nasional Berhad, the Malaysian government’s strategic investment fund.

Harteveldt said he expects the Malaysian government will continue to support the airline but will insist on a management shake-up.

“There is no question they have to bring in new management and new leadership,” he said.

Twitter: @hugomartin

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.