Roots of Redstone family’s bitter rift

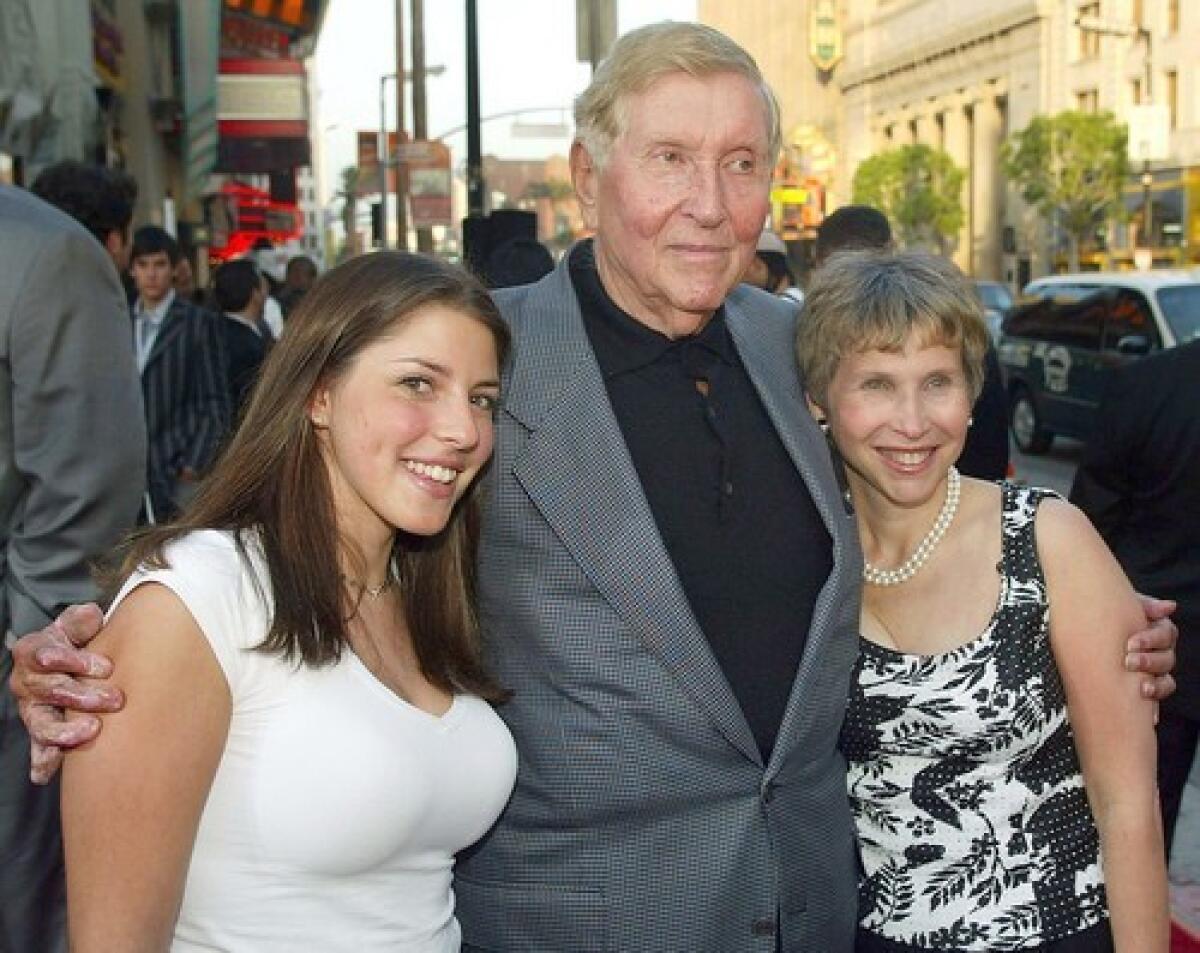

Was Sumner Redstone’s obsession with the creator of the video game “Mortal Kombat” the root of the unfolding family drama that has pitted the media mogul against his daughter and onetime heir apparent, Shari Redstone?

People who know them both suggest that the billionaire’s dealings in the second-tier video game company Midway Games Inc. was a flashpoint in their ruptured relationship.

Sumner, who had built a $50-billion empire with such assets as CBS and Viacom’s Paramount Pictures, MTV and Nickelodeon, envisioned video games as the next growth engine for the entertainment business. He steadily began accumulating shares in Chicago-based Midway in 1998.

Though Midway was mostly an also-ran in the video game business, Sumner was determined to turn the company into a major contender by marrying its content with the marketing and distribution might of MTV and Paramount.

His buying spree in Midway was done mostly through National Amusements Inc., the family theater circuit through which he controls Viacom and CBS. He gained control of nearly 90% of Midway’s stock through purchases between April 1998 and December 2005.

The investment eventually drew strong objections from Shari, particularly as Midway’s shares began to decline, said people with knowledge of the situation. Shari, 53, is not only president of National but its second-largest shareholder after her 84-year-old father.

Shari apparently concluded that Sumner’s purchases were artificially inflating Midway’s stock price -- a wasteful application of National’s money.

One person with knowledge of the situation said that Shari stood up to her father, telling him: “Enough -- we’re not propping that stock up.”

By then, the Viacom board had moved to distance itself from any conflict of interest Sumner’s control of Midway could present. In 2004, after he began to press Viacom executives to explore an acquisition of Midway, the board formed an independent committee to scrutinize any such deal but never moved toward an acquisition. Viacom executives privately were dismissive of Midway.

Spokespeople for Shari and Sumner declined to comment Wednesday.

Shari’s opposition marked the start of the bad blood between Shari and her father, who was not accustomed to being challenged by any of his lieutenants, including his daughter. The disagreements between Sumner and Shari have since multiplied, breaking out into a public feud in recent weeks over such issues as succession, corporate governance and the future of the family’s theater chain.

Negotiations to resolve their differences have been underway for months. Relations are so strained that Shari is considering legal action against her father, with the Midway situation one bone of contention.

Sumner’s financial arrangements for buying Midway stock put National in a vulnerable position. He had pledged National stock as collateral against a $425-million loan from Citicorp that he was using to buy Midway shares, according to documents filed with the Securities and Exchange Commission.

In late 2005, as Midway shares were declining, Citicorp issued a margin call against Sumner’s holdings -- a demand that customarily requires investors to restore the collateral value lost or face the seizure of their shares.

That means Citicorp could have seized Sumner’s National shares, the foundation of the family fortune.

A forced sale of Midway stock could have harmed National both by driving down the value of Midway shares, which the theater company also owned, and by putting at risk its ability to control, along with Sumner, the video game outfit.

In late December 2005, Sumner transferred the bulk of his personal holdings in Midway to National, which in turn agreed to pay off the Citicorp loan, according to SEC documents.

That gave National control over Midway and released its shares from the Citicorp lien. Shari supported the December transaction and even recommended it to National’s board. She was probably motivated by the need to unencumber National’s shares.

Sources say Shari opposed a second purchase of Midway shares by National from Sumner earlier this year. In February, National purchased an additional 12.4 million shares from Sumner for about $85 million, a negotiated price of $6.87 a share, roughly where the stock closed that day. The transaction brought National’s ownership to 74.3%, with Redstone directly holding another 13.6%.

Shari opposed using National’s money to buy Sumner’s Midway shares, according to people familiar with the matter who declined to be named because of the sensitivity of the situation.But the stock has been a dog. From a high of $23.26 in December 2005, the shares have plummeted. They closed Wednesday at $5.84, ahead of second-quarter earnings, which will be released today.

Shari is not the only member of the Redstone clan to raise questions about Midway. In a 2006 lawsuit, her brother, Brent, contended that Sumner had used National -- of which Brent was then a part-owner -- as a personal piggy-bank, and cited the repayment of the margin loan as an example of the family company’s “putting the interests of Sumner Redstone first and engaging in self-dealing.” Brent sold his National stake back to the company as part of a settlement earlier this year.

Sumner and National acquired their first Midway shares in 1998, when the company was spun off from Williams Industries, a pinball and slot machine maker in which they owned stakes. By May 2004, his and National’s combined holdings totaled more than 50%.

Midway has been a lackluster performer for years. Unable to duplicate the success of its best-known franchise, “Mortal Kombat,” the company has lost money since fiscal 2000, according to its latest annual report dated Dec. 31, 2006.

michael.hiltzik@latimes.com

claudia.eller@latimes.com

Times staff writer Thomas S. Mulligan contributed to this article.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.