To give or not to give can be a taxing question

Dear Liz: A good friend who is childless wishes to give his property to my daughter before his death. He has been an informal uncle for the whole 50 years of my daughter’s life, and we are, in effect, his family. However, I am concerned that the gift tax may be more than he bargained for. He is not tax-aware, and earns very little, so his tax knowledge is skimpy. He owns his property outright, however.

I know that someone can give as much as $14,000 without having to file a gift tax return and that there is a “‘lifetime exemption” of more than $5 million. If his property is worth, say, $500,000, can he be tax free on a gift of that magnitude by, in effect, using his lifetime exemption?

Answer: Essentially, yes, but he may be creating a tax problem for your daughter.

Gift taxes are not something that most people need to worry about. At most, a gift worth more than $14,000 per recipient would require the giver to file a gift tax return. Gift taxes wouldn’t be owed until the amount given away in excess of that annual exemption limit exceeds the lifetime exemption limit of $5.49 million.

Capital gains taxes are another matter and should always be considered before making gifts. Here’s why.

Your friend has what’s known as a “tax basis” in this property. If he sold it, he typically would owe capital gains taxes on the difference between that basis — usually the purchase price plus the cost of any improvements — and the sale price, minus any selling costs. If he has owned the property a long time and it has appreciated significantly, that could be a big tax bill.

If he gives the property to your daughter while he’s alive, she would receive his tax basis as well. If she inherited the property instead, the tax basis would be updated to the property’s value at the time of your friend’s death. No capital gains taxes would be owed on the appreciation that took place during his lifetime.

There’s something else to consider. If your friend doesn’t make much money, he may not have the savings or insurance he would need to pay for long-term care. The property could be something he could sell or mortgage to cover those costs.

If he gives the property away, he could create problems for himself if he has no other resources. Medicaid is a government program that typically pays such costs for the indigent, but there’s a “look back” period that could delay his eligibility for coverage. The look-back rules impose a penalty for gifts or asset transfers made in the previous five years. He should consult an elder-law attorney before making such a move.

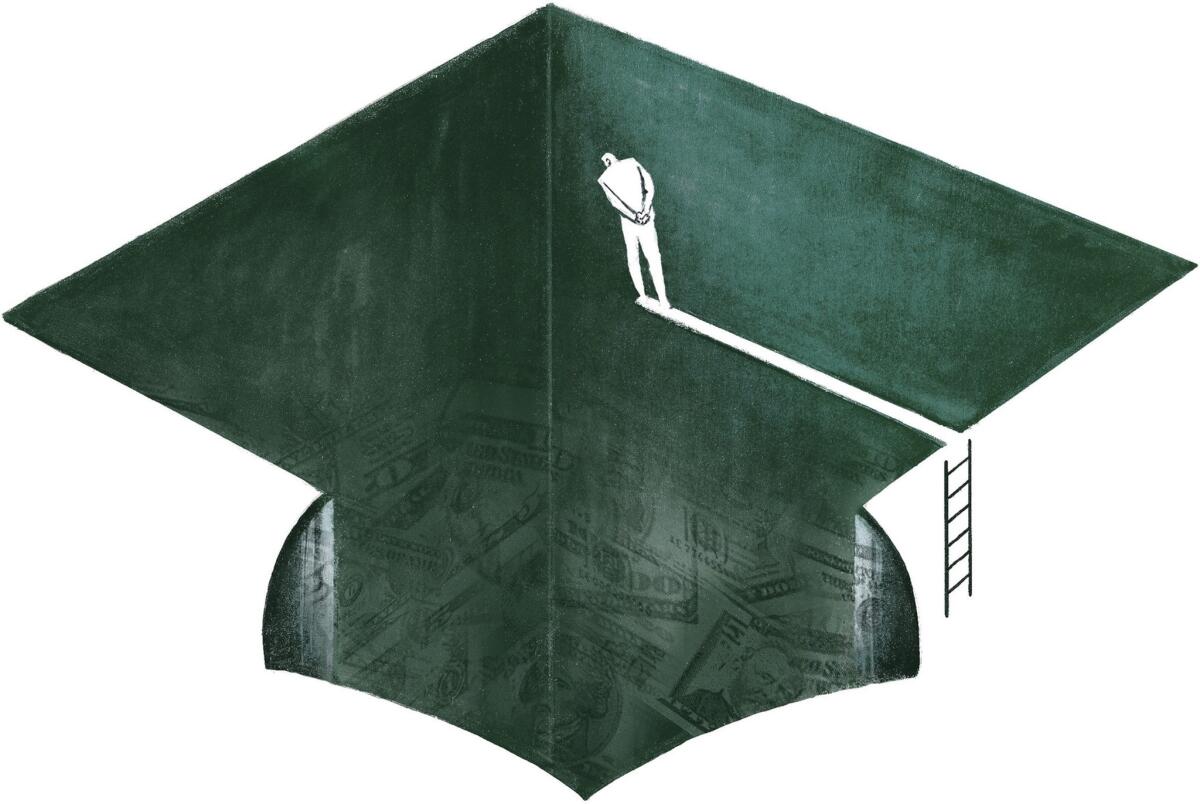

Should grandma sue over the student loan she co-signed?

Dear Liz: You recently answered a letter from a grandmother who co-signed a student loan for a granddaughter who isn’t paying the debt. Although you did not suggest it, a very viable option would be for the grandmother to contact an attorney and sue her daughter and her granddaughter for the debt owed.

It doesn’t appear that they care for the grandmother anyway, so why feel bad about holding their feet to the fire? The grandmother may not have a legal leg to stand on with the daughter, but surely the granddaughter received the benefit of the loan and should ante up.

Answer: Suing a family member is a pretty drastic step that many people are reluctant to consider. If the grandmother is in fact “judgment proof” — if creditors who sue her wouldn’t be allowed to garnish her income or seize her property — then the lender might start focusing its collection actions on the granddaughter. The grandmother wouldn’t have to go to the expense of suing the young woman or trying to collect on a judgment.

Either way, the bankruptcy attorney I suggested she consult to help determine if she’s judgment proof also would be able to advise her about filing such a lawsuit.

To reiterate, student loans typically can’t be discharged in bankruptcy, but bankruptcy attorneys understand the credit laws of their states and can help people assess how vulnerable they are to lawsuits and other collection actions.

Liz Weston, certified financial planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com. Distributed by No More Red Inc.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.