SEC’s Choice to Lead Board Draws Anger

The Securities and Exchange Commission on Friday picked former FBI Director William H. Webster to head a new accounting oversight panel in a partisan vote that symbolized how politically charged accounting reform has become in the current climate of financial scandal.

In a 3-2 vote, SEC Chairman Harvey L. Pitt and two other Republican commissioners chose Webster and four other candidates -- including former California pension official Kayla J. Gillan -- over more than 450 applicants to serve on the Public Company Accounting Oversight Board.

The vote came at the end of an hourlong meeting marked by acrimony and impassioned speeches on both sides.

The decision left SEC Commissioners Harvey Goldschmid and Roel Campos -- both Democrats -- disappointed because they had favored John H. Biggs, a New York pension fund executive with a reputation for backing tough new regulations for the accounting industry.

But Webster, a onetime federal judge and a longtime Republican, prevailed after Pitt and Republican SEC Commissioner Paul Atkins promoted the former FBI and CIA director as the ideal candidate to restore investor confidence in a scandal-plagued accounting industry.

“The accounting agency needs a tough cop,” said Atkins, citing Webster’s law enforcement background. Webster is “a dream candidate to be the George Washington of this accounting board.”

Others chosen Friday to serve on the oversight board were Gillan, former chief counsel with the California Public Employees’ Retirement System; former SEC general counsel Daniel L. Goelzer; former U.S. Rep. Willis D. Gradison Jr. of Ohio; and Charles D. Niemeier, chief accountant in the SEC’s enforcement division.

The accounting oversight board was created by the Sarbanes-Oxley Act, a sweeping overhaul of accounting and securities rules that President Bush signed in July. The board will oversee standards used by public accountants and discipline accountants who violate securities laws.

The rancor over Webster’s appointment comes as investors and policymakers are looking to the SEC to restore confidence in corporate bookkeeping. A wave of accounting scandals began last year when evidence surfaced that energy trader Enron Corp. used off-the-books partnerships and questionable accounting practices to hide its deteriorating financial condition. Enron’s main auditor -- accounting firm Arthur Andersen -- was convicted in June of obstruction of justice for shredding Enron financial documents.

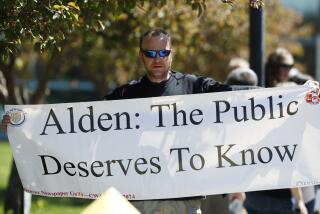

Campos said the rejection of Biggs underscores the perception that the SEC remains too closely aligned with the interests of the accounting industry, which had lobbied for Webster. He predicted that the board would face a legal challenge from disgruntled reform advocates, hampering the board’s effectiveness. Others discounted that possibility, however.

Pitt made an emotional defense of his choice of Webster, saying he was not pressured by the accounting industry to back the former FBI director.

“I am fiercely independent. I am beholden to no one,” Pitt said.

No one from the accounting profession, the Republican Party or the Bush administration had sought to influence his judgment, Pitt said.

Webster, a partner in a Washington law firm, could not be reached Friday. In a statement, Biggs said Webster, despite not having an accounting background, “is accustomed to moving into complex new worlds and finding his way immediately.”

Webster’s selection drew a mixed reaction on Capitol Hill, where he will have to mend political fences.

Echoing the comments of many of his fellow Republicans, Sen. Phil Gramm of Texas called the SEC’s new accounting panel “a quality board, which all objective observers will find acceptable.... For someone to criticize Chairman Pitt for not nominating their choice of chairman, or members, over the choice of the majority of the commission seems to me unfair and wholly political.”

But Sen. Paul S. Sarbanes (D-Md.), co-sponsor of the Sarbanes-Oxley legislation, criticized Webster’s appointment and called on Pitt to resign.

Sarbanes said Pitt was “appearing to bow to political and industry pressures” by not choosing Biggs, the head of pension fund TIAA-CREF.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.