In JPMorgan case, Sacramento prosecutor takes on family business

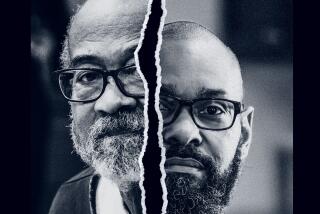

NEW YORK — Benjamin Wagner, the top federal prosecutor in Sacramento, has been nothing less than a thorn in the side of JPMorgan Chase & Co.

His office’s investigations into the bank’s toxic mortgage investments played a key role in the U.S. Justice Department’s landmark $13-billion civil settlement with the nation’s biggest bank. His prosecutors are continuing a parallel criminal probe which could prove even more worrisome for the New York financial giant.

But for Wagner, JPMorgan is not just some far-away, faceless Wall Street behemoth. It used to be something of a family business: his late father, Rodney Wagner, was a longtime JPMorgan banker.

And not just any executive. Rodney Wagner retired as a vice chairman after a distinguished career, a few years before the investment bank’s 2000 merger with Chase Manhattan Corp.

At a news conference announcing JPMorgan’s $13-billion settlement Tuesday, the younger Wagner was asked what his father would think of his case.

“My mom would be pretty proud of me,” Benjamin Wagner said.

Rodney Wagner played key roles in helping developing countries — notably Mexico and Saudi Arabia — restructure their debts. A 1988 Wall Street Journal article dubbed him the bank’s “debt trouble-shooter.”

As Bloomberg News has previously noted, he helped secure financing to rebuild Kuwait after the first Gulf War.

His 2005 New York Times obituary recalled how Rodney Wagner, in 1991, even rode out into the desert to explain to the Saudi king why a postwar financing deal needed his personal signature.

ALSO:

Carl’s Jr. owner CKE to be sold to Cinnabon owner Roark

FreshPoint to pay $4.2 million to settle Department of Defense suit

Consumer prices unexpectedly dip in October on lower gasoline costs