Los Angeles, San Francisco top cities for tax dodgers, study says

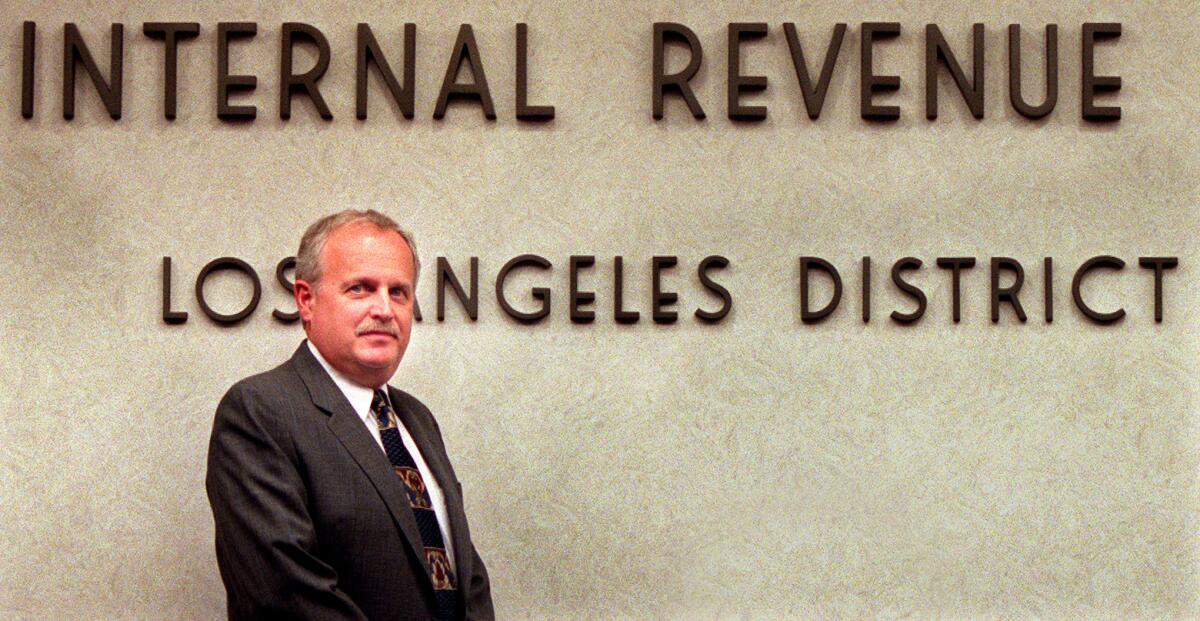

As procrastinators scramble Monday to file their federal income taxes, some who reside in the well-off enclaves of Los Angeles or San Francisco may be bracing for an audit by the Internal Revenue Service.

That’s according to a new study from the National Taxpayer Advocate, which scoured IRS data to pinpoint five metropolitan areas where small business owners are more prone to dodging taxes. Other top tax-cheating hubs are the District of Columbia, Houston and Atlanta.

Communities near the five cities were called out as well. Newport Beach and Beverly Hills, for example, are named as potential havens for people who fibbed to Uncle Sam.

The study focused on small business owners who have more opportunities than the average working stiff to fudge their tax returns. Owners of construction firms and real estate rental companies, it said, may be more prone to lying on their taxes than those in other industries.

The IRS uses such data to determine which taxpayers to audit, targeting those who are more likely to owe Uncle Sam extra cash.

Last year, the feared tax authority revealed that it was increasingly targeting millionaires -- auditing 12.5% of those pulling in $1 million in 2011, up from 8% in 2010. About 4% of those earning $200,000 and up were audited, up from 3% the year before.

But the agency has left alone most returns showing less than $200,000 in income, with about 1% facing audits.

Same goes for companies. Businesses with $250 million in assets have a 27.6% audit rate compared with a 1% audit rate for firms with less than $10 million in assets.

ALSO:

Executives doubt U.S. workers have the skills to succeed

Some banks are too big to prosecute, attorney general says

Gasoline is likely to stay at pennies per gallon in post-Chavez Venezuela

Follow Shan Li on Twitter @ShanLi

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.