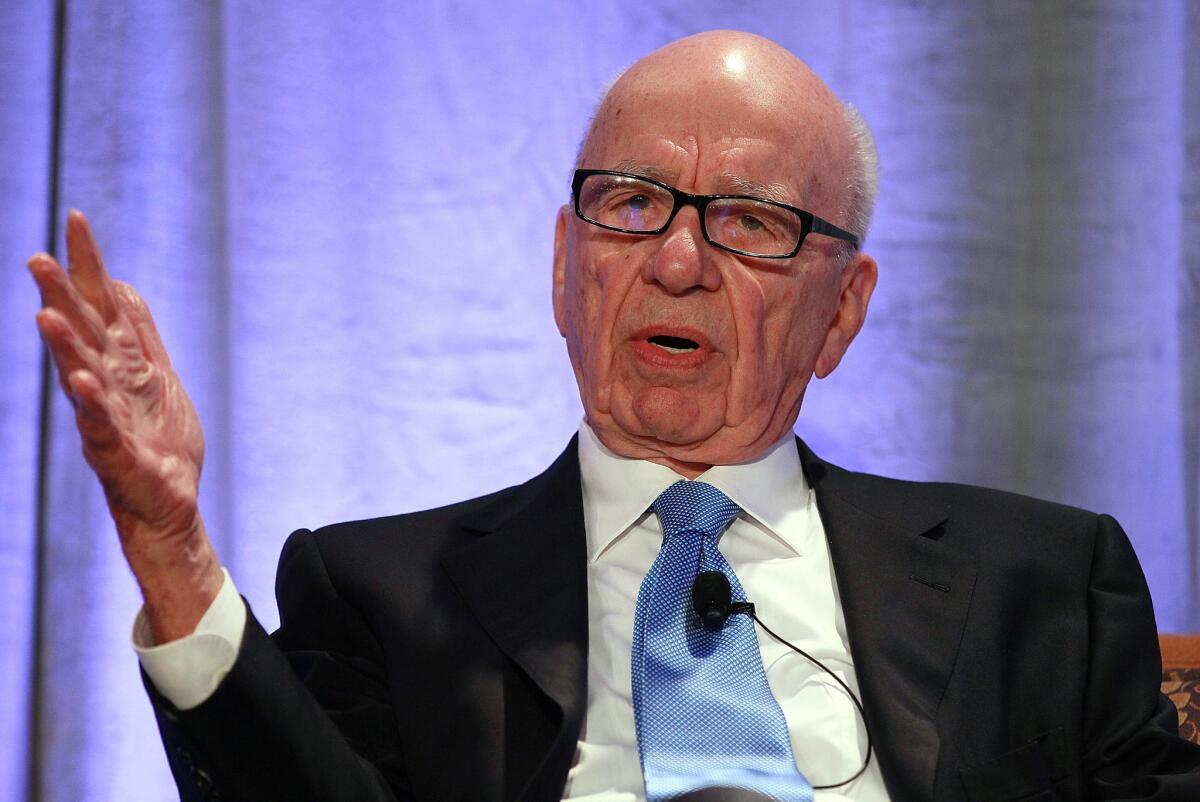

News Corp. revenue slides 4% amid decline in ad sales

Rupert Murdoch’s publishing company, News Corp., beat analysts’ profit estimates even though advertising revenue continued to fall.

News Corp. -- which includes the Wall Street Journal, New York Post, Times of London and HarperCollins book publishing -- released its fiscal second-quarter earnings late Thursday. It was the second earnings report at the company since it became a stand-alone entity at the end of June.

“Direct comparables are awkward because the company, in its present form, did not exist a year ago,” News Corp. Chief Executive Robert Thomson told analysts on an after-market conference call.

ON LOCATION: Where the cameras roll

For the October-December quarter, News Corp. reported net income of $151 million, or 26 cents a share, compared with nearly $1.4 billion, or $2.42, in the year-earlier period.

Earnings in the previous-year period benefited from a nontaxable gain of about $1.3 billion related to the November 2012 acquisition of some Australian television businesses.

Revenue slipped 4% to $2.24 billion, compared with $2.32 billion in the prior-year period.

The company’s adjusted earnings of 31 cents a share were considerably higher than analysts’ estimates of 20 cents a share.

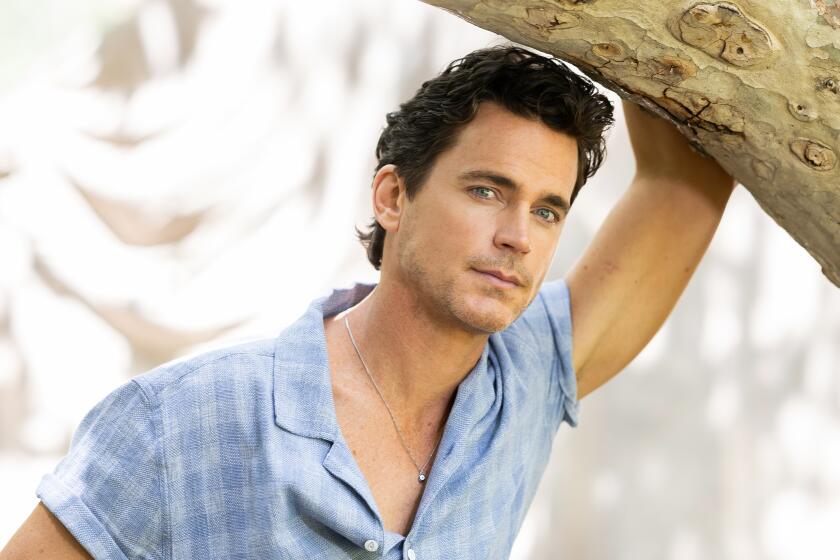

PHOTOS: Celebrities by The Times

News Corp. stock rose in after-hours trading. It closed up 41 cents to $16.02 a share.

The company’s main driver, its News and Information Services unit, generated $1.6 billion during the fiscal second quarter, a 9% decline from a year earlier. Revenue fell 17% at the Australian newspaper group, which is grappling with the weak economy in Australia.

Circulation and subscription revenue fell 7%, primarily because of problems at its Dow Jones institutional unit. The declines were partially offset by subscription price hikes for the Wall Street Journal and WSJ.com and a higher cover price for the Sun in Britain.

HarperCollins revenue increased 4% to $391 million, thanks to improved sales of children’s books and general books. Electronic book sales soared 39%.

The company’s fledging educational materials business, Amplify, suffered declines but company executives told analysts to stay tuned. Amplify is seeking wider adoption of its curriculum product and several states, including California, are expected to begin a curriculum review.

ALSO:

21st Century Fox second-quarter profit falls 12%

Los Angeles County entertainment jobs down 7% from 2007

Lions Gate posts record quarterly revenue after ‘Hunger Games’ hit

Twitter: @MegJamesLAT

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.