Editorial: Make good on a tobacco tax promise to pay higher rates to Medi-Cal doctors

The state’s budget picture isn’t nearly as bleak — at least for next year — as Gov. Jerry Brown painted it in January when he proposed a bare-bones spending plan. The anticipated $1.6-billion revenue shortfall is gone; the governor now is predicting $2.5 billion more in revenue for the coming fiscal year than his administration projected just a few months ago, thanks to an expected increase in capital gains taxes.

The $183.4-billion revised spending plan Brown unveiled Thursday restores some things that were on the chopping block in January and even finds a little more money to hand out. There’s $1.4 billion more for education above the amount required by Proposition 98. There’s $500 million more to pay child care providers. There’s about $400 million more to help counties pay for in-home health services and $6.5 million more for the California attorney general to fight President Trump.

But no more for Medi-Cal providers?

Apparently not, despite the passage last November of Proposition 56, which raised tobacco taxes and explicitly promised to “provide improved payments” to the doctors, dentists and other healthcare providers who serve Medi-Cal patients. What does that promise mean? Healthcare providers legitimately thought that meant increasing the state’s rock-bottom (relative to other states) reimbursement rates, which were cut during the recession and haven’t been fully restored.

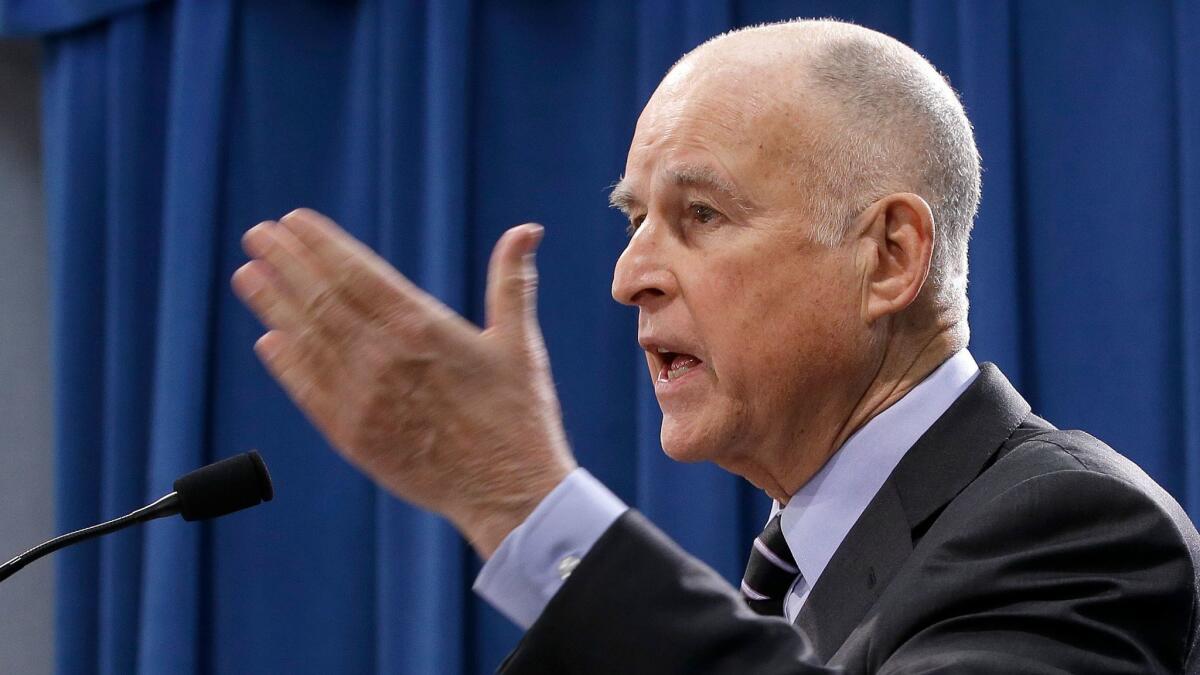

Instead, Brown wants to use $1.2 billion in new tobacco tax proceeds to cover the higher costs in Medi-Cal caused by rising healthcare expenses, reduced federal Medi-Cal contributions and the expansion of the program to cover children living in the country illegally. Otherwise, Brown argues, the state would have to make cuts elsewhere in the budget. “I thought that was the least harmful, least painful way to go,” Brown said Thursday during a briefing on his revised budget proposal.

One problem with Brown’s argument is that the state knew about the increased Medi-Cal costs long before Prop. 56 passed, and should have been prepared to meet them without dipping into tobacco taxes. Another is that in passing Proposition 56, voters were telling the state to improve Medi-Cal by addressing the reimbursement problem that has been driving doctors out of the program and making it harder to find care.

This is not the end of the debate. Legislators will now start hearings to hammer out a counter proposal. They should work with health care providers and consumer advocates on a compromise that improves provider payments and fulfills the promise made in Proposition 56. If there’s room in this budget to give more to so many other state programs, surely there’s more for both Medi-Cal beneficiaries and providers.

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.