You should be able to file class-action suits against banks, watchdog group says

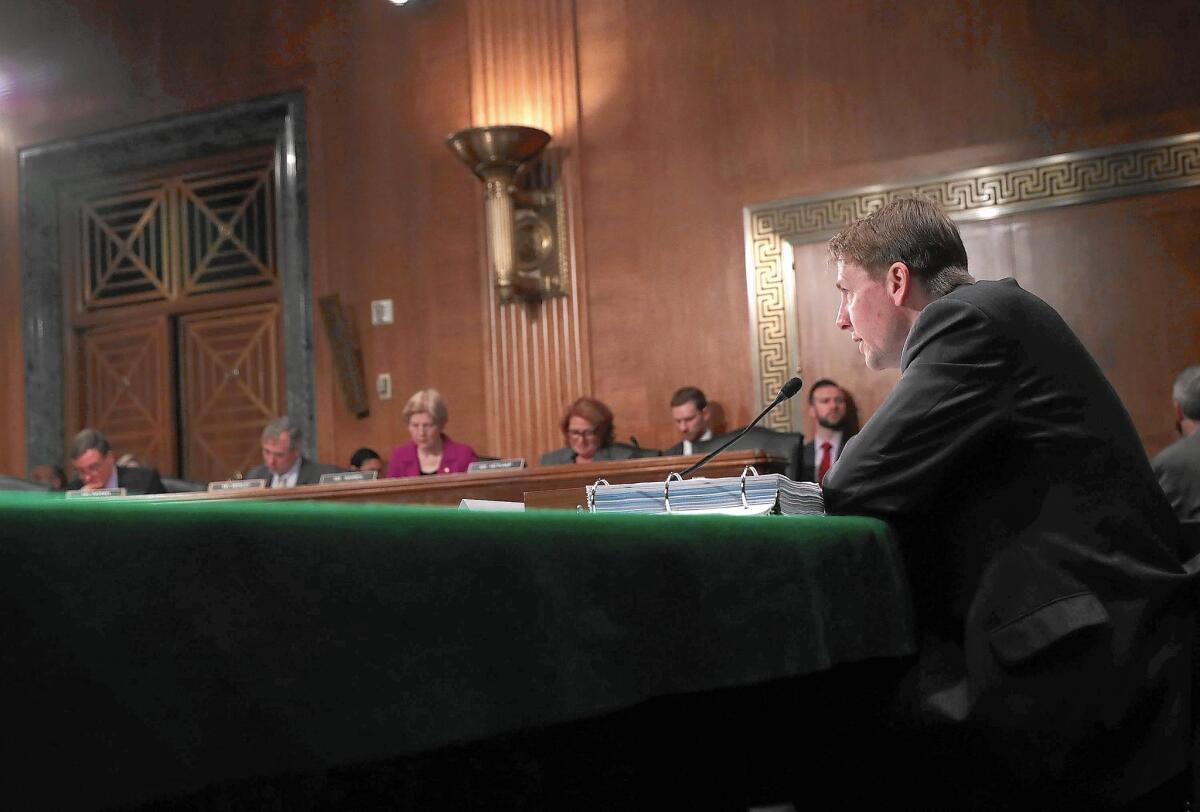

Richard Cordray, director of the Consumer Financial Protection Bureau, testifies at a Senate hearing last month. Class-action bans deny “consumers the right to seek justice and relief for wrongdoing,” he says.

Contracts that prevent consumers from filing class-action lawsuits against banks could soon be illegal under new rules to be proposed Thursday by the Consumer Financial Protection Bureau.

The centerpiece of the proposal — more than a year in the making and fiercely opposed by the finance industry — would prevent banks, credit card companies and other financial-service firms from including class-action bans within contracts that consumers sign when they open accounts.

Those bans have become a common part of contract language that also requires consumers to go to private arbitration rather than to court to settle disputes with banks and other companies. The proposed rules could end up also discouraging banks from including those arbitration clauses in their contracts.

Although industry groups argue consumers are better served by arbitration than by class-action lawsuits that can pay individual account holders little, consumer advocates and consumer bureau Director Richard Cordray say class-action bans prevent consumers from keeping banks accountable.

“Signing up for a credit card or opening a bank account can often mean signing away your right to take the company to court if things go wrong,” Cordray said in a statement, calling the practice a “contract gotcha that effectively denies groups of consumers the right to seek justice and relief for wrongdoing.”

The rules, an initial draft of which were first disclosed in October, are being released before a public hearing in Albuquerque.

The bureau is asking for public comments on the rules, which could take effect in about a year, though banks and industry groups will probably try to block the rules in court.

The bureau’s proposal would not specifically ban arbitration clauses, which have become common in consumer contracts. Rather, it would prevent those arbitration clauses from including language that bans consumers from joining class-action cases.

Such bans are common, and they’ve become more widely enforced after a 2011 Supreme Court ruling that said federal law requires state courts to honor bans, even if state laws prohibit them.

Arbitration clauses and related class-action bans have since become a hot topic among consumer advocates, who argue consumers are prevented from joining together to take on big companies in lawsuits that can result in millions of dollars in damages — payouts large enough to prompt changes in practices harmful to consumers.

SIGN UP for the free California Inc. business newsletter >>

For instance, a Santa Barbara attorney last year filed a class-action case against Wells Fargo on behalf of customers who say the bank created fake accounts in their names. But a federal judge ruled that arbitration clauses signed by customers prohibited the case from moving forward.

Alan Kaplinsky, a partner at the law firm Ballard Spahr who will testify at Thursday’s hearing on the industry’s behalf, acknowledged the main attraction of arbitration clauses was that they prevented class actions and their potentially multimillion-dollar judgments.

“What made arbitration clauses attractive was their impact on class-action litigation,” he said. “Most banks and companies using it now will conclude it’s no longer worth it.”

That will mean, he said, consumers have no option but to take banks to court if they believe they’ve been wronged. And in court, Kaplinsky said, consumers can easily be outgunned.

“Companies, in general, believe they have an advantage over consumers in court,” he said. “If a consumer wants to go to court, they have to take time out from work. Cases last longer [than in arbitration]. That’s good. Companies like to drag things out.”

Travis Norton, executive director of the U.S. Chamber of Commerce’s Center for Capital Markets Competitiveness, called the proposed rules “a backdoor ban” on arbitration clauses, which he said can provide individual consumers the chance for more financial relief than a class-action suit.

Thaddeus King, an officer with the nonprofit Pew Charitable Trusts’ consumer banking project, said it’s probably true that banks will ditch arbitration clauses if the CFPB’s rules take effect. But he said consumers will probably be just fine.

“That wouldn’t mean a consumer and a bank can’t go to arbitration. They’re always free to choose that option,” he said, noting that some banks and credit unions without arbitration clauses still resolve consumer disputes through arbitration.

King added that some consumers who might have preferred arbitration could be forced into court instead and might opt against the hassle and expense of filing a case. But he said more consumers will be helped by being able to participate in class-action cases.

Class actions allow many consumers, all with relatively small claims, to band together and file cases that it would otherwise make no sense to pursue.

Mark Greenstone, a partner at L.A. class-action law firm Glancy Prongay & Murray, said that if a bank charged an illegal fee of $10 a month, no individual consumer would hire a lawyer to sue the bank — nor would any lawyer handle the case.

“The consumer’s cost of hiring an attorney and litigating that is going to quickly exceed the value of the claim,” he said. “Only a zealot doing it for a moral purpose would do that.”

But if the bank has charged the same fee to hundreds or thousands of consumers, a class action can make sense.

“Class actions are able to be brought by large numbers of consumers who have been harmed a very small amount individually,” King said.

Kaplinsky said in cases where bank practices cause small amounts of harm to many consumers, the Consumer Financial Protection Bureau, federal prosecutors and state regulators should intervene rather than letting class-action cases set the agenda.

“That’s where the CFPB and the government steps in. They’re very good at dealing with that kind of wrongdoing,” he said.

Twitter: @jrkoren

MORE BUSINESS NEWS

YouTube said to be planning paid streaming TV service

Tesla Motors posts a bigger loss, and two key executives plan to leave

Takata agrees to recall another 35 million to 40 million air bag inflators