Opinion: Trickle-down ‘voodoo economics’ is back. When will Republican voters stop buying it?

To the editor: In 1980, George H.W. Bush dubbed a plan by his Republican presidential primary opponent, Ronald Reagan, to cut taxes on the wealthy and corporations without driving up the deficit “voodoo economics.” The idea was that the increased wealth would trickle down to working stiffs, spurring growth of the entire economy.

Well, how has that worked out for you?

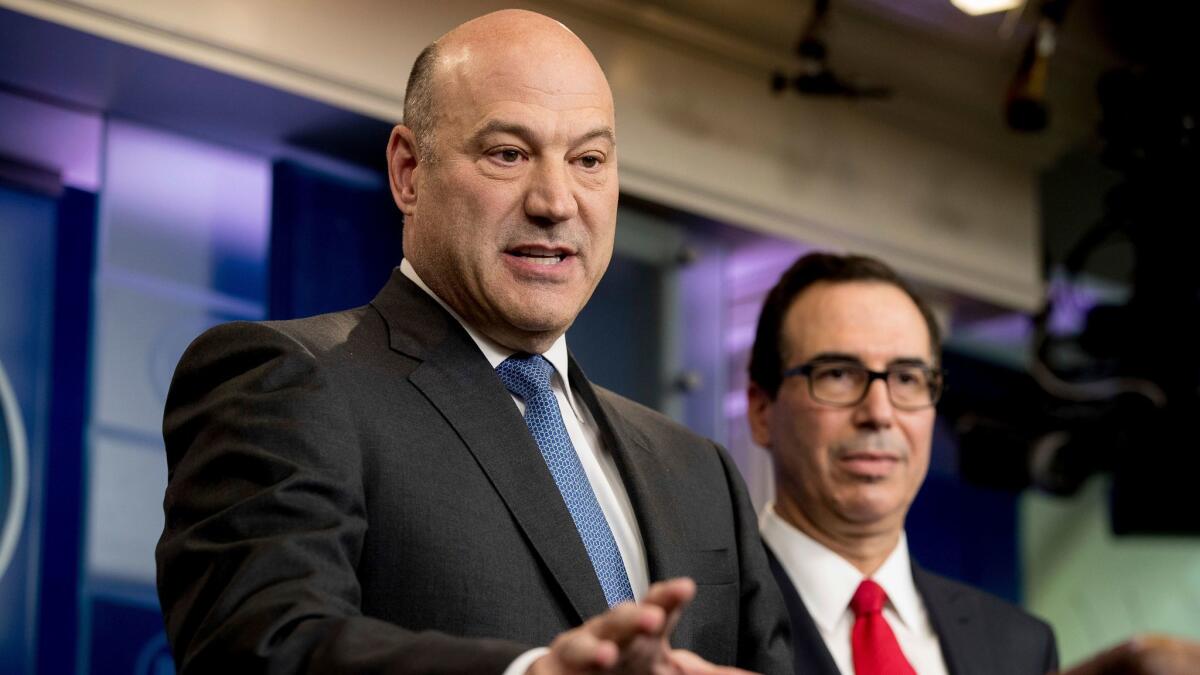

President Trump and congressional Republicans have just proposed cutting corporate taxes, which they acknowledge will add to the budget deficit only initially. We hear this rubbish over and over again, and Republican voters keep believing it. (“New Republican tax outline gives huge cuts to businesses, but details of individual relief are less certain,” Sept. 26)

How can lawmakers align spending with revenue? By decimating the safety net for Americans who cannot afford to donate to their campaigns.

When will Republicans figure out they are being taken advantage of? The math simply does not work out.

Deborah Wright, Rancho Santa Margarita

..

To the editor: It is a fact that the GOP plan will give big tax cuts to businesses. It is also a fact that the U.S. corporate tax rate is the highest among developed nations.

The article states this fact but qualifies it with the statement that “many companies pay a lower rate, if any tax at all, by using loopholes and deductions.” One fact omitted here is that other developed nations with lower corporate tax rates also have loopholes and deductions in their tax structures.

An important fact that you do not mention at all is that corporations pay taxes on their profits and, when they distribute these to shareholders as dividends, those profits are taxed again. This makes the effective tax rate on these profits even higher.

Steve Murray, Huntington Beach

..

To the editor: Reducing the number of brackets for individual taxpayers is not tax simplification.

It can take many hours of planning and record-keeping for a taxpayer to determine his or her “taxable income.” However, once that is determined, the calculation of the tax owed shouldn’t take more than five minutes. A person needs only to look down the applicable tax table (single person, married and so on) for the one line saying, “If your taxable income is X dollars but not over Y dollars, then your tax is A + B.”

So let’s have many more tax brackets, lower and higher, to make sure everyone pays their fair share. Remember, we have a huge national debt.

W. Michael Johnson, San Marino

The writer is a retired tax lawyer.

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.