With Trump’s North Korea summit off, is the trade war with China back on?

Only a week ago, the drums of a trade war seemed to be quieting as the Trump administration put a hold on plans to tax Chinese imports and there was talk of a so-called skinny deal emerging from renegotiations of the North American Free Trade Agreement.

But just like that, things could be simmering again after two abrupt moves by President Trump this week raised fresh questions about the direction of the administration’s herky-jerky trade policy.

One is the dramatic decision by Trump to cancel the much-ballyhooed summit with North Korean leader Kim Jong Un next month to discuss denuclearization. The president called off the June 12 meeting in Singapore, citing harsh statements coming out of Pyongyang lately — a change in tone that Trump has attributed to influence from China, North Korea’s erstwhile patron.

Trump has often suggested he would cut China slack on trade if Beijing helped pressure North Korea on the nuclear issue. And the president’s willingness over the last week to forestall tariffs on China, and to go easier on the U.S.-sanctioned Chinese telecom giant ZTE, were seen in part as a tradeoff for China’s cooperation on North Korea. A deal on granting leniency to ZTE still appeared close to being reached on Friday.

But now that the summit is off, is the trade war with China back on?

“If I were Chinese officials dealing with the economy, I’d be a little bit worried [that] this is going to usher in a harsher attitude from the U.S. on China trade,” said David Dollar, a senior fellow at the Brookings Institution and former U.S. Treasury economic emissary to China.

The other, less-publicized but potentially explosive trade action by Trump was to instruct Commerce Secretary Wilbur Ross to consider whether imported cars and car parts are harming U.S. national security and as such should be subject to new tariffs.

That investigation could take many months to complete, but the move drew immediate criticism from industry and governments across the globe, especially on the heels of Trump’s imposition of steep duties on imported steel and aluminum, also citing national security.

Officials from Japan, China and Europe all spoke out against the new probe, some calling it a threat to the international trade order and others warning that it could throw the globally integrated industry into turmoil. Sen. Patrick J. Toomey (R-Pa.) said it was simply “a bad idea” to raise taxes on American buyers of foreign-made cars and trucks. And few people could see how tariffs on imported autos and auto parts could reasonably be justified on the grounds of national security.

“The administration has yet to explain how this latest action fits into a coherent strategy to increase American auto jobs and wages for American workers, or whether it is just designed to create more chaos and confusion,” said Sen. Ron Wyden (D-Ore.).

The Commerce Department initiated the investigation by tapping a rarely invoked provision of U.S. trade law, called Section 232. In the case of imported steel and aluminum, the agency took a broad reading of “national security” as encompassing economic security, concluding that the rise of foreign metal production over the years had hurt domestic producers and presented a security risk to the country because it would mean fewer American sources for military armor and infrastructure such as the electric power grid.

Trump has used the metal tariffs, or the threat of them, as leverage to try to extract concessions from trading partners — allies and adversaries alike. But it has strained U.S. relations, particularly with Europe, which has vowed to retaliate. The president has responded by twice pushing out the tariff deadline for the European Union, Canada and Mexico, among a few others.

Those temporary tariff exemptions, however, expire at the end of this month, and the administration has not yet said whether they would be extended again, made permanent or allowed to lapse.

There’s little doubt that the auto tariffs will arouse even more resentment, and be challenged by U.S. trading partners, said Alan Wolff, the American trade lawyer who is deputy director-general of the World Trade Organization. Sales and employment in the car industry are far greater than steel and aluminum production, and autos account for the bulk of the trade surplus that Japan, Mexico, Germany and South Korea have with the United States.

Wolff wouldn’t predict whether the WTO would rule against a U.S. move to defend tariffs on national security grounds — such a case has never been adjudicated, he said — but other trade experts suggested that it could undermine the world trading order.

“If this is an act taken for national security reasons, then what economic act is not?” said James Bacchus, a former U.S. congressman and one-time chairman of the WTO’s appellate body. “If the United States can do this, then who cannot?”

For Canada and Mexico, the specter of new auto tariffs carries particular resonance. The two countries have been struggling over the last year to meet Trump’s demands for a revamped NAFTA, and the single toughest issue has been over rules on domestic-content requirements in cars that are traded tariff-free across borders in North America. The Trump administration has pressed for concessions so more vehicles and parts are produced in the United States, and the risk of steel and aluminum tariffs was aimed at pressuring Mexico and Canada to settle.

Earlier this month, talks were progressing and analysts were hopeful that a less comprehensive, scaled-down NAFTA deal containing mostly an agreement on auto rules could be concluded, opening the path to a new pact that could be approved by the current Congress. But only days are left before there’s any chance of a ratification vote this year.

The administration’s Wednesday night announcement of possible new tariffs on cars was no accident. It “coincided with an impasse between the U.S. and Mexico on the NAFTA automotive rules of origin,” said international trade lawyer Daniel Ujczo of the firm Dickinson Wright, noting that it was clearly meant to provide a second pressure point for Mexico and Canada.

“The announcement also has political objectives that serve as a response to criticisms this week that the president has ‘gone soft’ on China,” he said.

Indeed, Trump has come under considerable heat from supporters who have questioned the president’s commitment to his “America first” agenda, especially after he tweeted recently his intent to help rescue ZTE. The Chinese telecom equipment maker is partly state-owned and has been reeling from U.S. penalties imposed a month ago by Trump’s Commerce Department for violating sanctions on selling goods to Iran and North Korea. Trump, however, said too many Chinese jobs were being lost and suggested that he was doing China’s President Xi Jinping a favor, although he later added that ZTE’s demise would hurt American suppliers.

Trump’s move to roll back the penalties — which included a ban on U.S. companies from selling components to ZTE — drew a sharp bipartisan backlash in Congress.

On Friday, the administration informed lawmakers of a deal that would allow ZTE to restart doing business with San Diego-based chipmaker Qualcomm and other U.S. suppliers critical for its production, according to a person familiar with the communications. Trump said earlier in the week that ZTE could be expected to pay a fine of around $1.3 billion and overhaul its management as part of the deal.

The White House denied that the about-face on ZTE involved a quid pro quo, but last weekend, Treasury Secretary Steven T. Mnuchin said the administration was suspending plans to slap punitive tariffs on numerous Chinese imports for stealing U.S. intellectual property and forced technology transfer. That fueled further speculation that the president was backing down from his get-tough approach on China in exchange for Beijing’s support on his bid to achieve a diplomatic breakthrough with North Korea. Administration officials said Beijing had agreed to buy large amounts of more American products to cut the trade deficit, among other concessions, but there were few specifics.

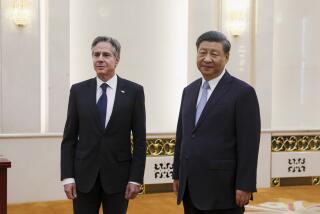

China experts differ on whether Xi had a hand in Pyongyang’s more defensive and antagonistic tone in recent days, but Trump said Tuesday that “there was a different attitude by the North Korean folks” after the May 8 meeting between Xi and Kim, the second in two months.

“Nobody knew about the meeting and all of a sudden it was reported that he was in China a second time,” Trump told reporters. “And I think things changed after that meeting. So I can’t say that I’m happy about it, OK?”

With the summit off, at least for now, analysts wonder about recriminations and whether Trump will revert to a more aggressive tack on China. “Many U.S. officials, and possibly Trump himself, will blame Beijing for interfering and possibly pushing Kim to keep [his] distance from the U.S.,” said Isaac Stone Fish, senior fellow at the Center on U.S.-China Relations at the Asia Society, an educational center in New York.

Ross is scheduled to travel to Beijing next week to continue talks on trade and ZTE, and what he comes away with from that meeting may be a bellwether of where bilateral relations are headed.

Dollar, the Brookings scholar, doubts that Beijing tried to foil the summit, even if some Chinese officials may harbor concerns about a unified Korea down the road that might ally itself with the United States. Nor does Dollar think Trump’s deal-making for a summit with Kim is over, with both sides having left the door open.

“So if this is kind of more slow-moving negotiations, then China’s influence remains important,” Dollar said. “I think [North Korea] is still a factor in U.S.-China trade negotiations and pushes the U.S. to be less hawkish.”

Twitter: @dleelatimes

UPDATES:

1:05 p.m.: This story was updated with more details about ZTE.

This story was originally published at 6:40 a.m.