By 2017, California could have $7.2 billion socked away in rainy-day fund

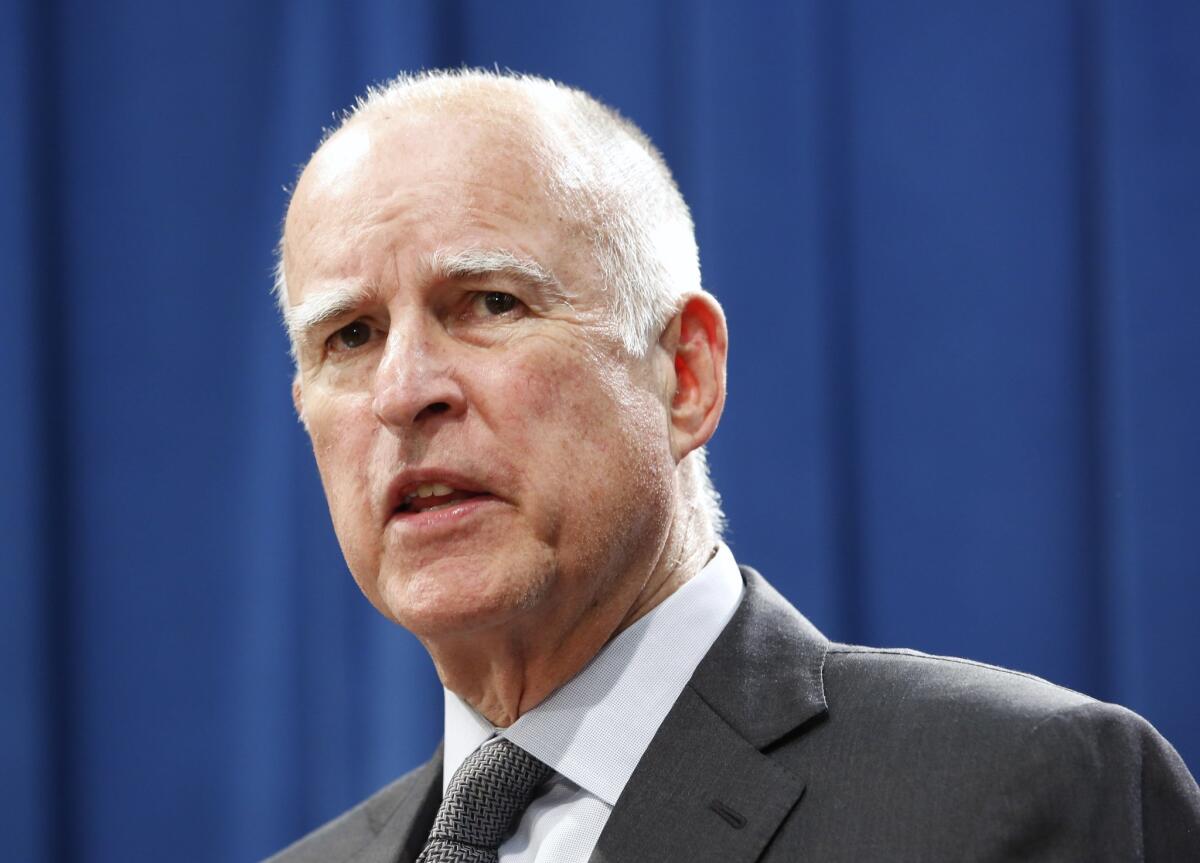

Gov. Jerry Brown answers a question concerning the budget agreement reached with legislative leaders at a Capitol news conference in Sacramento on June 16.

California’s finances are in a “decidedly positive” position, evidence of continued progress after the state emerged from a damaging recession years ago, legislative analysts said in a new report Wednesday.

By the summer of 2017, the analysts said, the state could have $7.2 billion socked away in a rainy-day fund.

“The state is enjoying very good fiscal health right now,” said Mac Taylor, the top analyst, in an interview. “It can still withstand certain negative economic situations in the future.”

The cash stockpile is the result of Proposition 2, which voters approved one year ago. The measure requires the state to deposit a portion of its revenue in an expanded rainy-day fund each year, with withdraws of the money limited to years in which there are steep economic downturns.

If a recession were to hit in 2017, legislative analysts said, the fund could be enough to cover deficits until 2019. Under this scenario, the state would face a $2.4-billion budget gap at that point — a far cry from the crises of years past.

“The state budget is better prepared for an economic downturn than it has been at any point in decades,” the report said.

Nonetheless, Gov. Jerry Brown’s finance director, Michael Cohen, said the state would need to be careful about committing to any new spending “during these fleeting good times.”

The report from legislative analysts will probably spark a new round of wrangling in the Capitol over the state’s financial commitments. Brown is scheduled to release his next budget proposal in January.

When the current fiscal year ends in June, the state could have $3.6 billion more revenue than expected when the governor signed the budget.

Assembly Speaker Toni Atkins (D-San Diego) said in a statement that lawmakers should “provide meaningful new investments in developmental disability services, education — from preschool to higher ed — infrastructure, and other critical needs.”

The potential for more revenue could undercut efforts by Brown and some Democratic lawmakers to quickly expand a tax on healthcare plans. If the current tax isn’t modified by next summer to comply with federal rules, California could lose $1.1 billion in funding from Washington for Medi-Cal, the state’s healthcare program for the poor.

Brown has called a special legislative session to focus on the issue, but little progress has been made. “Without additional revenue, there will be no alternative to reductions in our healthcare spending,” said Diana Dooley, the state’s health secretary, in a September statement.

However, legislative analysts expect the general fund could absorb the cost if the tax expires, a point highlighted by Republicans, whose support would be needed to raise new revenue.

In a statement, Assembly Republican leader Kristin Olsen of Modesto said, “[T]here is no need to tax the healthcare of 24 million Californians as proposed by the governor and legislative Democrats.”

Olsen and her Senate counterpart, Jean Fuller of Bakersfield, said additional revenue should be used to increase funding for the developmentally disabled and payments to doctors who serveMedi-Cal patients.

Even without new taxes, Fuller said in a statement, “there are opportunities ... [to] address the needs of the most vulnerable members of our society.”

Despite the positive report, public employee retirement costs could still be a drain on the state budget.

Brown wants to set aside funds to cover future healthcare costs for retired state workers, rather than paying them out of pocket each year. While the idea is seen as financially sensible, it would require more cash from the state budget.

There could also be more money needed for public pension funds, which have faced questions over whether they should require more funding from taxpayers to compensate for lower investment returns.

The California Public Employees’ Retirement System decided Wednesday to slowly reduce its long-term investment target to 6.5% annually from 7.5%.

Because the change is being phased in, legislative analysts don’t expect an immediate impact on the budget.

Meanwhile, the California State Teachers’ Retirement System has considered similar changes, which could also increase state costs.

Follow @chrismegerian for more updates from Sacramento.

For more political coverage, go to www.latimes.com/politics.

ALSO

What happened to Cudahy when a 29-year-old took over as mayor

Activists seek ballot measure for moratorium on L.A. ‘mega projects’

California tax board mishandled money, state controller’s audit finds

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.