Tax Increase for Quake Aid Voted : Relief: Quarter-cent raise will provide $800 million over 13 months. Most Republicans in Assembly oppose the hike.

The Legislature passed and sent to the governor Saturday a 12-bill package that would temporarily raise the sales tax by a quarter-cent and provide relief to the victims of the Oct. 17 Northern California earthquake.

Opposed by most Republicans in the Assembly, the $800-million tax increase was approved by the lower house with only two votes to spare. The bill sailed easily through the Senate.

When Gov. George Deukmejian signs the legislation, as he has promised to do, Californians will pay an extra 25 cents in taxes for every $100 of purchases for 13 months--from Dec. 1 of this year through New Year’s Eve, 1990. The sales tax now ranges from 6% to 7% in some counties.

The package was changed little after it was outlined in private meetings between Deukmejian and legislative leaders of both parties. Dozens of other bills proposed in the special session to respond to the quake were shelved until the Legislature returns for its regular session in January.

“Through its fast action, the Legislature has clearly demonstrated its concern and compassion for those in need,” Deukmejian said, adding that the package, would “restore some semblance of normalcy in the Bay Area.”

Senate President Pro Tem David A. Roberti (D-Los Angeles) said the Legislature’s work is not perfect. But, he added, “It is a reasonable response to a tragedy.”

Assembly Speaker Willie Brown (D-San Francisco) assured colleagues in his house that he would be willing to push for more taxes next year if the $800 million falls short of what is needed.

“We will be prepared to come back and offer some new means by which to finance that gap,” he said.

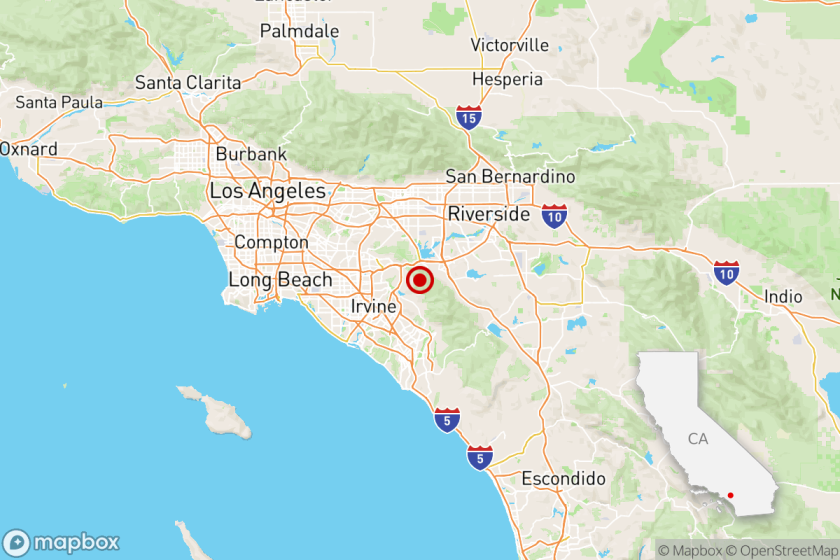

The revenue raised by the tax will be combined with up to $3.5 billion in federal aid, roughly $245 million from the state’s budget reserve and up to $200 million from other state programs. The total funds will be spent to repair the San Francisco-Oakland Bay Bridge, rebuild the collapsed Nimitz Freeway, and help thousands of Northern California individuals and businesses who suffered losses in the quake.

The legislation also will allow Caltrans to speed its reconstruction of the Nimitz Freeway and accelerate its program to strengthen bridges statewide against the forces of earthquakes.

Another measure in the package will allow victims of the Nimitz Freeway collapse to seek compensation from the state without going through the courts.

Other bills will aid farmers, grant public money to private, nonprofit institutions, including Stanford University, and allow individuals and corporations to carry forward earthquake-related losses for five years on their tax returns.

The legislation also will suspend temporarily provisions of Proposition 98, the school finance measure approved by voters last year, which would have required the state to give 41% of any tax increase to education.

Final action on the package came late Saturday after many lawmakers had tried for three days to broaden the scope of the session. The scripted nature of the activity irritated many lawmakers of both parties who were frustrated by their inability to change the leadership’s agenda.

“Many of us feel we have been left in the dark,” said Assemblywoman Jackie Speier (D-South San Francisco). “The decisions were really made before we ever got here and, with very few exceptions, what was already agreed to is going to be what is signed into law.”

But legislative leaders said the session would have been hopelessly out of control without the discipline they imposed. And in the end, identical but separate versions of the 12-bill package passed in each house without much debate.

Only the sales tax measure--which required a two-thirds majority vote--caused any significant acrimony. In the Senate, where 27 votes were needed, the bill passed 34 to 2. In the Assembly the vote was 56 to 17, with 54 votes necessary for passage.

Before passing the sales tax bill, the Assembly first rejected amendments by Assemblyman Tom McClintock (R-Thousand Oaks) that would have scuttled the tax increase and raised the money by freezing growth in state spending for the first 12 weeks of the next fiscal year, which begins July 1.

“The question is do we finance the relief by restraining the growth in state spending for a few weeks or do we impose an $800-million tax increase on the people of California?” McClintock asked. His amendments were rejected on a vote of 39 to 29.

On the tax measure itself, Assemblyman Pat Nolan (R-Glendale) urged his colleagues to finance the first months of quake relief out of the state’s budget reserve. He argued that the tax increase could still be passed in January if lawmakers found it necessary.

“No one can tell us how much this is going to cost,” he said. “All we have are maybes, might-bes and could-bes.”

But Republican Leader Ross Johnson of La Habra said he would vote for the bill, even if he did so “reluctantly.”

“This is not something Republicans enter into easily or lightly,” he said. “But we have to take this step.”

The Democratic author of the bill, Assemblyman Rusty Areias of Los Banos, held up a $20 bill and a nickel to illustrate the added tax burden the bill would impose. He said the increase was a small price to pay.

“It’s time to begin the process of putting our state back together,” Areias said.

Democrats in both houses blamed much of the damage to highways and government buildings on the reluctance of state leaders to invest in public works projects.

“California has gone from first to worst in many categories,” said Assemblyman Tom Hayden (D-Santa Monica). “What we have to do now is make up for a lot of lost time.”

Sen. Nicholas C. Petris (D-Oakland) said public works have suffered from a no-new-taxes “mind set that has propelled us into mediocrity.”

Staff writers Douglas P. Shuit and Jerry Gillam contributed to this article.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.