Telemarketing Fraud Targeted in Proposed Bill

A new high-tech telemarketing scam that is stinging banks and consumers is catching the attention of Washington.

But a proposed law aimed at protecting consumers may do little to limit banks’ exposure to the crimes.

The drafted legislation would address the problem of fraudulent demand drafts--a check-like mechanism that can be used to siphon money from checking accounts.

The scam, first reported by the American Banker in May, has cost banks and their unwitting customers tens to hundreds of millions of dollars since it first cropped up late last year, bankers and investigators said.

And despite the big losses, bankers seem to have few ways to combat criminals who use sophisticated check-printing equipment to take advantage of banks’ need to quickly process checks and demand drafts.

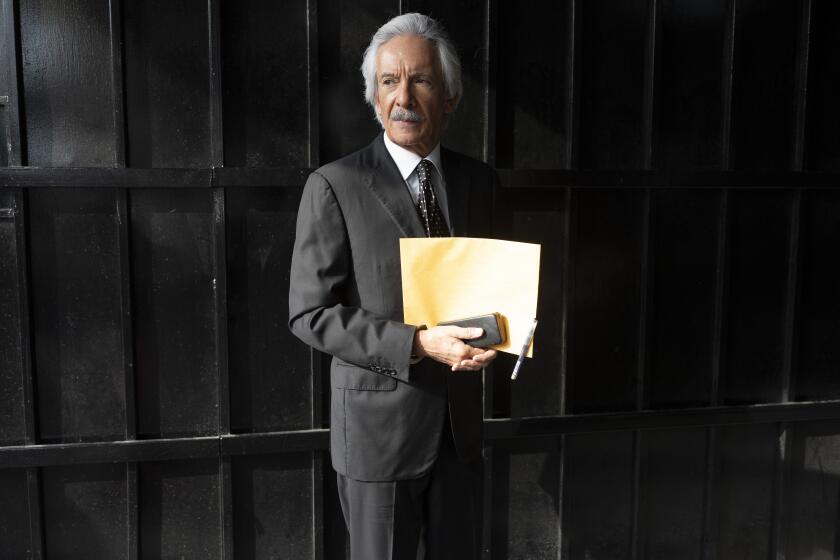

As a result, Congress may pick up the gauntlet. Rep. Ron Wyden (D-Ore.) is proposing legislation that would register and set bonds of about $200,000 for each telemarketer.

The bill, for which Wyden is seeking comment, could even include restrictions on the types of companies that can buy sophisticated check-printing equipment often used in the crimes.

Such measures would increase the power of state attorneys general and the Federal Trade Commission to prosecute telemarketers and could also discourage the use of demand drafts by telemarketing companies.

Demand drafts are used legitimately by a variety of businesses, from insurance companies to health clubs, to collect recurring payments from their customers.

However, when telemarketers attempt to use demand drafts for fraudulent purposes, banks are faced with a dilemma. Because of the Federal Reserve’s Regulation CC, which sets deadlines for clearing check deposits, financial institutions are forced to quickly pay these drafts.

If the customer complains that the payment was unauthorized, the paying and the originating banks may be then locked in a tug-of-war over who should foot the bill.

No law currently specifies which party is at fault in these transactions, and Wyden’s draft legislation does not resolve the issue.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.