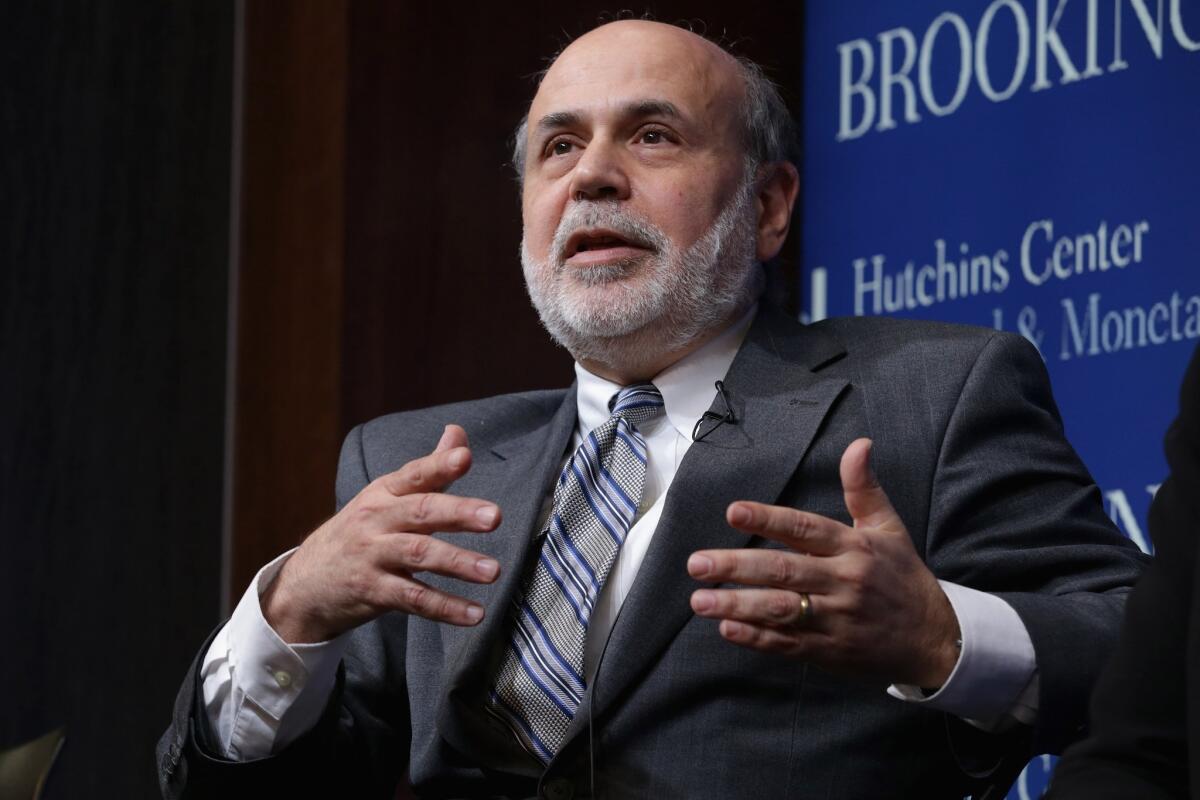

Ben Bernanke, unfettered by markets’ scrutiny of Fed, starts a blog

Former Federal Reserve Chairman Ben Bernanke launched a blog Monday with a post pushing back against critics of his low-interest-rate policies. Above, the ex-central banker at a panel discussion this month at the Brookings Institution in Washington.

Former Federal Reserve Chairman Ben S. Bernanke launched a blog Monday, devoting his first post to a stout defense against critics of his policy of historically low interest rates to combat the effects of the Great Recession.

Bernanke said he would post from time to time — “when the spirit moves me” — and take advantage of his post-Fed freedom to discuss economic and financial issues “without my words being put under the microscope by Fed watchers.”

Bernanke, who was the central bank’s chief from February 2006 to January 2014, is writing as a distinguished fellow in residence at the Brookings Institution, a Washington think tank.

In his post, he pushed back against “confused critiques” of his low-interest-rate policy.

One such critique was from a lawmaker who had accused him and other members of the Fed’s rate-setting panel of “throwing seniors under the bus” by keeping rates so low for so long. Bernanke said the legislator was concerned about retirees who relied on interest income from bank accounts, where rates react to fed policy.

“I was concerned about those seniors as well,” Bernanke wrote. “But if the goal was for retirees to enjoy sustainably higher real returns, then the Fed’s raising interest rates prematurely would have been exactly the wrong thing to do.”

He argued that raising rates would have triggered an economic slowdown, which would have required the Fed to lower them again.

His post, sometimes resembling a wonky economics lesson, also rejected criticism that he had helped distort financial and economic markets by keeping rates “artificially low.” He said the criticism presupposed that markets by themselves could somehow set money supply and thus fix short-term interest rates, but that was not the case.

“[The Fed] has no choice but to set the short-term interest rate somewhere,” he wrote. “So where should that be? The best strategy for the Fed I can think of is to set rates at a level consistent with the healthy operation of the economy over the medium term,” what he called the “equilibrium rate.”

The proper equilibrium rate is determined by the state of the economy, which itself is the subject of constant debate within the Fed, he wrote.

“The state of the economy, not the Fed, is the ultimate determinant of the sustainable level of real returns,” he said. And the economic factors that affect rates will be the subject of future posts, he said.

Predictably, Bernanke’s blog got some attention online.

Economist Paul Krugman said on his New York Times blog that Bernanke’s post was standard economics but notable for revealing “what the people he talked to as Fed chair complained about most.”

Twitter: @deanstarkman

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.