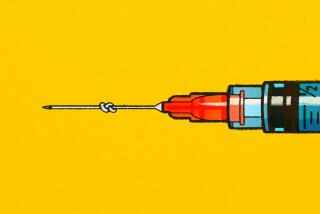

Allergan adopts ‘poison pill’ defense in Valeant takeover bid

Allergan Inc., the Irvine company that makes Botox, has adopted a “poison pill” defense that could make it more difficult for Canadian company Valeant Pharmaceuticals International Inc. and activist investor Bill Ackman to force through a takeover bid.

The company’s “stockholder rights plan” would allow existing shareholders to buy Allergan stock at a steep discount if any single investor acquires more than 10% of its shares.

The move prevents Ackman, who disclosed earlier this week that he had acquired 9.7% of Allergan’s shares, from significantly increasing his holding.

Allergan, which announced the decision late Tuesday, said the program would be in place for one year.

Valeant, based in Laval, Quebec, and Ackman, chief executive of Pershing Square Capital Management, offered $46 billion in cash and stock for Allergan on Tuesday. They said combining the two companies would “create an unrivaled platform for growth and value creation in healthcare.”

The companies had combined revenue last year of more than $12 billion.

Valeant said it would offer $48.30 in cash and 0.83 shares of its stock in exchange for each share of Allergan stock. At Monday’s closing price, the deal would be worth about $152.89 per share, or $45.6 billion.

Several analysts said they thought Allergan would reject the offer as too low. Allergan would also likely be unhappy about Valeant’s plan to significantly reduce research and development spending, potentially eliminating hundreds, or thousands, of high-paying jobs.

Shares of Allergan were up 33 cents, or 0.1%, to $163.98 in midday trading Wednesday. Valeant shares were down $1.75, or 1.3%, to $133.66.

ALSO:

IRS paid 1,100 of its employees bonuses although they owed back taxes

Boeing posts profit on jet deliveries, raises 2014 forecast

Obamacare pushes health insurance costs up: Where to take your gripes

Follow Stuart Pfeifer on Twitter

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.