Stocks erase an early loss after Fed widens bond purchases

Stocks on Wall Street rallied back from a sharp, early slump Monday, ending the day with modest gains after the Federal Reserve unveiled its latest push to prop up the economy.

The S&P 500 climbed 0.8% in the latest day of big swings for global markets as a remarkable, weekslong rally shows some cracks. Worries are rising that additional waves of coronavirus infections could derail the swift economic recovery that Wall Street just a week ago seemed so sure was on the way.

When trading began in New York, the S&P 500 quickly fell 2.5%; stocks that most desperately need the economy to reopen were hit particularly hard.

But some investors took advantage of the nervousness and bought stocks, which helped trim the S&P 500’s losses as the day progressed. The index then popped decisively higher after the Fed announced it will buy individual corporate bonds. The purchases will be part of the central bank’s previously announced program to keep lending markets running smoothly, which enables big employers to get access to cash.

They’re also the latest reminder that the Fed is doing everything it can to help support markets, analysts said. Central banks have repeatedly come to the economy’s rescue over the years, and it was huge, unprecedented moves by the Fed this year that helped put a halt to the S&P 500’s nearly 34% sell-off on worries about the recession coming out of the coronavirus pandemic.

The S&P 500 rose 25.28 points Monday to 3,066.59, which is 9.4% below the record high it set in February.

The Dow Jones Industrial Average rose 157.62 points, or 0.6%, to finish at 25,763.16. The Nasdaq composite climbed 137.21 points, or 1.4%, to 9,726.02.

“Volatility is here to stay, at least for a little while,” said Jason Pride, chief investment officer of private wealth at Glenmede. “Nobody in the financial industry has a good way to forecast this.”

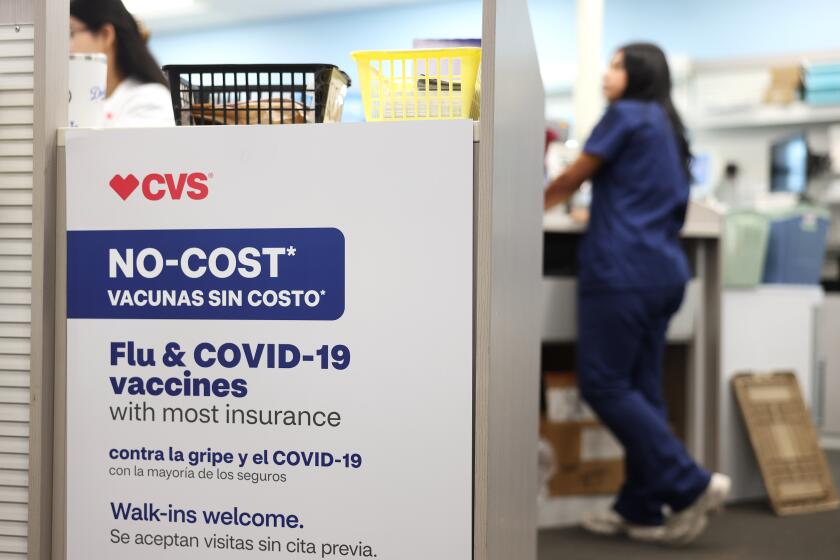

Tallies of COVID-19 cases are still growing in states across the country and nations around the world. Governments are relaxing lockdowns in hopes of nursing their devastated economies back to health, but without a vaccine, the reopenings could bring on further waves of COVID-19 deaths.

China is reporting a new outbreak in Beijing, one that appears to be the biggest since China largely stopped its spread at home more than two months ago. In New York, the governor is upset that big groups of people are clumping together outside bars and restaurants without face masks, and he threatened to reinstate closings in areas where local governments fail to enforce the rules.

That’s the biggest worry for markets: If coronavirus infections swamp the world, governments could bring back the orders for people to stay at home and for businesses to shut down that sent the economy into its worst recession in decades. Even if that doesn’t happen, rolling waves of outbreaks could frighten businesses and consumers enough to keep them from spending and investing, which would itself hinder the economy.

It was just a week ago that investors seemed ebullient about expectations for a coming economic recovery. The hopes got a shot of adrenaline this month when a report showed that U.S. employers added jobs to their payrolls in May, a big surprise when economists were expecting to see millions more jobs lost. That raised expectations that the economy could rebound nearly as quickly as it plunged.

That optimism sent the stock market on a second leg of its rally, an upturn that began in March after the Federal Reserve and Congress promised unprecedented amounts of aid to support the economy. Besides its corporate bond-buying program, the Fed has also cut interest rates back to nearly zero and expects to keep them there through 2022. Its chair, Jerome Powell, may offer more details about the Fed’s outlook in testimony before Congress scheduled for this week.

All through its torrid rally, though, many professional investors were warning that the market’s gains may have been overdone considering how long and uncertain the economic recovery looked to be. Last week the S&P 500 climbed back to within 4.5% of its record high.

Some of the rally was likely driven by a big influx of individual investors into the market. Brokerages reported big increases in client numbers and trading earlier this year, and stocks popular with individual investors have returned 61% since the market hit a bottom on March 23, according to Goldman Sachs. That’s much more than the 45% rise for stocks popular with hedge funds and traditional mutual funds.

The yield on the 10-year Treasury note rose to 0.71% from 0.69%. It tends to rise and fall with investors’ expectations for the economy and inflation, and it was above 0.90% earlier this month.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.