Column: Let’s put Donald Trump’s $750 annual tax payment in perspective

The headline nugget in the exposé of Donald Trump’s taxes published Sunday by the New York Times is that Trump paid $750 in federal income tax in 2016 and 2017.

In many other years, he paid nothing, the Times reported. But let’s put those $750 payments in context, so we can have a sense of the scale of his reported ripoff of all other American taxpayers.

First, a reminder: Trump has bragged about not paying taxes. When Hillary Clinton accused him during a 2016 Presidential debate of stiffing the government on his tax obligations, he responded, “That makes me smart.”

He also accused Barack Obama of avoiding his civic obligations by paying taxes amounting to “only” 20.5% of his $790,000 salary in 2012—vastly more than Trump has reportedly paid.

Now let’s take a look at Trump’s tax record.

$750 was about what the average American household owed in federal income taxes per month.

In 2017, median income for American households was $63,761, according to the Census Bureau. (The median is the level at which half of all households earned less and half earned more.) The federal income tax bite for families with that much taxable income—that is, after the standard deduction and personal exemptions—was about $8,600 for couples filing jointly, and $11,670 for singles.

As a group, the Trumps, the Zuckerbergs, and the Buffetts of this world pay lower tax rates than teachers and secretaries.

— Emmanuel Saez and Gabriel Zucman, UC Berkeley

That works out to $716 for couples and $972.50 for singles per month. In other words, you probably owed more federal income tax for a month than Trump paid for the entire year in 2016 and 2017.

People who earned only $60,000 paid more in Social Security and Medicare taxes per month than Trump paid in income tax per year.

Payroll taxes, which fund Social Security and Medicare, are the largest bite taken out of most income earners’ paychecks. They come to 15.3% of earned income; that’s split 50-50 between employees and employers, though economists tend to consider both halves to be tantamount to a burden on the employees.

For an employee earning $60,000 — less than the household median — that comes to $9,180 a year. Again, about as much in a month as Trump paid in income tax for the year.

The New York Times is vague about how much Trump paid in payroll taxes, in part because Trump’s tax advisor, who was quoted in the story, was vague on the topic.

Trump’s payroll tax deferral is a mortal threat to Social Security.

But it’s proper to observe that the payroll tax is the most regressive federal tax. It’s largely capped every year, absolving the wealthiest Americans of paying it on most of their income. This year, the cap on the Social Security portion of 12.4% is $137,700; the Medicare component of 3.9% isn’t capped, and those earning more than $200,000 will pay an additional 0.9% for Medicare.

But those taxes are levied only on wages — earnings from capital gains or dividends aren’t taxed at all. It isn’t clear from the Times report how much of Trump’s income came in the form of wages, other than the $400,000 statutory salary he was due as president in 2017. But as a wealthy individual, he undoubtedly avoided payroll tax on most of his income.

Trump paid less than the owed sums keeping thousands of Floridians from voting.

In 2018, Florida voters overwhelmingly passed a constitutional amendment restoring the voting rights of most former felons who had served out their sentences, including probation and parole.

The state Legislature, however, passed a law interpreting the convicted person’s obligations as including financial obligations, such as court fees, fines and restitution orders. That interpretation has been upheld by a federal appeals court, which overturned a lower court judge’s ruling that the law amounted to an unconstitutional poll tax.

The amounts keeping many ex-felons from voting can be as small as a few dollars. As many as 85,000 Floridians with possible court-ordered financial obligations have registered to vote and may be prevented from casting a ballot in the November election, according to a public advocacy coalition.

Plaintiffs in the lawsuit heard by the federal courts have financial obligations running into the thousands of dollars — and, in a couple of cases, millions. All the plaintiffs say they are unable to pay the amounts, and some say the state hasn’t been able to give them an exact accounting, or even any accounting, of what they owe.

True populists wouldn’t be punishing workers by cutting their unemployment benefits.

Trump, as it happens, is a legal resident of the state of Florida. Judging from the Times report, he may owe substantial sums to that state if his claims of federal tax exemptions are rejected. But nothing in state or federal law keeps him from voting.

Trump paid less in many years than he charges for a single night at his Washington hotel.

Want to stay at Trump’s signature Trump International Hotel in Washington, D.C.? It will cost you more than Trump reportedly paid in taxes in 2016 and 2017.

Suites at the hotel start at $1,016 a night and run as high as $8,476. (The two-level “Ivanka Study,” named after Trump’s daughter — who the Times says has been pocketing a hefty consultant fees that Trump has deducted from his income for tax purposes — costs $1,276 a night.) All rates are exclusive of taxes and fees.

It costs less to stay in one of the hotel’s guest rooms. They range from $476 to $636 a night.

The Trump International has been the target of government watchdogs since Trump’s inauguration. They contend that his pocketing income from the hotel violates the constitutional ban on high federal officials receiving financial “emoluments” from foreign countries.

The governments of Saudi Arabia, Kuwait and Malaysia, among others, have spent hundreds of thousands of dollars to stay at the hotel during official visits. A lawsuit challenging this practice is still in federal court.

It’s not normal for wealthy Americans to pay no taxes at all.

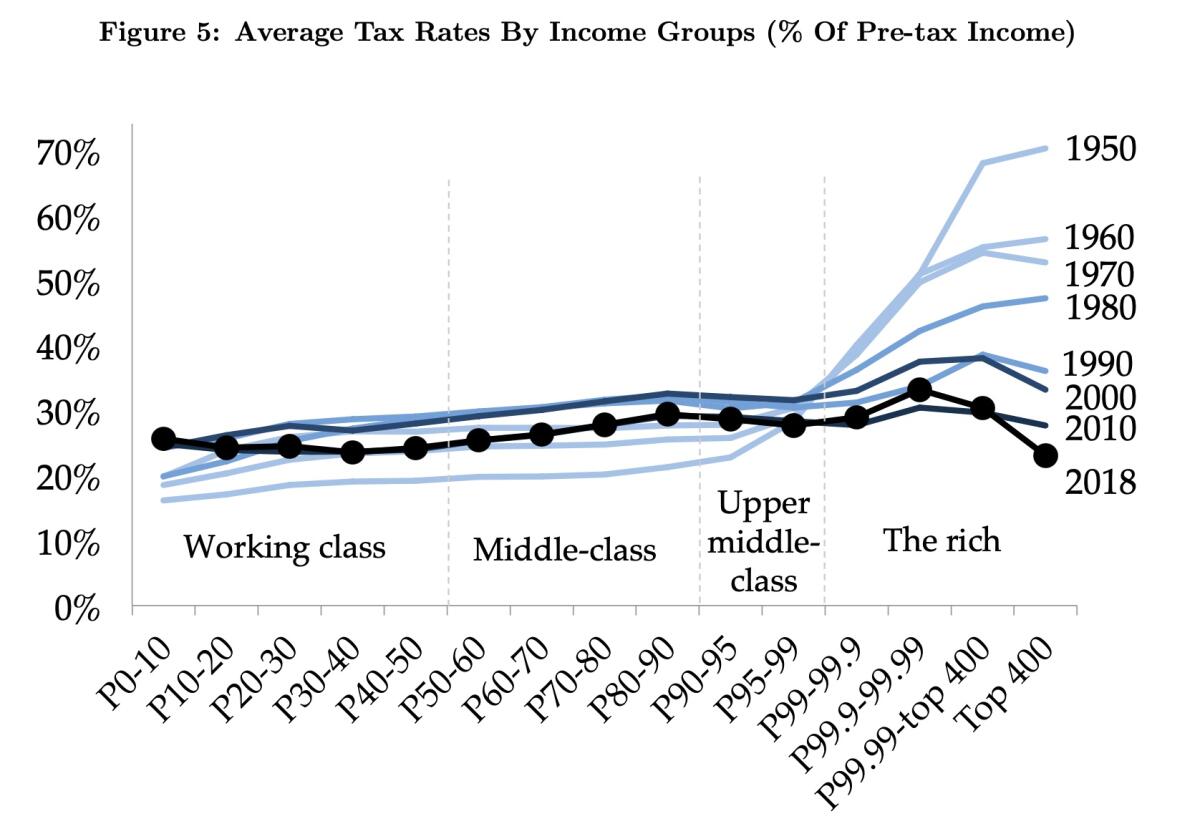

The image of the ultra-rich American paying zero taxes may be baked into national mythology, but almost all American plutocrats pay something. That’s the finding of Emmanuel Saez and Gabriel Zucman of UC Berkeley, whose latest analysis of the U.S. tax system was published Saturday, just a day ahead of the Times’ investigation.

“By any metric, the period from 1980 to 2020 has been an era of extraordinary wealth accumulation among the rich in the United States,” Saez and Zucman write.

Saez and Zucman point out that the tax bite on the richest Americans has been steadily coming down; it’s now the lowest it has been at least since 1950, even as the wealthy claim an ever-larger share of national income.

The federal income tax system is still broadly progressive, meaning that the tax burden generally rises with income, but is regressive at the very top — the 400 richest taxpayers paid a lower percentage of their income than the top 0.1%.

The authors calculate that the lowest-income 50% of Americans, with average incomes of $18,500 a year, pay an average of 25% of that income in taxes, or $4,625. The rate increased slightly for the next 40%, reaching 28% for the top 90% to 99%, then fell to an average of 23% for the richest 400.

“As a group,” Saez and Zucman wrote in their 2019 book, “The Triumph of Injustice,” “the Trumps, the Zuckerbergs, and the Buffetts of this world pay lower tax rates than teachers and secretaries.” Evidently, the Berkeley economists underestimated Trump’s tax avoidance ability.

On the other hand, Trump paid more in taxes than Mexico has paid for his wall or China has paid in U.S. tariffs.

Among Trump’s electoral mantras has been that Mexico would be paying for his anti-immigrant wall along America’s southern border, and that China has been paying American tariffs on China’s exported goods.

Neither assertion is correct. Mexico has never paid a cent for the wall, which has been financed by redirecting U.S. budget appropriations toward its construction. Economists are unanimous that tariffs are a burden on consumers in the tariff-charging country, in this case U.S. consumers, because they’re paid initially by importers, not exporters. So Trump, to be fair, has paid more in taxes than either country has paid for his fancies.