California is cutting cannabis taxes in hopes of saving struggling pot businesses

Tax cuts and other reforms are coming to the California cannabis industry as authorities seek to revamp a system that businesses, growers and others say has been stymied by over-regulation.

A bill signed by Gov. Gavin Newsom last week cuts a cultivation tax placed on cannabis growers and shifts excise tax collection from distributors to retail businesses, according to the California Cannabis Industry Assn.

“While imperfect, we achieved some significant victories, which we should be proud of,” the association said in a statement.

When Californians voted in 2016 to allow the sale of recreational marijuana, advocates envisioned a system of thousands of shops and farms obtaining state licenses. Officials promised “social equity” to those hit hardest by the war on drugs.

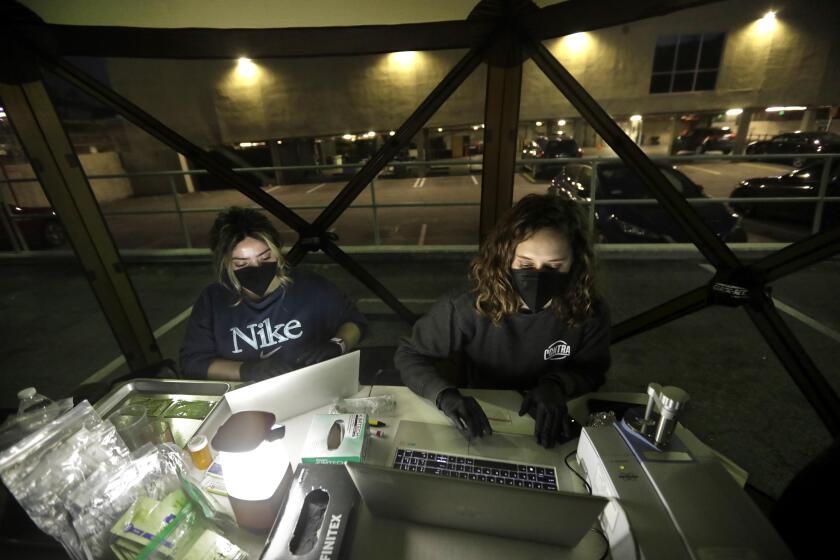

In Los Angeles a program targeted entrepreneurs with marijuana arrest records, those with low incomes and people who lived in areas disproportionately affected by cannabis arrests.

But growth in the legal market was hampered by complex and confusing regulations, high taxes and decisions by some communities to ban cannabis shops. Industry experts and lobbyists have been fighting for reforms ever since.

The promise of ‘social equity’ has been a key narrative tied to California’s legalized pot industry. So far, efforts have been mired by costly delays.

The new law, AB 195, is being touted as a step in the right direction.

“CCIA has been lobbying for the elimination of the cultivation tax since it went into effect four years ago,” read the cannabis association’s statement. “Zeroing out the cultivation tax indefinitely and shifting excise tax collection from distribution to retail are big wins for our industry! We also achieved tax relief for at least three years, successfully pushed back on an automatic tax increase, which would have taken effect in 2024, bolstered enforcement against unlicensed operators, and provided additional relief for social equity operators.”

Other reforms put in place by the new bill include capping the excise tax rate at 15% for three fiscal years, though it may be increased after July 1, 2025; allowing social equity licensees to keep 20% of the excise taxes they collect to reinvest in their businesses; making equity licensees eligible for a $10,000 tax credit; $40 million in tax credits, including $20 million for certain storefront retail and microbusinesses, and $20 million for cannabis equity operators; and adding enforcement tools to fight against the illicit cannabis market.

In their statement, the industry group said the work is far from over and that the survival of the regulated cannabis industry requires providing stable tax revenues to the state as well as advancing public health and safety.

Robert Raich, an Oakland-based attorney and California cannabis law expert, told The Times on Tuesday that incremental changes in the new bill are very important.

“The most visible improvement will be supporting the legal, regulated market in cannabis,” Raich said. “The problem we have had ever since 2018 when we entered this regulated and taxed paradigm in California is that the regulations are too severe, too strict, and the taxes are so high that the vast majority of the market is still the underground market.”

Regulations have been driving prices so high that a person buying from the unregulated “legacy market” is likely to pay 50% less than if they buy from a licensed dispensary, he said.

The system in place before the passage of AB 195 was also making it difficult for small-scale cultivators to earn a living, Raich said.

Cannabis entrepreneurs complain that the sluggish rollout of L.A.’s social equity program is hurting some of the people it was supposed to help.

“If you want to promote small businesses rather than huge industrial-size facilities, then eliminating this cultivation tax is an important element to achieve this goal,” he said.

Although businesses and cultivators will see some relief from the cultivation tax, the excise tax is still too high and will continue driving businesses and consumers toward the underground market, Raich said.

“Frankly, the excise tax should also be eliminated or at least greatly reduced,” he said.

Nevertheless, the industry is celebrating this victory, Raich said.

“It is universally applauded for what it does do, even though we didn’t get everything we sought,” he said. “If you are a cannabis consumer, it makes a huge difference. You can buy more safe cannabis that’s been tested. You’re saving yourself money.”

And those who do not consume cannabis should also be pleased at the passage of the bill, Raich said.

“It’s estimated that just 20% of the overall market is the legal market, meaning that roughly 80% of the market is the underground, legacy, unregulated market,” he said. “That’s a very visible failure. If we want to keep people operating legally rather than keeping them as criminals, then we need to have a system that actually works.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.