Editorial: We’ve entered the coronavirus economy

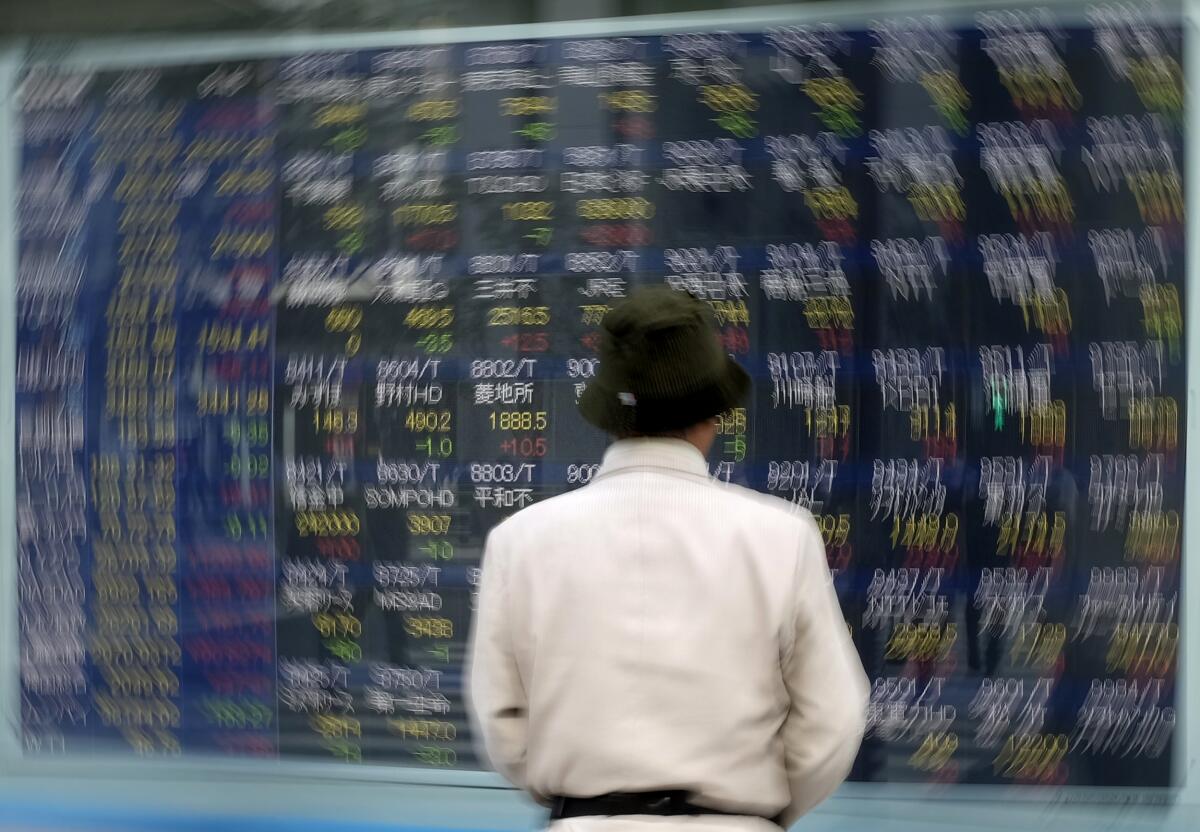

As hard as it may be to believe, cheap gas isn’t always a good thing. For instance, after Saudi Arabia announced a deep discount in its crude oil prices, global stock markets plummeted, with the Dow dropping nearly 8% Monday. If history is any guide, gas prices will recover from this clobbering far sooner than the value of your 401(k). The stocks on the S&P 500 index have now lost a collective $5 trillion since the index’s peak just a few weeks ago, suggesting that the 11-year bull market may finally have turned bearish.

It’s a mistake to conflate the stock market with the economy, but in this case, it’s hard to miss the red flags investors are waving. They’re signaling that the outbreak of the novel coronavirus is causing problems that are large and far-reaching enough to trip up the formidable U.S. economy. Sure, they may be overreacting, and public health officials may find a way soon to slow a virus, which has been detected in more than half of the 50 states. At this point, however, it’s hard to tell whether investors are being panicky or prudent.

Here’s the connection between Monday’s sell-off and conoravirus. Government- and business-imposed travel restrictions and consumer worries about contracting COVID-19 have cut the demand for fuel, leading to a glut in supply and a 30% drop in crude oil prices as of last week. The Organization of Petroleum Exporting Countries, the cartel of nations whose economies depend on oil sales, proposed cutting oil production to try to push prices back up, but the plan was scuttled Friday when Russia, the world’s third-largest oil producer, balked.

Saudi Arabia, the world’s second-largest producer, responded over the weekend by cutting its crude prices sharply — a move that analysts say was meant to punish Russia and grab a larger share of the market. Yet one clear loser is the U.S. oil and gas industry, which had ridden the fracking wave to become the world’s top producer.

Because it typically costs more to extract oil from U.S. shale beds than from Middle Eastern sands, it’s hard for U.S. energy companies to compete when prices are as low as Saudi Arabia is pushing them. And when U.S. oil and gas producers pull back, it has ripple effects on their employees, on the companies that do business with them and on the communities where they operate. That’s why investors were especially tough Monday on the stocks of companies, such as Halliburton and Schlumberger, that supply equipment to U.S. oil fields.

It’s funny, but it wasn’t that long ago when lower gas prices would have been celebrated from coast to coast. That was before the shale oil explosion helped the United States end its dependence on foreign oil. One unfortunate byproduct, however, is that the U.S. economy no longer thrives on lower oil prices. True independence from foreign oil cartels will come not from fracking, but from a far greater investment in renewable energy supplies.

Economists, too, worry that the domestic oil industry’s slowdown could be a harbinger of another downturn in U.S. manufacturing. The sector hit a rough patch in the first six months of 2019, but consumer spending was strong enough then to keep the U.S. economy growing. Thanks to the coronavirus, however, a number of headwinds are building.

The tourism industry is tanking. Events are being canceled right and left, pulling countless dollars out of the host communities and, in the case of business conferences, wiping out the deal-making that many companies rely on. A wide range of industries with China-linked supply chains are running out of products and parts. Restaurants, theaters, concert promoters and other businesses that rely on consumers venturing out in public are starting to feel the pinch.

The plunge in the markets can only make matters worse. The “wealth effect” of the rising stock market helped spur consumers to borrow and spend more, with household debt hitting a record $14 trillion earlier this year. The market’s plunge could promote the opposite reaction, further crimping consumer spending.

As last Friday’s jobs report shows, the U.S. economy was chugging along at a decent clip through February. And there are signs that China may have COVID-19 under control, potentially allowing that country’s manufacturers to get back on track and easing the strain on supply chains and global demand. So if health officials succeed in halting the spread of the coronavirus here, then the episode may pass with a relatively small number of casualties, human or corporate. Still, it would help if federal and state governments started looking at the virus as more than just a health issue, and got ready to respond accordingly. President Trump said Monday he would be taking several proposals to Congress aimed at boosting consumer spending and helping workers who don’t have paid sick leave, and that’s a good place to start the conversation.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.