Insurers already calculating 2015 premiums as Obamacare kicks in

After months of head counts for Obamacare, it is the medical bills that will start to matter now.

Even before enrollment closes Monday, California has far exceeded its initial goals for signing up people under the Affordable Care Act. Although the sheer volume of 1.1 million policyholders is impressive for a brand new government program, the number of sicker patients is what’s likely to draw the most attention.

How sick they are and the size of their medical bills will be front and center in the weeks to come as insurers begin drawing up next year’s insurance rates, which will become public this summer.

The outcome — hefty rate hikes or more modest increases — in the pivotal state of California could help shape political races nationwide and the future of enrollment for President Obama’s signature law.

WellPoint Inc., parent of California’s leading health insurer in the exchange, Anthem Blue Cross, has already predicted “double-digit-plus” rate increases on Obamacare policies across much of the country.

Other experts discount the notion of soaring premiums because the Obama administration has programs in place to help health plans offset losses from higher-cost customers.

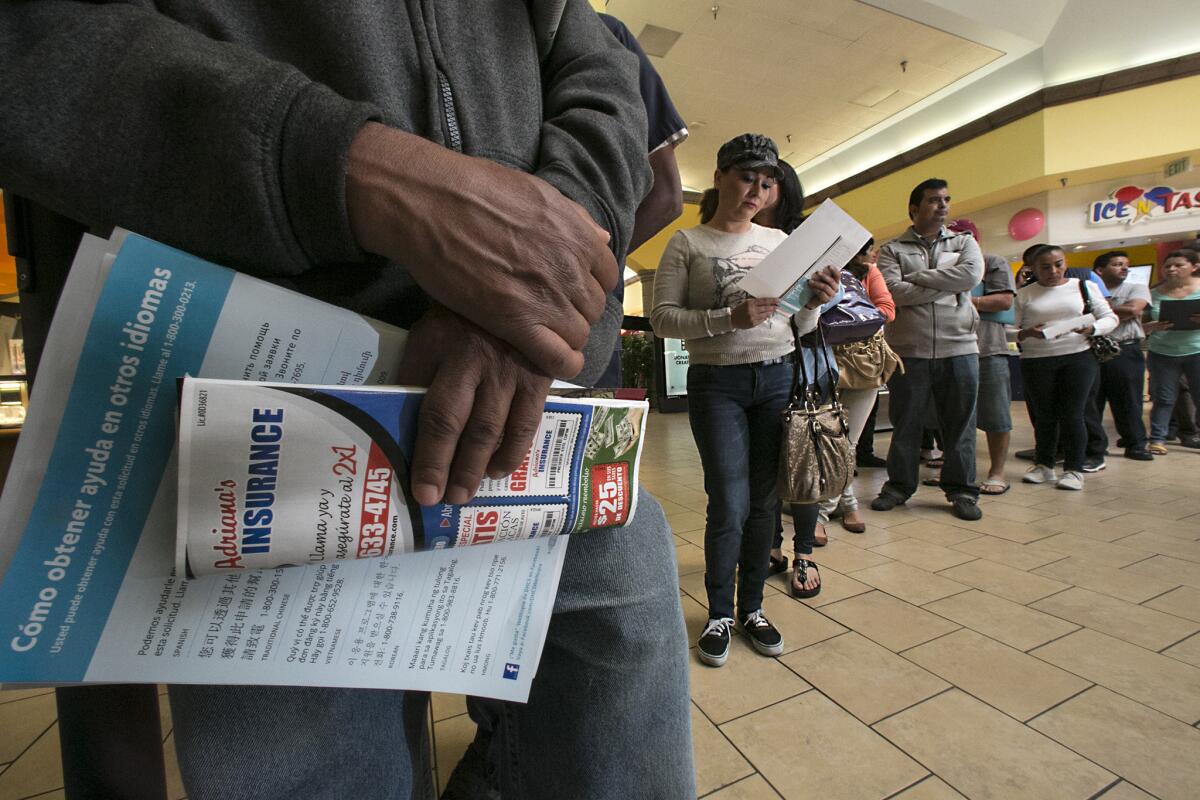

Meanwhile, most everyone involved is waiting to see how many additional people rush in by Monday, the last day to begin enrolling in Obamacare.

But health insurers aren’t wasting any time sizing up what patients are costing them now and what that will mean for 2015 rates.

Hunkered down in conference rooms, insurance actuaries are parsing prescriptions, doctor visits and hospital stays for clues about how expensive these new patients may be. By May, insurance companies must file next year’s rates with California’s state-run exchange so negotiations can begin.

“If rates in California increase by 20%,” said Robert Laszewski, a healthcare consultant in Virginia, “enrollment will go down and any healthy people will bail.”

Those concerns are one reason the Covered California exchange, insurers and health-law supporters are trying so hard to persuade young and healthy people to enroll before Monday’s deadline. The goal is to improve the chances of getting a balanced mix of policyholders and keep monthly premiums down.

No matter the final outcome, Covered California officials are confident they have done enough to avert upheaval in the market.

“I think we’re in a position to be optimistic that if rates go up at all, it will be in the single digits,” said Peter Lee, executive director of Covered California.

Harriet Davidson, 60, was one of the first people in line for Obamacare after being shut out of the market for years.

The self-employed consultant in Contra Costa County was rejected twice for individual health insurance because of her diabetes and a thyroid condition. The healthcare law removed that obstacle by guaranteeing access to coverage regardless of preexisting conditions.

That meant Davidson could buy a Silver plan from Blue Shield of California that costs her $92 a month — thanks to a federal subsidy.

“I probably neglected my health the last few years because of the expense,” Davidson said. “Now I’m going to have every test known to man.”

She plans to undergo lab tests for her diabetes, a mammogram, a bone density scan and a colonoscopy — everything she put off while she went without comprehensive insurance.

Davidson’s medical bills are the kind of expenses that could end up being scrutinized in a conference room on the 18th floor of Blue Shield’s headquarters in San Francisco. The company’s chief actuary, Amy Yao, and a small team of co-workers meet every other day to pore over the latest data and trends. “It’s kind of the sausage-making factory,” she said.

Yao said claims information is usually a better guide to future costs than a customer’s age, sex and other demographic data. But there’s a risk to putting too much weight on such a short time period, and there’s no guarantee Blue Shield will hang on to these same customers when they get a chance to renew their policies early next year.

“It’s really dangerous to draw conclusions from a small sample because you could be off materially,” Yao said. “Pricing is really challenging this year.”

Jacinta Camacho Kaplan, 63, is another person who immediately put her new health plan to use. The retired writer in Santa Monica has visited the hospital twice since she enrolled and needs follow-up care for a brain tumor that was treated in 2007. Kaplan pays about $600 a month for a high-end Platinum plan from Anthem Blue Cross.

“I’m a big user because I have these problems,” she said. “It’s a godsend to have this insurance.”

Covered California enrollment has made steady progress among young people, but officials acknowledged it was still falling short of their ultimate goals.

The turnout among young Californians ages 18 to 34 reached 27% of total enrollment through March 1, the latest data available. About one-third of the people eligible for subsidies are in that age group.

Many health policy experts say the prevalence of older, sicker customers in the exchange shouldn’t surprise health insurers.

They also note two major unknowns that could alter the equation: It was always anticipated that younger people would procrastinate until the Monday deadline, and the risk pool for rate-setting purposes also includes tens of thousands of people who are buying new policies outside the state exchange. Details about the size and makeup of that market aren’t known yet.

“I think all of the health plans expected the first 500,000 people would be older and sicker,” said Marian Mulkey, director of the health reform and public programs initiative at the California HealthCare Foundation. “I don’t expect a dramatic shift in the rates.”

Covered California’s overall enrollment as of Thursday had already surpassed the most optimistic estimates by 33%. By another measure, the state has reached nearly half the 2 million Californians who are eligible for premium subsidies.

To receive that government assistance, consumers must purchase their policy through the exchange. Otherwise, they can choose to bypass the state marketplace and buy the same health plans directly from insurers.

California’s exchange has benefited from widespread political support for the Affordable Care Act, a largely functioning website and a broad network of clinics, nonprofit groups and labor unions aggressively promoting enrollment. It started slow in October, with only 30,000 people picking out a health plan in the entire month. Last week, more than 80,000 people enrolled over a four-day period.

In recent weeks, the state revamped its advertising and put the spotlight on younger enrollees. Orange County construction worker Luis Lupercio, 38, and his two sons star in a Spanish-language TV commercial aimed at attracting Latinos.

He said he couldn’t afford health insurance previously for his family of four, particularly as work dried up after the recession. But cost was no longer an issue with a federal subsidy. He said he got a Health Net policy through the exchange for just $1 a month.

“I rarely get sick,” Lupercio said. “Getting coverage for my kids was more important.”

Most health insurers remain bullish about their prospects under the healthcare law and have been pleased with California’s better-than-expected performance overall.

“But a lot of healthy people sat out Year 1, so you need another big influx” when enrollment opens again in November, said Charles Bacchi, executive vice president at the California Assn. of Health Plans, an industry trade group.

Santa Monica resident Julia Reed Nichols, 27, lost healthcare coverage about a year ago when she no longer qualified for her parents’ insurance plan. She enrolled in a Bronze plan from Anthem Blue Cross for $93 a month after taking into account a premium subsidy.

“I held my breath for the last year without insurance,” worried about incurring big medical bills if something unforeseen happened, she said. “But it is hard to get a twentysomething to pay another bill because so many of us are already drowning in student loan debt.”

Twitter: @chadterhune

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.