Chad Terhune

writer

Chad Terhune previously covered the business of healthcare, including medical costs, patient safety and the rollout of the federal health law. Prior to joining in 2012, he was an award-winning reporter for the Wall Street Journal and Businessweek. Chad spent more than a decade at the Journal and his stories on health insurance won a National Press Club award. At Businessweek, his stories on health reform and subprime mortgages earned recognition from the New York Press Club and Investigative Reporters and Editors. He graduated from the University of Florida. Terhune left The Times in January 2016.

Latest From This Author

Marcela Villa isn’t a big name in healthcare — but she played a crucial role in the lives of thousands of Medicaid patients in California.

With no insurance through his job, Jose Nuñez relied on Medicaid, the nation’s public insurance program that assists 75 million low-income Americans.

Ashley Summers said she got an unpleasant surprise in February when she tried to pick up a prescription for her rheumatoid arthritis: Her pharmacy said her insurance had been canceled, even though her premiums were paid.

Stepping into the land of the Trump resistance, Seema Verma flatly rejected California’s pursuit of single-payer healthcare as unworkable and dismissed the Affordable Care Act as too flawed to ever succeed.

Premiums in California’s health insurance exchange will rise by an average of 8.7% next year, marking a return to more modest increases despite ongoing threats to the Affordable Care Act.

Cooking dinner one night in March, Mark Frizzell sliced his pinkie finger while peeling a butternut squash and couldn’t stop the bleeding.

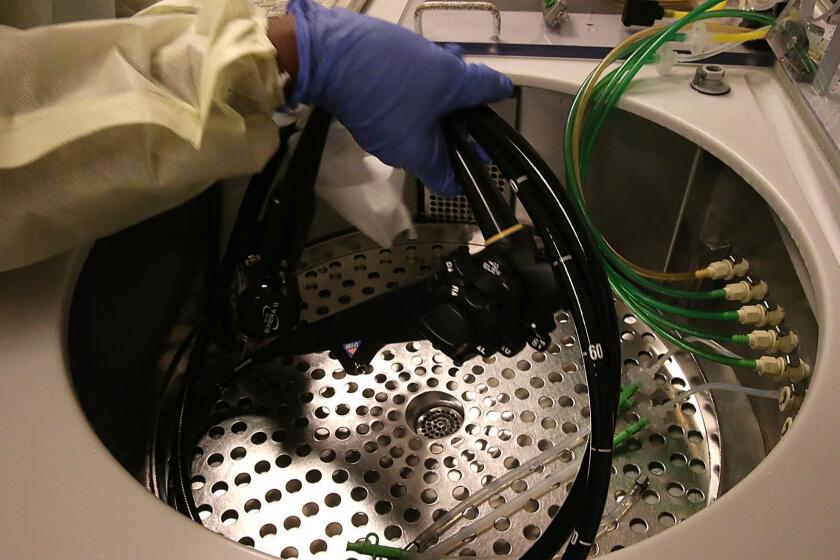

In an ominous sign for patient safety, 71% of reusable medical scopes deemed ready for use on patients tested positive for bacteria at three major U.S. hospitals, according to a new study.

In a high-profile legal action aimed at the financial cost of healthcare consolidation, California’s attorney general has sued Sutter Health, the largest hospital system in Northern California, alleging anticompetitive business practices that unfairly drove up costs for patients.

California signed up an estimated 450,000 people under Medicaid expansion who may not have been eligible for coverage, according to a report by the U.S.

Norma Diaz and her husband, Joseph Garcia, have dedicated their careers to running a nonprofit health insurer that covers some of California’s neediest residents.