Fed’s Lacker predicts more stimulus cutbacks despite modest growth

A top Federal Reserve official expects the central bank to continue reducing a key stimulus program even though he sees more modest growth this year than many analysts have projected.

Jeffrey Lacker, president of the Federal Reserve Bank of Richmond, Va., said Tuesday he supported the decision by central bank policymakers in December to start reducing the monthly bond-buying program.

The Fed now is purchasing $65 billion a month in bonds after the Federal Open Market Committee voted to cut the amount by $10 billion at its December and January meetings.

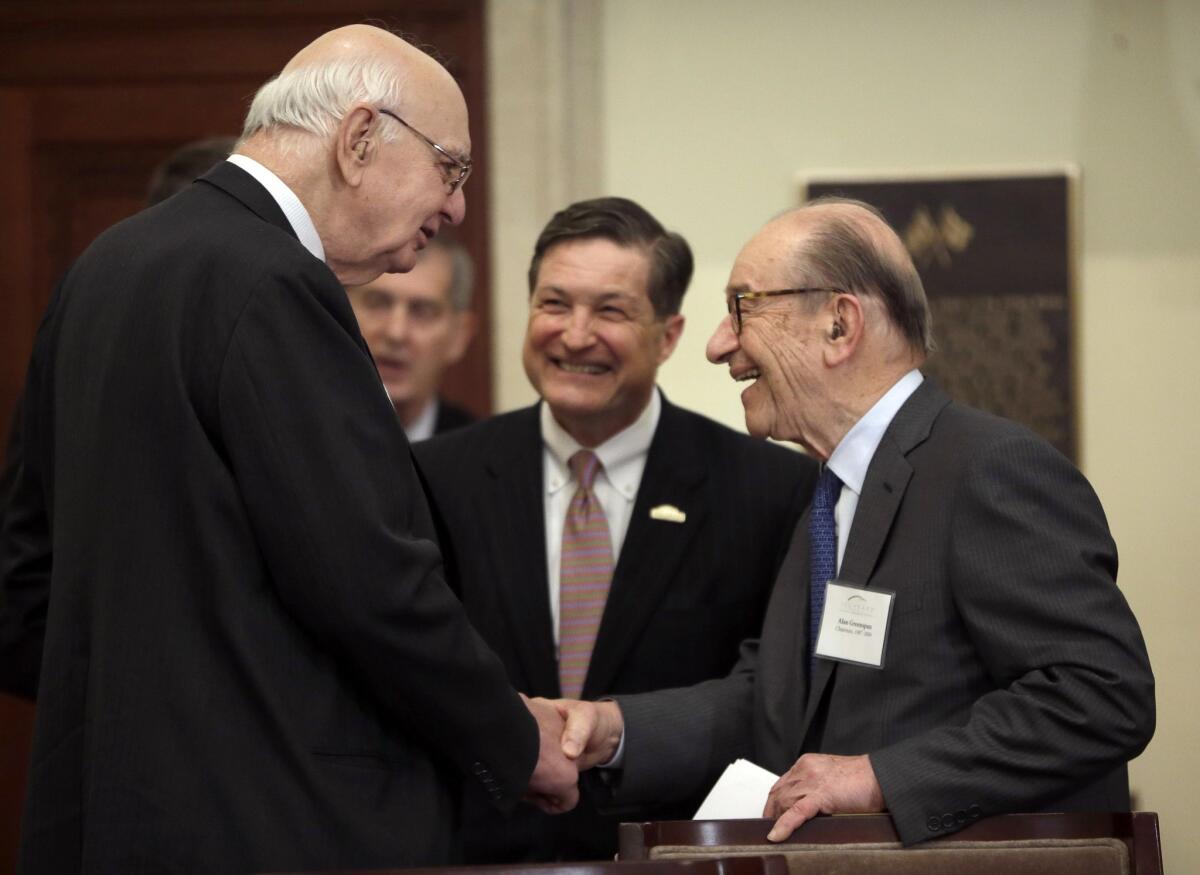

PHOTOS: Federal Reserve chairs through the years

Analysts expect the cuts to continue under new Fed Chair Janet L. Yellen, who was sworn in Monday.

“Since the program began in late 2012, we’ve seen a substantial improvement in a variety of indicators of labor market conditions, including the unemployment rate and the level of employment,” Lacker, a non-voting member of the Federal Open Market Committee, said in a speech at Shenandoah University in Winchester, Va.

“So it made sense to initiate the process of bringing the program to a close,” he continued. “I expect to see further reductions in the pace of purchases at upcoming meetings.”

The prediction by Lacker, who has been a critic of the bond-buying program, came despite large recent drops in financial markets and turmoil in emerging markets that could cause Yellen to push to stop the cutbacks -- or even increase the purchases to try to add more stimulus to the economy.

Although Lacker noted the labor market has improved significantly since the bond-buying began in September 2012 -- the unemployment rate has dropped to 6.7%, from 8.1% -- he’s not as optimistic about economic growth as other Fed officials and private economists.

He said Tuesday that “the turning of the calendar is an occasion for hope regarding prospects for the year ahead.”

But he observed that hopes for stronger economic growth continually have been dashed during the recovery from the Great Recession.

Despite widespread projections that the economy will expand by about 3% this year, Lacker said he expected growth to be “just a little above 2% -- not much different from what we’ve seen for the last three years.”

“The pickup in growth late last year is certainly a welcome development, and it may well be a harbinger of stronger growth ahead,” he said.

“But experience with similar growth spurts in the recent past suggests that it is too soon to make that call.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.