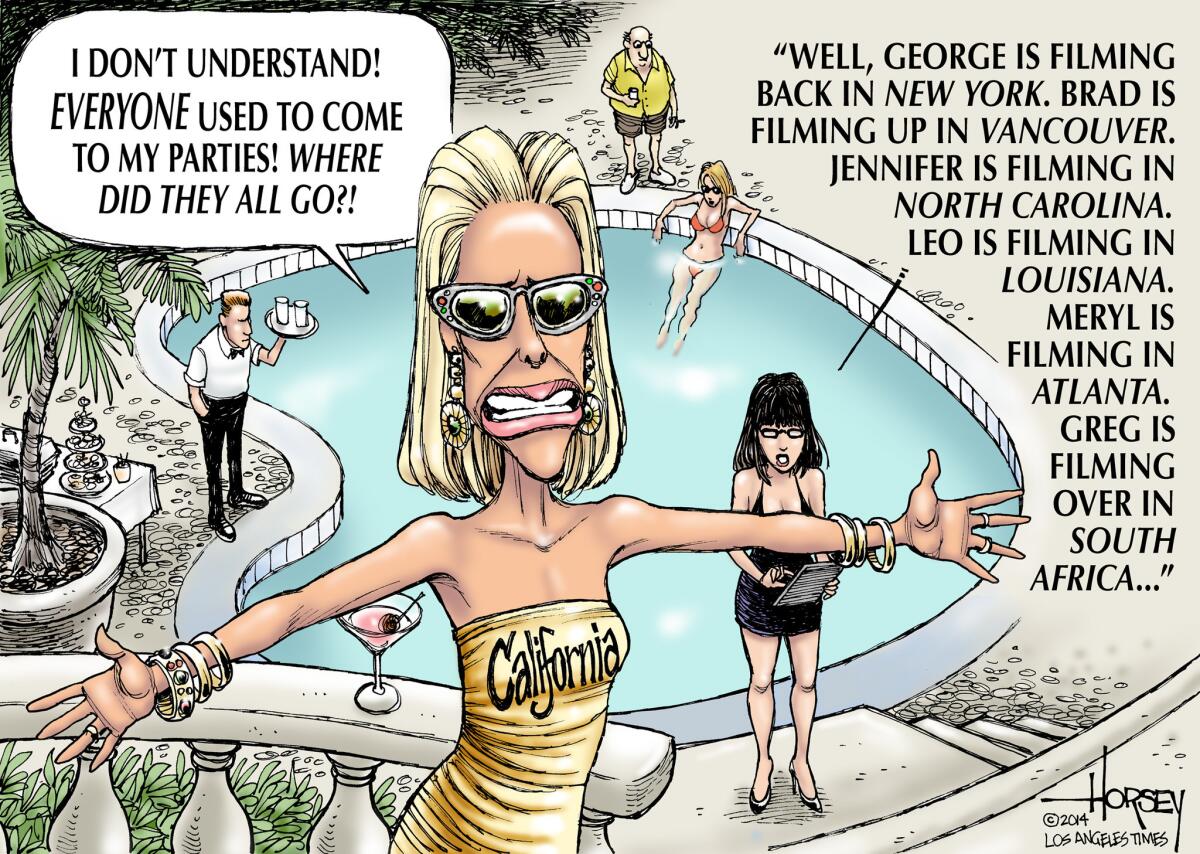

Runaway production leaves California in the lurch

How much longer can Hollywood claim to be the movie capital of the world? Can the California Legislature reverse the slide of film production away from Los Angeles simply by enhancing tax credits for the movie and television industry or, one day, will the Oscars be presented in Atlanta or Toronto or New Orleans?

Such questions grow more pertinent year by year. Lawmakers in Sacramento are now mulling over a plan that would extend the current $100-million movie industry tax credit program that is set to expire on July 1, 2017. There is debate about whether the tax deal for filmmakers actually boosts the state economy -- supporters and opponents each point to studies that claim to bolster their opposite positions -- but there is no argument about the problem.

According to a recent report in the Los Angeles Times, the number of top-grossing films made in California has dropped 60% in the last 15 years. A big share of TV production has also left the state. All that business has gone to other states that offer filmmakers a better deal. About 40 states -- North Carolina, Georgia, Louisiana and New York prominent among them -- now give tax breaks to movie and TV producers. In 2012, those tax breaks, rebates and grants totaled $1.5 billion, according to the Times analysis.

Foreign countries are also in the game. Canada has long made it attractive to shoot TV shows and movies north of the border and Vancouver and Toronto have often doubled for American cities in major Hollywood films. In November, Thai Princess Ubolratana Rajakanya led a delegation to L.A. to promote Thailand as a location for film production. South Africa offers vivid landscapes, nonunion workers and government rebates as high as 25% of production costs.

One producer who has taken advantage of the growing phenomenon is Gregory Bonann, the man who gave the world “Baywatch.” Bonann has not left the beach with his new TV series, “SAF3,” a show that features fictional stories about an elite rescue task force in Malibu.

But he has left California. Early in the planning stages for the new series, Bonann decided to save money by taking advantage of the tax incentives in North Carolina and was set to shoot there. Then, he was offered an even sweeter deal in South Africa. California could not compete.

ON LOCATION: Where the cameras roll

California leaders may need to be even more proactive if the state is to retain its signature industry. But more than the movie business is in play in the competition between states. There is a wide range of companies the states are trying to steal from one another in a spiral of ever-more-generous tax breaks. Some economists now say many states are giving away so much revenue that the price being paid may outweigh the benefit.

A very recent case in point: In what is being cited as the biggest single example of “corporate welfare” in U.S. history, the Washington state legislature awarded tax breaks worth $8.7 billion to Boeing in order to guarantee that the company’s next jet, the 777X, would be built at the Boeing plant north of Seattle. Even though Boeing has a 100-year history in Washington, corporate leaders made it clear they were ready to shift production to California, South Carolina, Texas or any other state if they could get a sweeter offer.

As Boeing is to Seattle, the entertainment industry is to Los Angeles. It was once unthinkable that most movies and TV shows would be made anywhere else. It’s not so unthinkable anymore.

ALSO:

Horsey on Hollywood: 2013 wrecks in review

Horsey on Hollywood: Gunplay in PG-13 movies

America wolfs down ‘The Wolf of Wall Street’ excess

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.