Netflix stock hits all-time high on forecast of strong global growth

Netflix Inc. stock soared to record levels Tuesday, apparently propelled by a new analyst report predicting surprising growth in the streaming video service’s international subscribers.

The stock stock rose to a high of $321.61 in early trading, after MKM Partners analyst Rob Sanderson wrote that global gains in subscribers would exceed expectations, and one day surpass the number of customers in the U.S.

Sanderson wrote that the economics of the entertainment business will change with the shift to Internet-delivered programming -- and that Netflix is “a driving force” of this trend.

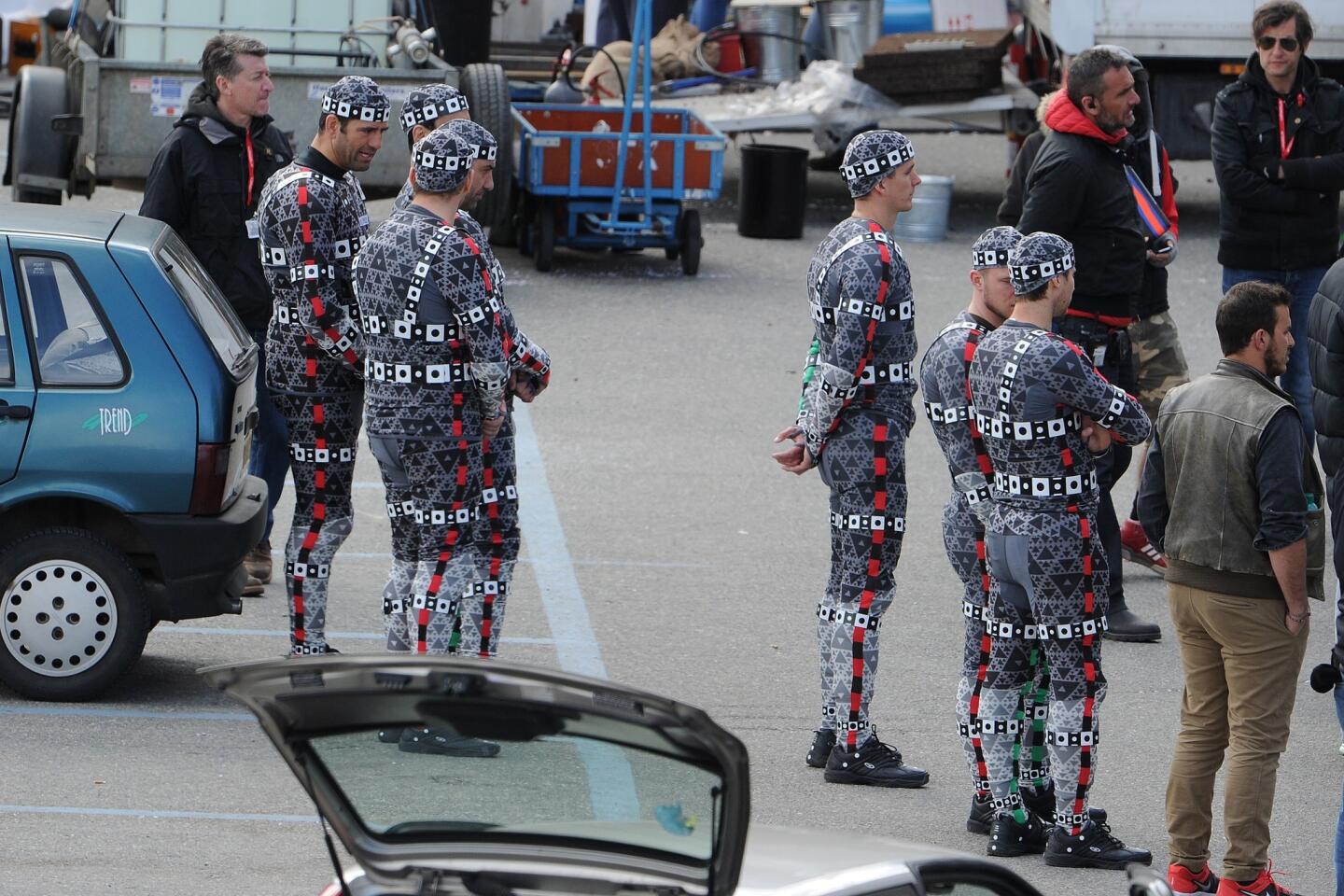

ON LOCATION: Where the cameras roll

Moreover, Sanderson cited recent deals with pay television distributors Virgin Media in Britain, which is testing a program in homes with a Virgin Media TiVo devices, and with Com Hem in Sweden as indication that some cable operators now view Netflix as a partner whose Internet-streamed movies and TV shows enhance the appeal of broadband services.

“Anecdotes from the U.K. are encouraging, suggesting Netflix is becoming a ‘must-have’ service,” Sanderson wrote. “This is the most competitive market and the company was not the first mover. We continue to think international subs will surprise and eventually be as large (or larger) than domestic.”

The MKM Partners report, issued Tuesday morning, seemed to drive up the price of Netflix stock to an all-time high. Shares were trading at $319.74 mid-session, up $10.53 from the previous day’s close.

Netflix will report third-quarter earnings on Oct. 21. In its most recent filing, the company said it had 30 million domestic streaming subscribers, and 7.5 million internationally. The service now is available in Canada, Ireland, parts of Latin America and the Netherlands.

ALSO:

CBS, NBC, ABC and Fox debuts show some promise

Lady Gaga, Eminem and Arcade Fire to headline new YouTube awards

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.