State Agency OKs Plan to Alter Quake Premiums

Rates for basic earthquake insurance would double for parts of Riverside, Santa Barbara and Humboldt counties and increase 60% for many San Fernando Valley residents under a plan approved Thursday by the California Earthquake Authority board of directors. The board also approved an option for homeowners to buy increased coverage.

The plan, which would also lower rates by 4% in the Bay Area and by 3% in much of Los Angeles, is subject to review and approval by the California Department of Insurance. If approved, the rates could go into effect by April.

The CEA says the new rates benefit more policyholders than they punish, reducing premiums 4.5% overall. The rate plan reflects new scientific information about soils and earthquake risk, said CEA Chief Executive Greg Butler, who announced his resignation Thursday. (The CEA named Chief Deputy Insurance Commissioner David Knowles as his replacement effective Jan. 1.)

The overall logic of the rates remains the same: The insurance cost is significantly higher in areas that the CEA believes face greater risk of earthquake damage.

The new rates are generally lower in part because of lower reinsurance costs--the premiums other insurers charge to help cover the CEA’s risk--and the increased number of policies taken out by homeowners in lower-risk areas, Butler said.

Under the plan, some of the lowest rates in the pool would be increased, often dramatically. Premiums in parts of Riverside and Humboldt counties would double to $2.05 per $1,000 of coverage. Other residents in those counties would pay 12% to 34% more, or $5.25 per $1,000 of coverage.

Rates in Santa Barbara would rise from 99 cents per $1,000 to $1.99. In Northridge, current rates of $1.66 per $1,000 would increase to $2.66.

Rates in most of Los Angeles would drop from $2.90 to $2.80. San Luis Obispo would see a 60% drop, to $1.11, while rates in Monterey and parts of the Bay Area would fall 18%.

The authority, which provides most earthquake coverage in the state, also voted Thursday to offer increased coverage for an additional premium.

The move to increase coverage came after two years of homeowners’ and consumer advocates’ complaints that the CEA’s coverage is too limited and its costs too high. CEA policies have a 15% deductible, compared with the 5% to 10% deductibles that were commonly available through private insurance before the 1994 Northridge earthquake. Contents coverage is limited to $5,000 and expenses for living elsewhere while a home is rebuilt are capped at $1,500.

Under the plan approved Thursday, reducing a deductible to 10% would cost policyholders an extra 80 cents per $1,000 of coverage, or $125 for the average Los Angeles home, which is insured for $156,000. Increasing contents coverage to $50,000 and emergency living expenses to $10,000 would cost 65 cents per $1,000 of coverage, or $101 a year.

The CEA board said the expanded coverage would help fill the gap left by private insurers, who abandoned the earthquake market after the Northridge quake and who largely failed to offer supplemental coverage after the CEA was created in 1996.

The additional coverage should be available by spring.

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Earthquake Rate Changes

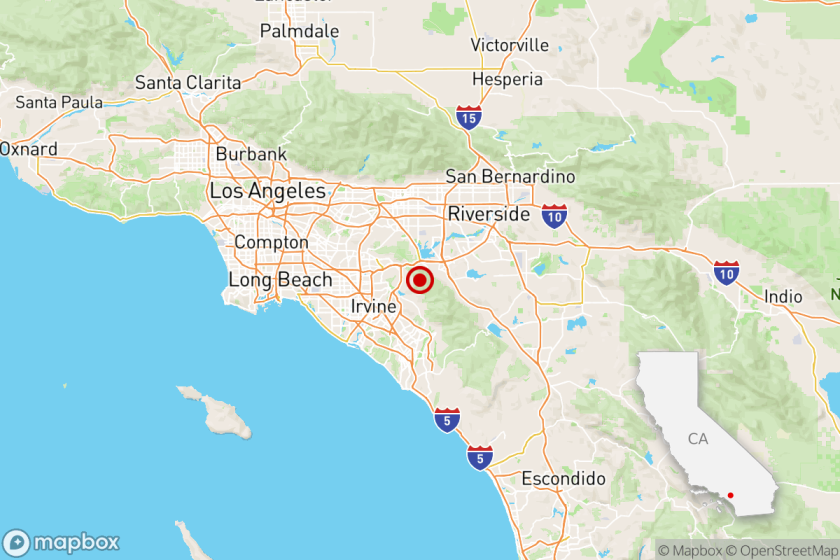

The California Earthquake Authority has adjusted premium rates three times since its 1996 inception. The latest proposal would increase rates dramatically in parts of Riverside, San Bernardino and Los Angeles counties, based on new risk estimates. Rates, per $1,000 of coverage:

*--*

Area Nov. 1996 Nov. 1997 Proposed Imperial County $5.25 $5.25 $5.25 South central Riverside County 4.75 4.33 5.25 North central Riverside County 5.12 4.68 5.25 Far west, south and north Riverside County 1.17 1.05 2.05 Central Los Angeles County 3.19 2.90 2.80 and north Orange County* NW corner of Riverside County and 3.19 2.90 3.90 SW corner of San Bernardino County North Los Angeles County** 1.81 1.66 2.66 Northwest Los Angeles County 4.64 4.24 4.98 Ventura County 1.98 1.82 2.76 Santa Barbara County 1.14 0.99 1.99 San Luis Obispo County 5.25 2.84 1.11 Monterey County 5.03 4.54 3.73 Outer ring around Bay Area 2.88 2.64 2.59 Inner ring around Bay Area 5.25 4.57 4.41 San Mateo Peninsula 5.25 4.57 3.76 Mendocino County 1.17 1.05 1.90 Humboldt County 1.17 1.05 2.05 Napa/Sonoma counties 4.90 2.74 2.69 Rest of state 1.17 1.05 1.05 Statewide average 3.29 2.92 2.79

Area % chg. Imperial County 0% South central Riverside County +21 North central Riverside County +12 Far west, south and north Riverside County +95 Central Los Angeles County -3 and north Orange County* NW corner of Riverside County and +34 SW corner of San Bernardino County North Los Angeles County** +60 Northwest Los Angeles County +17 Ventura County +52 Santa Barbara County +101 San Luis Obispo County -61 Monterey County -18 Outer ring around Bay Area -2 Inner ring around Bay Area -4 San Mateo Peninsula -18 Mendocino County +81 Humboldt County +95 Napa/Sonoma counties -2 Rest of state 0 Statewide average -4.5

*--*

* Includes most ZIP codes from 90000 to 91899.

** Includes ZIP codes 91011, 91020, 91040, 91042, 91214, 91342, 91350 and 91351.

Source: California Earthquake Authority

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.