Proposition 13 is a political third rail in California. Changing it will be a hard sell

There was a jarring reality check in the Legislature last week for interest groups plotting to change Proposition 13 and raise property taxes on major businesses.

The reality is that raising any taxes will be very hard to sell voters.

The plotters are led by some powerful public employee unions, including those representing teachers and service workers. They plan to place a citizens’ initiative on the November presidential election ballot next year.

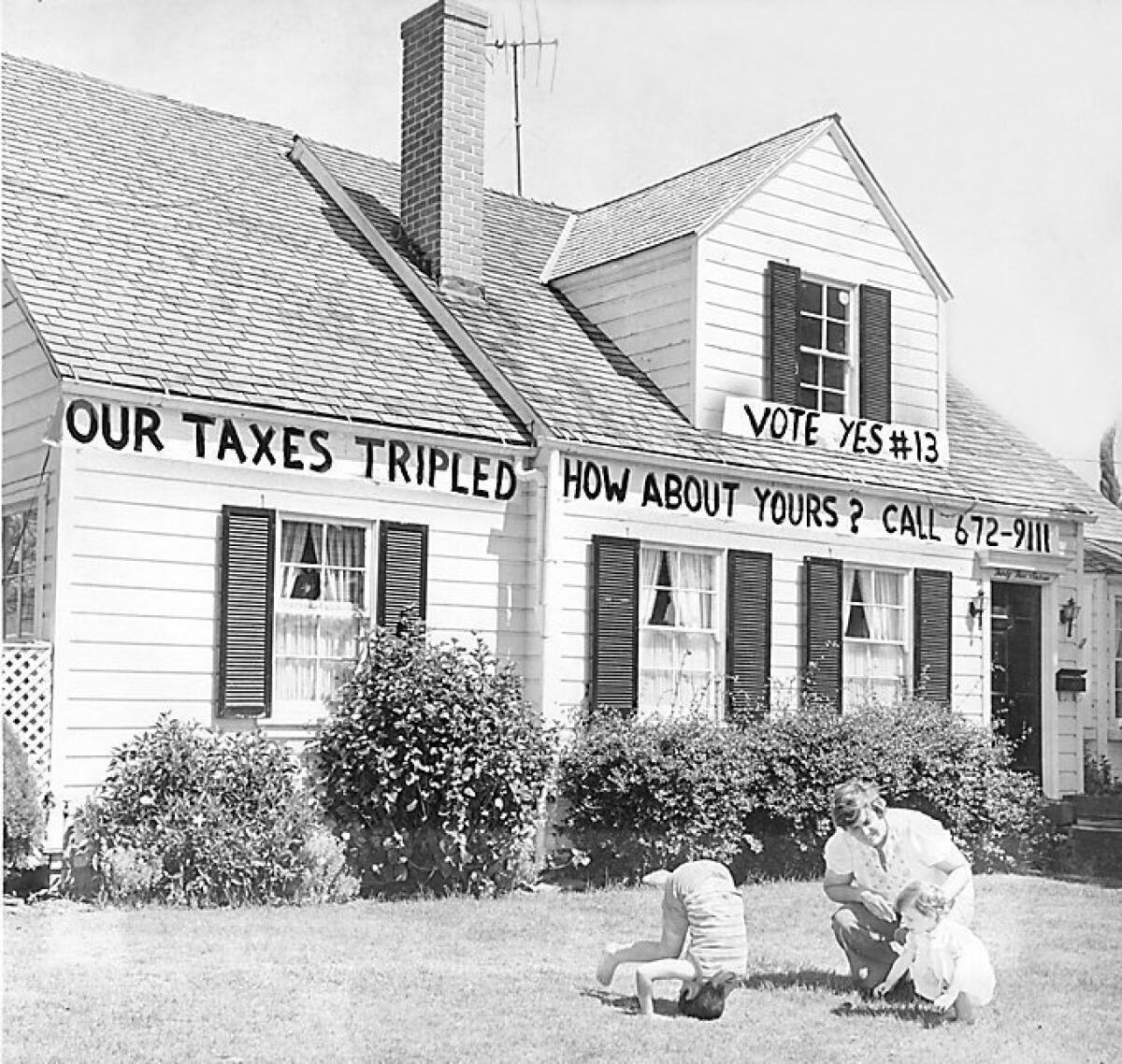

Their measure would require that commercial property owned by all but the smallest businesses be reassessed at market value every three years. Under Proposition 13, passed by voters during a 1978 tax revolt, neither commercial nor residential property is reassessed until it’s sold. Then it’s taxed at 1% of market value and that can’t be increased by more than 2% a year.

The proposed tax hike would raise an estimated $11 billion annually, with 40% going to public schools and community colleges, and 60% to local governments.

The reality check came when the Assembly took up another proposal to alter Proposition 13. The constitutional amendment, ACA 1, would reduce the local vote required to sell bonds or raise special taxes from a two-thirds supermajority to 55% if the money is used for infrastructure projects, including affordable housing.

School construction bonds already can be passed with a 55% vote. That was approved by voters in 2000. Before that, all local bonds needed a two-thirds vote — dating back to the 1800s.

Proposition 13, however, required voter approval of all local tax increases. Previously, city councils or local boards could impose them. And the measure mandated that special taxes for specific projects be passed by a two-thirds vote.

Assemblywoman Cecilia Aguiar-Curry (D-Winters), author of ACA 1, argued that her measure isn’t a tax increase. The proposal merely would allow California voters to decide whether it should be easier for local people to sell bonds and hike taxes to pay for community public works projects.

Assemblyman Todd Gloria (D-San Diego) put it this way:

“Something is wrong in this country when Donald Trump can get elected president of the United States with 46% of the vote, but California can’t get something built with 58%.” He was referring to a San Diego bond that failed to pass with a 58% vote, which in most elections would be considered a near-landslide.

But many of his fellow Democrats still fear Proposition 13 as a political third rail and couldn’t be persuaded.

“If a legislator votes to change Proposition 13, they’re going to pay the ultimate price at the ballot box,” says Rob Lapsley, president of the California Business Roundtable. He’s part of a big-bucks coalition that opposes ACA 1 and is gearing up to fight the ballot initiative.

That’s tough talk and obviously many Democratic legislators believe it. They hold a supermajority in each house, including 61 of 80 seats in the Assembly. Aguiar-Curry needed 54 votes for her constitutional amendment, but could only muster 44. Five Democrats voted “no” and 12 ducked the vote.

That tells us two things:

First, the Democrats’ vaunted supermajority control of the Legislature is overrated because, on the toughest issues, they shy away from using it. They’re leery of messing with Proposition 13 or, for that matter, any major tax. ACA 1 was not a top priority for legislative leaders or Gov. Gavin Newsom.

And if it had passed the Assembly, the insiders’ expectation was the measure would die quietly in the Senate because leader Toni Atkins (D-San Diego) apparently is determined to avoid floor votes on taxes.

Second, Proposition 13 may be practically untouchable. Legislators who must run for reelection in competitive districts fear danger in venturing near it, except to serve as protectors. Presumably their read on the districts they represent is that voters are saying hands off 13.

Former Gov. Jerry Brown understood that as well as anyone. Before he was elected to a third gubernatorial term in 2010, Brown told me: “Messing with 13 is a big fat loser.” And he didn’t.

One veteran Democratic consultant, who has run many initiative campaigns but is not involved in the attempt to overhaul Proposition 13, expressed astonishment over ACA 1’s failure in the Assembly.

“I was shocked,” the consultant said, asking for anonymity. “It’s really an ominous sign” for the initiative.

The political guru predicted opponents will successfully make the “slippery slope” argument that reformers will next try to raise home property taxes. The strategist added that voters are already bitter about taxes because California’s are so high and the state just raised gas levies and vehicle registration fees a heap.

The consultant also asked, “Why would they bring up [ACA 1 in the Assembly] if they couldn’t get the vote?”

Aguiar-Curry replies that four more Democrats were willing to vote for the measure if it would have assured passage. But first the vote count needed to reach 50. It got only to 47, then three peeled off.

“They were watching their backs,” she says. “Politics instead of policy. I have to honor that. But sometimes you have to take a risk. …

“If it doesn’t happen this session, I’ll keep working on it until I retire.”

She isn’t termed out until 2028. It may take at least that long. That’s unfortunate because 55% should be enough support for any local project, whether a school or affordable housing.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.