Support dwindles for changing Proposition 13

Support has dwindled for removing commercial properties from tax limits imposed by Proposition 13, the landmark property tax initiative approved by voters in 1978, according to a new poll by the Public Policy Institute of California.

In addition, California voters were almost evenly split on the idea of extending a tax increase that Gov. Jerry Brown persuaded voters to approve in 2012. That measure, Proposition 30, temporarily increased the sales tax by a quarter-cent and raised income levies on high earners.

The findings come as unions and grass-roots organizations are considering offering statewide ballot measures on both tax measures.

The so-called split-roll proposal to change Proposition 13 would require the regular reassessment of commercial properties while keeping tax protections for residences in place. Fifty percent of likely California voters said they favor the split roll, while 44% said they opposed the idea, the poll found. In January 2012, 60% of voters supported such a change.

“This would face a difficult hurdle,’’ said Mark Baldassare, president of the Public Policy Institute. “Most people believe that, overall, Proposition 13 is a good thing.”

Baldassare said tinkering with Proposition 13 drew greater support when the state was in dire financial straits and needed more tax revenue. Now that California’s economy is on the rebound, with state tax revenues higher than anticipated, support has dwindled.

The poll results also showed a pronounced partisan divide. Among Democrats, 59% were in support of a split roll, while 34% were opposed. Among Republicans, 36% were in support and 56% opposed. Independent voters were evenly split.

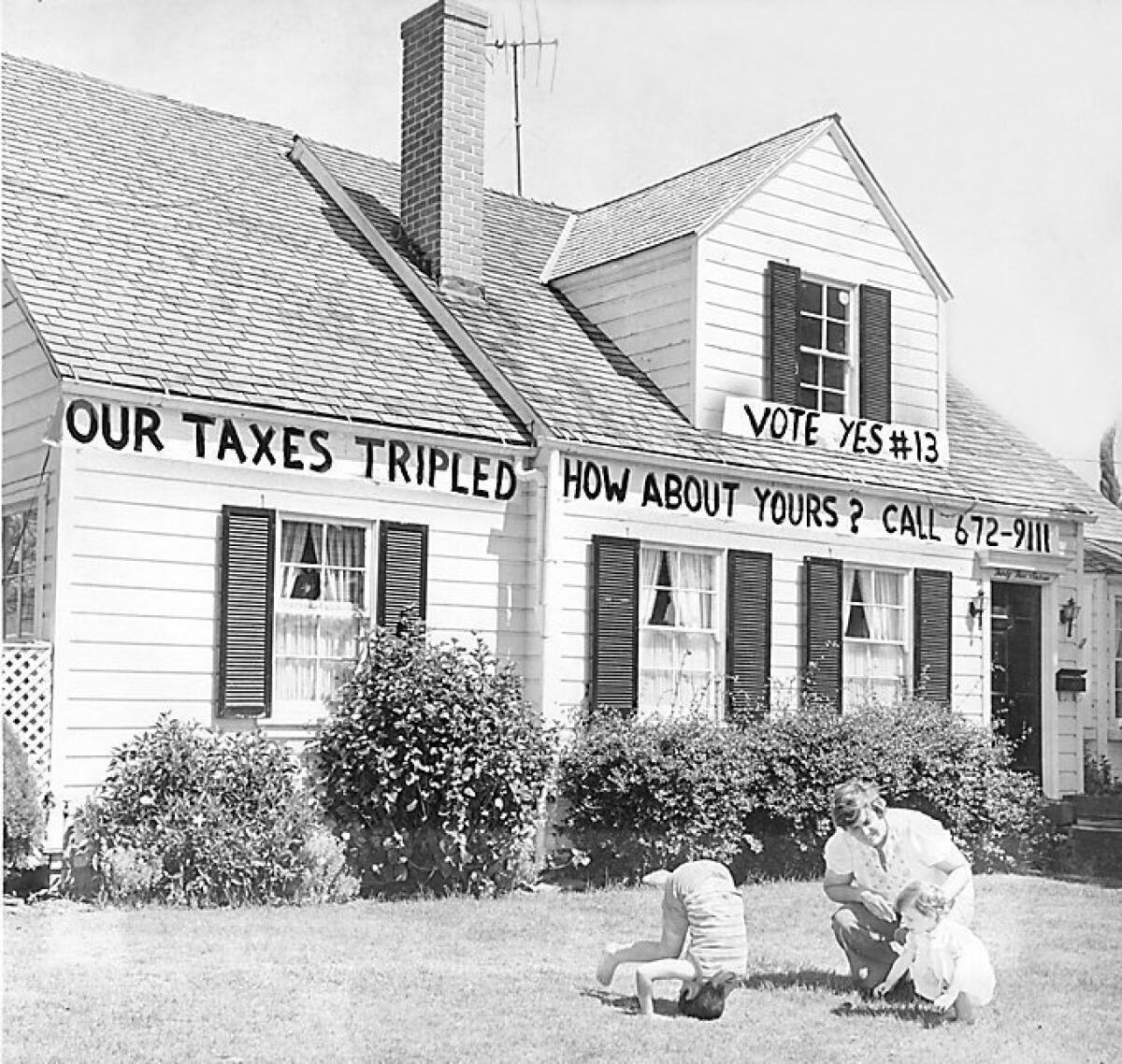

Before California voters approved Proposition 13 in June 1978, assessments were based on a property’s “fair market value,” and the skyrocketing housing market was triggering mammoth property-tax increases for many residents.

Proposition 13 limited annual property taxes to 1% of the appraised property value and prohibited counties from increasing a property assessment more than 2% a year. Under the measure, property can be reassessed only after a change in ownership. Under a companion measure approved by voters in November 1978, Proposition 8, properties can also be reassessed when property values fall.

------------

FOR THE RECORD: An earlier version of this post said Proposition 13 limited annual property tax increases to 1% of assessed value. It limits annual tax to 1% of appraised value.

------------

Among the polls other findings on tax issues:

- 67% of likely voters supported raising taxes on cigarettes

- Californians were more divided on taxing the extraction of oil and natural gas in the state, with 47% of likely voters in favor and 48% opposed

On behalf of the PPIC, the polling company Abt SRBI Inc. canvassed 1,706 California residents by telephone from May 17 through May 25. The margin of error overall is plus or minus 3.6%, higher for subgroups.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.