Snapchat maker sees gains in early trading Friday

Shares of Snap Inc. opened at $26.39 Friday, up about 8% from their price at market close Thursday.

Snap made its debut Thursday on the New York Stock Exchange, trading under the ticker symbol SNAP.

Shares were priced at $17 prior to trading but soared more than 40% to $24 when trading began Thursday. They closed at $24.48.

At 7:02 a.m. Pacific time Friday, Snap’s stock was trading at $26.98.

NBCUniversal invests $500 million in Snapchat maker’s IPO

NBCUniversal Chief Executive Steve Burke announced to employees Friday that the company purchased a $500-million stake in Snap Inc.’s initial public offering.

At $17 per share, the Comcast-owned media conglomerate behind Universal Studios, Bravo, USA Network, DreamWorks and more received about 15% of the shares available in this week’s IPO.

With Snap shares quickly rising since their public trading debut Thursday, NBCUniversal’s allotment was worth $784 million by early Friday.

But don’t expect the company to sell soon. NBCUniversal was the first advertiser on Snap’s Snapchat app and the first major network owner to commit to developing shows for Snapchat, such as spinoffs of the “The Voice” and “Saturday Night Live.” Snap and NBCUniversal also collaborated around the 2016 Olympics. And NBCUniversal owns portions of media start-ups BuzzFeed and Vox -- two other key business partners of Snap -- through $600-million worth of investments.

“It is rare to have the opportunity to invest at this stage in a company as visionary and dynamic as Snap, and it is a compliment that they chose NBCU as a partner,” Burke told his employees.

Snap declined to comment.

High school makes $24 million from Snap IPO

A California high school has made millions of dollars from the initial public offering of shares in Snap Inc., the company behind the Snapchat photo messaging application.

The board of the Saint Francis High School in Mountain View agreed to invest $15,000 in seed money in Snap in 2012, when the company was just getting started.

It had been invited to do so by one of the student’s parents, a venture capital investor, the high school president says in a letter issued to the school community Thursday.

The school held onto the investment until this week, when Snap shares sold for $17 each in an IPO. The share price rocketed 44% higher when trading began Thursday.

The school was quoted by media including website Quartz as saying it sold two-thirds of its shares at $17 each, to raise $24 million.

“The school’s investment in Snap — which this morning announced the completion of its IPO — has matured and given us a significant boost,” said the high school president, Simon Chiu, in the letter.

The after-party: Snap employees celebrate the IPO

At the Venice Whaler Bar & Grill about a mile south of Snap’s main offices, about 250 people had gathered by Thursday afternoon. A bartender said they had begun arriving by mid-morning.

Wearing Spectacles, T-shirts decorated with Snap’s ghost logo and name badges with bitmojis, they filled the upper level of the bar. They looked out on the boardwalk and sunny beach while soccer and college basketball games — as well as CNBC, which broadcast Snap’s stock price throughout the trading day — played on TV sets.

Some of them snapped photos using Snapchat lenses as they downed beers, margaritas and shots, periodically erupting in cheers.

“I think we’re all feeling pretty good,” said one member of the group, who declined to give her name.

Workers celebrated the IPO on social media, too.

How Snapchat maker’s ‘pop’ compared with other tech IPOs

Snap Inc. shares jumped on the first day of trading, achieving what’s known as a “pop.” Here’s how the maker of Snapchat sizes up against other recent tech IPOs.

Investor Chris Sacca should’ve answered this 2012 email. Oops

Chris Sacca — an early investor in Twitter and Uber, among other companies — apparently received an invitation from Snap’s Bobby Murphy in 2012, when Snapchat was in its infancy.

Looks like that was an opportunity Sacca didn’t take.

Today, he’s good-naturedly kicking himself.

Snap stock will plunge, these analysts predict

Now that Snap Inc. is publicly held, stock analysts are weighing in with their initial forecasts for the shares, and some are quite bearish.

Brian Wieser, an analyst with Pivotal Research Group in New York, initiated coverage with a “sell” rating and a year-end target price of $10 a share.

That’s less than half the price at which Snap, the Venice-based maker of the Snapchat app, was changing hands during its first trading day. The IPO itself was priced at $17 a share.

“Snap is a promising early-stage company” but faces several obstacles, including “aggressive competition” and a “core user base that is not growing by much,” Wieser wrote in his note to clients. “Investors also will be exposed to what appears to be a sub-optimal corporate structure operated by a senior management team lacking experience transforming a successful new product into a successful company.”

Anthony DiClemente of the investment firm Nomura Instinet also expects Snap’s stock to sink. He gave the stock a “reduce” rating in his initial report and a price target of $16 a share.

He wrote that the “upside in [SNAP] shares is limited” by several factors, including “already slowing growth in daily active users” and “fierce competition from larger rivals such as Facebook” and two Facebook divisions, Instagram and WhatsApp.

Snap’s shares “are fairly valued at best at the IPO price,” DiClemente wrote.

Snap buys lunch for protesters in Venice. That doesn’t shut them up

Snap Inc. set up two food trucks Thursday near its offices on Market Street offering free cheeseburgers and ice cream to all comers. A taco truck arrived in time for the lunch hour.

A steady stream of people, mostly skateboarders, lined up for food. A few shouted anti-Snap comments as they waited for their meals.

Mike Lindley, a protestor and organizer with Veterans for Peace, was trying to encourage people to stay away from the trucks, which he saw as simply a way for the company to garner good publicity. Lindley said he moved to Venice in 1968 after serving in the Navy and now stays on a friend’s couch because he can’t afford rent.

“I want to see them actually working with the community,” Lindley said of Snap -- for example, by demanding that the city open the public restrooms on the beach at night so the homeless can use them.

Darick Breland, who manages a clothing store a few blocks away, didn’t mind accepting free food from Snap. “I’ll take their business, too,” he said.

But Breland objected to Snap’s effect on local companies. He said he has watched as business owners along the oceanfront got bought out to make room for Snap facilities. Plus, he said, Snap employees used to visit local coffee shops and restaurants, but now that the company has a cafeteria, they rarely do.

Breland said that what bothered him the most was Snap workers’ attitude toward locals. “They got a badge, they don’t say nothing to you,” he said. “You can say hello.”

At lunchtime, some protestors grew louder and more aggressive, yelling and cursing at Snap employees who were walking in and out of the company cafeteria building. Police repeatedly warned them not to block the sidewalk and street.

This post was updated at 12:45 p.m. to describe an escalation of aggression.

Exclusive interview: How Snapchat founder Evan Spiegel feels after the historic IPO

Shortly after Snap Inc. began trading on Wall Street on Thursday, Snapchat founders Evan Spiegel and Bobby Murphy sat down with The Times to discuss the historic IPO and the company’s future.

Spiegel, 26, is one of the youngest entrepreneurs in history to take a company public and perhaps the youngest-ever to lead a $30-billion enterprise.

But the milestone still hadn’t felt real to him, just over an hour after shares of the Snapchat app maker started trading on the New York Stock Exchange.

“How do we feel? We were just thinking about how do we answer that question,” an exhausted Spiegel said, looking at his co-founder Bobby Murphy beside him. “It’s exciting.”

On Snapchat’s big day, locals protest its presence in Venice: ‘Snap killed Mom and Pop’

An hour and a half after Snap Inc. shares began trading on the New York Stock Exchange, about 30 protesters had gathered at the corner of Market Street and Pacific Avenue in Venice, near the company’s offices. They carried signs that said “Venice is a community, not a corporate campus” and “Snap killed Mom and Pop.”

Nate Hansen, 24, was one of the first protesters to arrive, riding a skateboard he’d painted. The Connecticut native moved directly to the Los Angeles beachside neighborhood in 2014 to be an artist. Today he lives in an apartment near where Jim Morrison once lived and sells his paintings on the boardwalk.

“I’m living the dream,” he said.

But Hansen is worried about rapid change in the neighborhood, including rising rents and the takeover of local cafes and other properties by Snap. “This is one of the few remaining artist communities left,” he said.

Hansen said he’s not anti-Snapchat — “I love Snapchat! Can that be on the record?” — and relates to founder Evan Spiegel’s desire to work on the beach. But he called it “selfish” for a company to take over oceanfront businesses and residential properties.

Hansen said he’d like to see the company at least move “up and inland,” occupying second-floor lofts so small businesses can keep operating at street level.

“Anyone’s welcome here — it’s Venice,” Hansen said. “But don’t come here and try to take it over.”

Mark Rago of the Alliance for the Preservation of Venice, which organized the protest, said the group’s chief complaints are that Snap is using residential properties for business, taking up parking spots and cluttering public streets and sidewalks with private shuttles, crosswalks and security guards.

Rago said he and others had been harassed by security guards outside unmarked Snap offices, and that the guards deter tourists from visiting adjacent businesses.

Also among the protesters were half a dozen construction workers, members of Carpenters Union Local 1506 who objected to Snap’s hiring of non-union contractors.

Snap’s founders get $272 million in cash each, plus billions in paper gains as stock soars

Snap Inc. founders Bobby Murphy and Evan Spiegel each made $272 million by selling shares in their company’s initial public offering. And they each made more than $1 billion in paper gains as shares soared on the first day of trading.

Snap shares closed Thursday at $24.48, up from $17 when shares priced late Wednesday, a gain of 44%.

At Thursday’s closing price, Murphy’s remaining shares — he and Spiegel each sold only a small percentage of their holdings in the IPO and continue to own hundreds of millions of Snap shares — are worth $5.2 billion, a gain of $1.6 billion since this morning.

Spiegel has gained that much, and more.

Along with his Snap holdings going into this week’s offering, the Snap chief executive was granted about 37 million additional shares when the public offering closed. Those shares are now worth about $911 million.

This post was updated at 2:10 p.m. with figures that reflect the stock’s closing price.

Is Snapchat a media company? Even Hollywood can’t decide

Hollywood has mixed views on its budding relationship with Snap Inc.

Several TV networks and publishers have taken the bold step of creating original, bite-sized programming for Snapchat’s video and publishing platform, Discover.

Yet not everyone is ready to go all in with Snapchat. The major movie studios and production companies have preferred to use the app as a marketing tool for their big-screen offerings, hoping to target teens and young adults who increasingly devour content though mobile phones.

Photos: Snapchat’s path from the Venice boardwalk to Wall Street

Los Angeles Times photographers first covered Snapchat in 2013 when founders Evan Spiegel and Bobby Murphy worked with a few employees in an old building on Ocean Front Walk in Venice. Let’s just say it’s grown since then. See the evolution.

Should you invest in Snapchat today, or wait? Play our game

Many investors want to know whether they should buy shares of Snapchat maker Snap Inc. The better question might be when.

Play our IPO game and test your instincts about how soon to invest in newly available tech stocks.

Cheers and applause from Snapchat offices in Venice

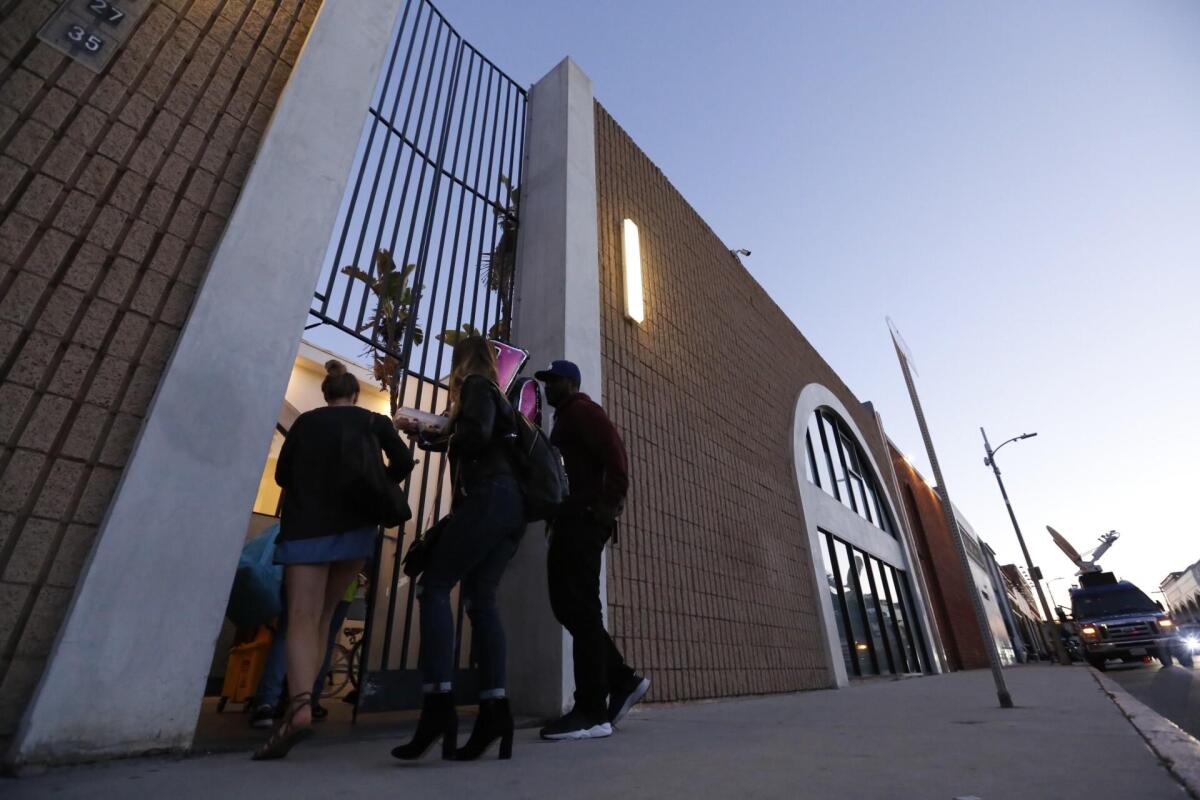

Outside Snap’s main offices at 63 Market St. in Venice, all was quiet Thursday morning but for several TV and radio crews lining the street.

Down the block, a steady trickle of about two dozen employees quickly and discreetly entered a building at 21-27-35 Market St., occasionally assisted by a security team watching from across the street.

They arrived on foot, by bicycle and by Uber, some wearing T-shirts with the Snap ghost logo and some toting badges with what looked like bitmojis. One carried balloons, another a bottle of wine or champagne.

As 6:30 a.m. approached, a few stragglers ran down the block and through the gate.

At precisely 6:30 a.m., the time that Snap co-founders Evan Spiegel and Bobby Murphy rang the opening bell at the New York Stock Exchange, cheers and applause erupted from inside the building.

Evan Spiegel and Bobby Murphy ring the NYSE opening bell

Snap Inc. Chief Executive Evan Spiegel and Chief Technology Officer Bobby Murphy just rang the opening bell at the New York Stock Exchange in the Los Angeles company’s stock market debut.

The pair arrived decked out in suits at the stock exchange on a windy morning in lower Manhattan. Inside they found the trading floor more yellow than usual. Spiegel choose yellow as Snapchat’s main color because no other major app had used the option, and he wanted his company’s to stand out. At the stock exchange, Snap’s faceless-ghost logo -- and its eye logo for hardware -- lighted up screens.

Seconds before they rang the opening bell, a laughing Spiegel, wearing a golden tie and white dress shirt, whispered into the ear of a tense but smiling Murphy, who sported a navy tie and light blue shirt,

Snap will trade under the stock symbol SNAP.

This post was updated at 6:59 a.m. with a photo of Spiegel and Murphy.

This post was updated at 6:38 a.m. with details of Spiegel and Murphy’s arrival.

Preparing for Snap’s stock market debut: Views from coast to coast

At the New York Stock Exchange:

And outside the Snap offices in Venice:

CEO Evan Spiegel makes Snapchat, Snapchat

An enigmatic 26-year-old who took an app once derided as a sexting tool and sparked a youth phenomenon, CEO Evan Spiegel is the reason Snap will outpace and out-innovate its biggest competitor, the company contends.

His vision has led tens of millions of people under age 25 to open Snapchat 20 times a day to reach friends and catch up with what’s happening in the world. Its signature auto-deleting videos encourage spontaneity and carefree self-expression. That’s no small detail to a generation taught from an early age that anything shared on social media can one day be used against them.

Spiegel’s view of social media is decidedly different from Facebook founder Mark Zuckerberg, who is six years older. But with Facebook racing to catch up, Spiegel is challenging investors to shell out for young and cool at the expense of safe and mainstream.

Report: SEC advisory group will look at whether Snap’s structure will mean less information for investors

A committee that advises the Securities and Exchange Commission will meet next week to discuss whether Snap Inc. will disclose as much to its shareholders as other public companies do, according to a report from Reuters.

Snap, the company behind messaging app Snapchat, priced its initial public offering on Wednesday, selling shares for $17 apiece. Those shares, unlike those of most public companies, do not give stockholders voting rights.

Snap is the first company to issue non-voting shares in an initial public offering. Kurt Schacht, the chairman of the SEC’s Investor Advisory Committee, told Reuters that the committee will review whether Snap will have to report all of the same information typically disclosed by public companies.

He said the committee will also discuss whether Snap’s move could encourage other companies -- and tech companies in particular -- to go public with non-voting shares and whether that’s good or bad.

“Is this is a slap in the face of corporate governance, or is this the market efficiency of the future?” Schacht asked, according to Reuters.

Read the full report here.

You might own Snap’s non-voting stock soon, like it or not

The new shares of stock that Snapchat parent Snap Inc. priced at $17 apiece Wednesday don’t have the voting rights that customarily come with public company stock.

If you don’t like that arrangement — and many big investment firms don’t — you can simply choose not to buy Snap shares when they start trading on Thursday.

But you probably won’t be able to avoid non-voting Snap stock for long.

Not today, and not this month, but eventually, many investors, even ones who bristle at Snap Inc.’s share structure, will wind up owning a piece of the Venice company.

Snap is so large and so valuable that, barring an immense decline in its share price, it will almost certainly be included in many of the stock indices that determine where retirement savers and other passive investors put their money. That means that if you have a 401(k), an IRA or a pension plan, you will own some Snap shares, even if you’d rather not.

Take, for instance, the California State Teachers’ Retirement System. The massive pension fund — one of the nation’s largest — is a member of the Investor Stewardship Group, a new coalition of pension and investment firms that advocates for, among other things, shareholder voting rights.

Aeisha Mastagni, a CalSTRS investment officer, doesn’t like that Snap shares have no voting power, but she also acknowledges that, because CalSTRS invests much of its assets in index funds, the pension giant will wind up owning some Snap shares anyway.

“We don’t want to encourage this kind of bad behavior,” Mastagni said, referring to Snap’s non-voting share structure. “But at the end of the day, CalSTRS will ultimately own Snap if it ends up in the index.”

Snap could be added to indices managed by London Stock Exchange operator FTSE Russell as early as June. Snap will have a market capitalization large enough to be part of the widely followed Russell 1000 and Russell 3000 indices, which track the nation’s largest 1,000 and 3,000 public companies, respectively.

S&P Global, the company that manages the benchmark S&P 500 index, generally waits at least a year and often longer to add newly public companies to its stock indices. Companies must be worth at least $5.3 billion to be added to the S&P 500, so as long as Snap shares don’t tank over the next year or two, the company could be in line to join the index sometime in 2018.

When companies are added to big indices, their stocks tend to gain as investment funds that track those indices must buy shares, boosting demand.

What happened to ousted Snapchat founder Reggie Brown? No, really, we don’t know

It’s been six years since Reggie Brown, then a junior at Stanford University, hatched the idea that would become the popular vanishing photo app Snapchat.

But while his former friends and Stanford classmates Evan Spiegel and Bobby Murphy are preparing a Wall Street debut for the company now known as Snap Inc. — potentially Los Angeles’ biggest-ever initial public stock offering — little is known about Brown’s whereabouts.

Brown was ousted from the company months after its founding in 2011. Two years later, he filed a lawsuit against his former business partners, Spiegel and Murphy, alleging breach of contract.

They settled, and Brown walked off with $157.5 million.

What’s happened since then?

Bobby Murphy is the yin to Evan Spiegel’s yang at Snapchat

Evan Spiegel, the face of Snap Inc., is a jet-setting, supermodel-dating, trend-making, once-in-a-generation technology chief executive.

Snapchat co-founder Bobby Murphy is an unknown entity publicly. He’s rarely seen or heard from outside the research and development teams he leads as chief technology officer. The few people willing to discuss him describe him as quiet, unpretentious and stoic.

Chuck Eesley, who taught Murphy at Stanford’s engineering school in 2010, said the unique thing about the role of the understated technical leader is that technologists who successfully partner with a business or design leader are a rare breed.

“There’s a lot of technical-heavy teams where no one wants to work with the talker, the seller … the loudest guy in the loudest bar,” said Eesley, who studies entrepreneurship. “But a lot of the research shows you need that combination of skills.”

Teens tell us how they really use Snapchat

Snapchat boasts 158 million daily active users. More than half of them are under the age of 25.

These young users are valuable to Snap because they’re valuable to advertisers. They also interact with the app the most: Users 24 and younger visit it more than 20 times a day and spend at least 30 minutes there, while those 25 and older log 12 visits lasting a total of 20 minutes, according to Snap.

If you’re not in this demographic and don’t understand how Snapchat works, don’t worry. We’ve got you covered. We talked to high school and college students involved in The Times’ High School Insider program to find out what gets them to open the app and what turns them off.

Ahead of IPO, protesters demonstrate outside Snapchat company’s Venice headquarters

A group of about 60 Venice residents and business owners gathered outside Snap Inc. headquarters Tuesday afternoon to show their disdain for the company’s large footprint in the neighborhood.

They said they hoped to draw attention to the Snapchat maker’s takeover of Venice landmarks, including bars and buildings, to make way for its corporate offices.

Barbara Lonsdale, who has lived in Venice for 30 years and helped organize the protest, said she was particularly annoyed by the ubiquity of the company’s shuttles, which ferry employees between offices.

“They’re just zipping each other from mini campus to mini campus,” she said. “They act like they own the place.”

Tensions spurred by Snap’s unusual real estate strategy aren’t new, but the demonstrators aren’t happy that an initial public offering of Snap shares this week will bring the company billions of dollars in cash to keep expanding.

Snap said in a statement:

We don’t just have our headquarters here; many of us also call Venice home. We’ve been very grateful to be a part of this creative community for over the last four years and we’ve worked closely with local schools and nonprofits to be a good neighbor. No one could have anticipated how quickly we’ve grown, and we have already begun focusing our future growth outside of Venice.

Snapchat firm reportedly closing in on $25-billion valuation for IPO

Snapchat maker Snap Inc. has generated enough interest from potential purchasers of its stock to initially price shares at about $18, according to Business Insider and CNBC.

Earlier this month, Snap said it expected to offer as many as 230 million shares to institutional investors for $14 to $16, valuing the Los Angeles company at potentially $22.5 billion. But that initial public offering pricing didn’t represent a notable premium on how much investors paid for Snap shares in a private financing last year. That led to speculation that Snap would later raise prices.

At $18 a share, Snap would notch a valuation of $25.2 billion and raise about $4 billion — what people close to the company described as a target last fall.

The details are expected to be finalized Wednesday. Snap shares are to begin trading on the New York Stock Exchange on Thursday under the symbol SNAP in the most anticipated IPO since Alibaba and Facebook went public several years ago.

How the Los Angeles Times has described Snapchat over the years

When new apps hit the market, journalists must decide how to describe the newfangled technology to readers. As the company, its technology and its usage change, so too do our descriptions.

The Los Angeles Times started covering Snapchat in 2012, months after the Venice company debuted its eponymous app. Below are some of the ways our reporters have described the app over the years.

H/T to Harper’s magazine, which gave Buzzfeed a similar treatment in 2015.

2012

Snapchat, an app often used to send “sexts,” or sexually explicit content

2013

Snapchat, the Venice start-up that recently turned down a $3-billion acquisition offer from Facebook

Snapchat, the blazing hot messaging start-up

2014

Snapchat, a popular mobile app

2015

Snapchat, the ubiquitous social media app among teens

2016

2017

Snapchat, the leading entertainment hub for 158 million daily users — most of them young adults.

Snap wants to go public but not run as a public company

When the company behind messaging app Snapchat holds its much-anticipated initial public stock offering in a few days, it will offer new shareholders exclusively nonvoting shares, something no company has tried before in a public debut.

That means those shareholders won’t have a say on executive pay, who’s on the company’s board or whether to accept a potential acquisition.

“It’s all about control,” said Kai Liekefett, a partner at law firm Vinson & Elkins who works with companies that are under pressure from investors. “There’s no other reason. There’s no tax reason, no business reason.”

Founders Evan Spiegel and Bobby Murphy’s grip on the company will be so tight, they will be able to maintain control even if they no longer work for Snap and even if they own a tiny percentage of the company’s total shares. They’ll also be able to decide who can acquire shares that have even token voting power.

Snap’s IPO could make some employees millionaires while others are left out

Initial public stock offerings of hot tech companies have minted millionaires, with stories of even janitors who worked at Google striking it rich after the company went public in 2004. As Snap Inc. hurtles towards its own IPO, many await a life-changing payday.

Of Snap’s 2,000 employees, hundreds could become on-paper millionaires if the company goes public at its ambitious $22.2-billion valuation. But many others stand to come away with a much smaller windfall, or none at all.

And for many workers, being at a company as it goes public can be an emotional roller coaster — one that is rarely acknowledged because of the taboo of discussing personal wealth.

Snap has no headquarters

Snapchat has broken the mold of Silicon Valley in many ways. Now, with parent company Snap Inc.’s initial public stock offering imminent, it is poised to do so again.

Snap will begin trading on public markets without a designated headquarters, an anomaly in the tech world. None of Snap’s peers — the 10 California-based technology companies with the biggest IPOs of the last 15 years — lacked a corporate headquarters when it went public.

Snap knows its strategy is unusual: The company listed its lack of a headquarters and spread-out West L.A. offices on its financial filings as a risk that could potentially harm its business and future revenue prospects.

Snap’s roadshow schedule: 7 cities in 2 weeks

Snapchat maker Snap Inc. plans to start pitching its stock to big-time investors Friday, kicking off a nearly two-week sales process leading up to an expected New York Stock Exchange debut.

Business Insider posted a detailed schedule of where Snap executives and the company’s investment bankers will be heading:

- Friday: Mid-Atlantic

- Feb. 20: London

- Feb. 21: New York City

- Feb. 22: New York City

- Feb. 23: Boston

- Feb. 24: Midwest

- Feb. 27: Los Angeles/San Francisco

- Feb. 28: San Francisco

The meetings with representatives of mutual funds, hedge funds and other investors capable of making big purchases is known in the industry as a roadshow. These buyers will get first dibs on Snap shares. Most smaller funds and individual investors who want to buy Snap shares for their personal portfolios will have to wait until the stock market listing goes live in early March.

Snapchat company sets IPO targets: $3.7-billion windfall and $22-billion valuation

Snap Inc. set a starting price range of $14 to $16 per share for its initial public offering, which at the top end could value the Los Angeles technology company at more than $22 billion.

The IPO of the Snapchat mobile app developer is expected to be the largest ever for a Los Angeles firm and the biggest since Alibaba and Facebook.

The share prices, which were disclosed in a securities filing early Thursday, are nonbinding. But they set the stage for Snap officials, led by Chief Executive Evan Spiegel, and investment bankers at Morgan Stanley and Goldman Sachs to hold discussions with investors around the world about their interest in betting on the nearly 6-year-old company.

No major L.A.-area start-up investors stand to profit from Snap IPO

Of the nearly $3 billion that Snap Inc. has raised from investors for technology and hiring ahead of next month’s expected IPO, almost none of it has come from Los Angeles financiers.

The county’s leading venture capital firms — the investors that technology entrepreneurs often turn to for money and advice — knew the photo-messaging app had become a hit among teenagers. But for a variety of reasons, they passed on financially supporting the company.

Between Snapchat’s founding at Stanford University in spring 2011 and its rise to the global stage in 2013, Los Angeles firms had a short window to get a sizable piece of the company.

At Upfront Ventures, the largest start-up investor based in Los Angeles, associate James Bailey urged managing partner Mark Suster to take a meeting with Snapchat. But Suster dismissed the app as a tool for sexting and marital infidelity.

CrossCut Ventures and Clearstone Venture Partners didn’t have enough free cash to make a bet on Snapchat. For many firms, including Baroda Ventures, CT Ventures and Rustic Canyon Partners, a chat app with no business plan didn’t fit the profile of a company they’d back.

“We did not see the real revenue potential back then,” CT’s Alex Suh said.

Snap poached a top Instagram exec in 2014. But it ended in an expensive resignation

Emily White left a senior position doing business deals at Instagram to become Snapchat’s chief operating officer at the start of 2014.

But a year later, she resigned as it turned out that Chief Executive Evan Spiegel preferred keeping more direct control of operations.

That lesson didn’t come cheap. Snapchat maker Snap Inc. recorded nearly $44 million in stock-based compensation expenses during the quarter White and another key figure resigned in 2015, the company disclosed in its stock offering documents. That was more than double Snap’s stock-related expense in all of 2016.

The disclosure suggests that White received stock options as part of her employment that were to gradually become available to her to exercise over several years. She resigned before some options had vested, but Snap decided to grant them to her anyway as part of her departure.

The same went for Mike Randall, a former Facebook executive who had spent six months running Snapchat’s ad sales team before leaving.

But the bulk of the $44 million is tied to White, according to a source not authorized to speak about the details. It’s unclear if White maintains Snap shares, but they would have almost doubled in value since she left.

White, who now serves as a board member of Lululemon and Zayo Group, didn’t respond to requests to comment. Snap declined to comment.

What’s a daily user? Facebook and Snapchat have different definitions

Just as Snap and Facebook disagree on what counts as a video view, the two social media agents disagree on how to calculate usage.

Snap says it counts daily users of Snapchat by taking an average of daily usage over an entire three-month period. Facebook considers only the final month of the quarter when taking the average.

Using Facebook’s counting method, Snap sees a slight bump in the number of daily users than by its own math — for example, from 158 million to 161 million in the last quarter of 2016. But the company said in a regulatory filing that it believes looking across an entire quarter “provides a more meaningful metric.”

Snap also isn’t giving out data about people who use the app at least once a month, even though analysts who follow Facebook like to compare daily and monthly usage to see whether people are becoming more immersed in the service.

For the record, Snap considers a fraction of a second of a video playing as a view. Facebook defines as a view as three seconds of playback.

Snapchat turns into a broadcast platform in the developing world, and that’s bad for business

Facing questions about slowing user growth, Snapchat maker Snap Inc. said it was more susceptible to competition from apps like Instagram in developing countries where cheap Androids outnumber expensive iPhones and high-speed mobile data plans aren’t an option.

In a regulatory filing last week, Snap revealed that it didn’t add any users outside of North America and Europe during the last three months of 2016 compared with the prior quarter.

On Thursday, the company took a fresh try at explaining what might have happened.

Snap said software bugs had made its Android app difficult to use, the effect of which was felt more starkly in developing countries where iPhones are a rarer sight.

In addition, slower mobile networks limit Snapchat usage to when people are connected to Wi-Fi. That largely turns Snapchat into video-watching app in places outside of North America and Europe. People don’t use it as much to upload videos of their own and talk to friends. Losing the communications aspects of Snapchat makes usage more sporadic.

“This consumption-heavy engagement means that a smaller percentage of [daily users] are creating content, which more closely resembles a broadcast model where a few users share content with a broader group of followers,” Snap said. “This means that user engagement in these countries is more susceptible to competition by broadcast-oriented platforms.”

When Instagram released a feature in August aimed at getting users to sit back and watch videos, it represented more direct competition in the developing world, which might explain why Snapchat struggled to add users in the months after. In those markets, there simply wasn’t as much reason to tune into Snapchat as in North America and Europe, where its communications tools are popular.

The new details were among some of the highlights in an amended document filed with the Securities and Exchange Commission. Other new points include:

- Snap acknowledged a bump in advertising revenue during the third quarter of 2016 because of the Summer Olympics.

Snap said it recently granted board member Joanna Coles 52,736 shares of its stock that will vest over the next couple of years. The deal brings her pay in line with other Snap board members.

Snap added British bank Connaught and UBS Securities as additional underwriters of its IPO.

Snap reaches $1-billion cloud computing deal with Amazon Web Services

Snap is hedging its reliance on Google for online storage and computing resources with a $1-billion agreement with rival Amazon Web Services.

Videos and photos posted to Snapchat move through computers operated by Google as the traverse the Internet under a five-year, $2-billion agreement between the companies. On Thursday, Snap said it has signed a similar deal with Amazon as a backup.

Analysts have questioned Snap’s usage of computing vendors because costs could get out of hand as its social media and entertainment service grows. Many companies, including Facebook, have developed their own infrastructure. Though Snap said it might go that route, the company described working with third parties as a better use of its limited cash.

Still, the hosting costs likely accounted for about a third to a half of Snap’s $925 million in expenses last year.

Snap said it has worked with Amazon since last March. Amazon is scheduled to receive $50 million from Snap this year, $125 million in 2018, $200 million in 2019, $275 million in 2020 and $350 million in 2021.

Snapchat’s young users are its greatest asset — and one of its biggest risks

Snap’s ability to court a young demographic with its Snapchat app has been one of its defining characteristics and the pillar of its success. But its reliance on users younger than 25 also is one of its biggest liabilities.

“It’s the rocks many ships have crashed on,” said Erik Gordon, a professor at the University of Michigan’s Ross School of Business, who has studied companies that staked their success on the loyalty of young customers.

“Think of all the teen retailers that were fabulously successful five to 10 years ago that are now in terrible shape. Look at Abercrombie and Fitch,” Gordon said.

Snap knows this. In its S-1 — a form that companies planning to go public file with the Securities and Exchange Commission — Snap pinpointed as a risk the fact that the majority of its users are 18 to 34 years old, a demographic that “may be less brand loyal and more likely to follow trends.”

Whether the company succeeds in the long term or falls on the sword of youthful disloyalty will depend on whether it is touched by the “age effect” or the “cohort effect,” Gordon said.

How Snap’s co-founders will stay in control

Even after Snap goes public, co-founders Evan Spiegel and Bobby Murphy are set up to essentially keep total control of the company.

After a company’s IPO, a percentage of voting power typically is transferred to investors. But Snap’s filing shows that the vast majority of such privileges would be retained by Spiegel and Murphy. That gives them room to steer the company how they see fit without meaningful oversight from shareholders.

Michael Pachter, research analyst with Wedbush Securities, said the move to largely consolidate voting power between the two co-founders is not unusual in the tech community, especially in the last decade. But never has it been done before an IPO, Snap said.

Two of these guys run Snap now. The third sued them.

Snap’s origin story is similar to those of many other successful tech start-ups: Some college friends start with an idea, and after a lot of hard work and luck, it becomes a popular and growing business. Usually some disputes pop up along the way.

In Snap’s case, the friends were Stanford University undergraduates Evan Spiegel and Reggie Brown and recent graduate Bobby Murphy.

Snap wasn’t immune from disputes. Spiegel is now Snap’s chief executive; he’s been described as the company’s visionary thinker. Murphy, now chief technology officer, focuses on the app’s technical side. And Brown is long gone.

Brown sued in 2013, saying they stole his idea and ousted him.

Snap’s Thursday filing with the Securities and Exchange Commission reveals what Brown received when the lawsuit was settled: $157.5 million.

The filing reads:

“In February 2013, an individual filed an action against us, our predecessor entity and two of our officers in Los Angeles Superior Court, alleging that we were using certain intellectual property that the individual jointly owned with our founders. In September 2014, the parties entered into a settlement agreement that resolved all claims among the parties. Under the agreement, we agreed to pay the individual a total of $157.5 million and such amounts were recorded in 2014.”

Brown’s attorney did not immediately respond to a request for comment.

Confused by Snapchat? Consult these handy diagrams

The concept behind Snapchat is simple: Users send pictures and videos to each other that disappear a short time after being viewed. It’s supposed to be intuitive, and for the tech-savvy young folks who make up Snap Inc.’s prime demographic, that may be true.

But people who aren’t already using Snapchat may need a little explanation. Thankfully the company’s S-1 filing includes some handy schematics.

“The only explanation I’ve ever seen of how to actually use Snapchat is buried in its IPO filing,” one user wrote on Twitter.

The diagrams depict the app’s different looks in different situations, clearly outlining the array of tools users have at their disposal.

Need a Snap instruction guide? Just consult page 92 of the S-1 filing.

Hiring outside talent didn’t come cheap for Snap Inc.

In late 2014, the company then known simply as Snapchat announced it had hired a star banker away from Credit Suisse to be its chief strategy officer.

Imran Khan had deep connections in the technology industry, links that helped Snapchat score a $200 million investment from Chinese Internet giant Alibaba months after he was hired.

But luring and retaining executive talent like Khan did not come cheap for the Venice social media firm, which was building critical momentum at the time of the hire.

Khan’s compensation last year, including salary and bonus, amounted to $5.5 million, according to its Thursday IPO filing. Not only that, Khan received over 7 million restricted shares valued at $145.3 million.

“They had to pay a ton to keep him there,” said Josh Stomel, founder of Neohire South, a tech employment agency. “Snap needed smart, senior executives in order to scale. So they gave substantial money that these people wouldn’t find anywhere else.”

Stomel said Snap’s executive salaries were about double what other tech companies are paying in the Los Angeles area.

Among the company’s other well-paid executives is Timothy Sehn, Snap’s senior vice president of engineering. Sehn’s compensation last year was $1.4 million and he owns 2.6 million restricted shares valued at $40 million.

Andrew Vollero, Snap’s chief financial officer and a former Mattel executive, earned a base salary of $300,000 in 2016. And Chris Handman, Snap’s head attorney, earned $475,000 in base salary.

Snap co-founder and Chief Executive Evan Spiegel made about $1.5 million in salary and bonus last year. Co-founder and Chief Technology Officer Bobby Murphy took in about $250,000.

Once Snap completes its IPO, Spiegel’s annual salary will drop to $1 -- a move that puts him in the same league as other dollar-salary honchos such as Facebook Chief Executive Mark Zuckerberg, Google co-founders Sergey Brin and Larry Page and President Trump.

Spiegel won’t need the paycheck since he and Murphy each own about 22% of Snap’s Class A common stock. If the IPO values Snap at $25 billion, as sources familiar with the company predict, the pair stand to gain over $5 billion each.

The Snap IPO is a sucker’s bet

Some words for anyone expecting to make a mint from Snap: Good luck, sucker.

My rationale comes right out of the Snap filing, though it’s in numbers that have seemed to get casually glossed over in the pro-Snap pre-IPO hysteria. The S-1 tells the goriest story of bloodletting this side of Shakespeare’s “Titus Andronicus.”

Let’s start with the bottom line: Snap, which gets all its money from advertising, is an enormous money loser. The red ink has been getting worse even as revenue grows.

When these losses will end is anyone’s guess, including management. Among the risk factors listed in the filing is this: “We ... may never achieve or maintain profitability.” Yes, these risk factors are often boilerplate, but the filing provides no justification for ignoring this one.

And that’s not the only major drawback.

Snap files for long-anticipated IPO

Conceived six years ago by Stanford University fraternity brothers to help peers send photos that would vanish after viewing, Snapchat roared through high schools and colleges, starting in Orange County. When the app hit 40,000 users in months, its co-founders knew they held a treasure.

Now, according to Thursday’s IPO filing, it boasts 158 million daily active users — and sources familiar with the matter say Snap’s stock sale could generate up to $4 billion. with shares priced to value the company at upward of $25 billion.

Snap tells advertisers it reaches users -- even in the bathroom

A Form S-1 isn’t often a place to look for colorful language. The paperwork required by the Securities and Exchange Commission is where companies looking to go public disclose all their finances.

Still, Snap Inc. found a way to include the word “poop” in its filing -- a long-awaited 120,000-word pitch to ordinary investors.

The word shows up in a section about why Snapchat is a powerful advertising tool.

“Advertising is more effective and less wasteful when paired with the right contextual understanding. Smartphones can achieve this because they are personal in a way that other forms of media will never be — we eat, sleep, and poop with our smartphones every day,” the filing said.

No stranger to things that typically occur behind closed doors, Snap also made a point to dismiss the notion its app is mostly for sending explicit images.

“When we were just getting started, many people didn’t understand what Snapchat was and said it was just for sexting, even when we knew it was being used for so much more,” the filing said.

For the record, neither “poop” or “sexting” show up on the SEC’s database for other filings, which dates to 1994.

Your guide to Snapchat, Snap Inc. and the IPO

What is Snap Inc.? A camera company — huh?? We break it all down for you.

Snapchat spends a lot to keep its chief executive safe

Evan Spiegel is a prized commodity -- and his company’s filing on Thursday with the Securities and Exchange Commission proves it.

Snap Inc. spent $890,399 in 2016 on personal security costs for its co-founder, the document shows.

The spending was revealed in a section of the firm’s S-1 filing detailing compensation for Spiegel, who is known to travel between his firm’s beach-community offices in a black SUV.

Snap may have good reason for the expenditure. Among the risks the company said is the potential loss of Spiegel and co-founder and Chief Technical Officer Bobby Murphy.

“Mr. Spiegel and Mr. Murphy are high profile individuals who have received threats in the past and are likely to continue to receive threats in the future,” the filing states.

And it doesn’t look like Snap will scale back its security spending soon: It’s hiring for two full-time security jobs in Los Angeles, according to its website. Qualified candidates must have “physical security, risk management or law enforcement experience ...” as well as “an ability to assess, understand and mitigate threats to the company and people while not stifling creativity and fun.”

How Snapchat began

Conceived six years ago by Stanford University fraternity brothers as a silly online service to send photos that would disappear without saving, Snapchat has become a force in technology, advertising and entertainment. Here’s how it happened.

How Snap’s numbers compare with other tech giants

As Snap Inc. moves toward its hotly anticipated initial public offering, its finances will inevitably be compared with those of other social media giants like Facebook and Twitter, which filed for IPOs in 2012 and 2013, respectively.

Here’s now Snap stacks up on several key metrics sure to be scrutinized by investors.

Daily active users: This measures the number of users that opened the app or used the service in a 24-hour period.

- Snap: 158 million

- Facebook: 483 million

- Twitter: More than 100 million

Revenue: This measures how much money the company brought in during the fiscal year before the IPO filing.

- Snap: $404.5 million

- Facebook: $3.7 billion

- Twitter: $316.9 million

Percentage of revenue from advertising: They’re called social media firms, but really they are advertising platforms -- Snap Inc. especially.

- Snap: 96%

- Facebook: 85%

- Twitter: 85%

Profit/losses: It’s not uncommon for tech firms to enter public markets while still in the red. Out of these three, Facebook was the only one to post a profit before its IPO.

- Snap: $514.6 million net loss

- Facebook: $1 billion net income

- Twitter: $79.4 million net loss