Quake insurance: Is it worth buying?

Few know the risk of living in earthquake country quite like Susan Hough.

The 46-year-old seismologist heads the U.S. Geological Survey’s Pasadena office, which monitors earthquakes statewide. She also has written a book about Charles Richter, who invented the scale for measuring the magnitude of quakes.

She’s lived through a few big ones too, including the 1992 Landers quake and the catastrophic 1994 Northridge quake. And yet, Hough doesn’t carry quake insurance on her vintage 1926 South Pasadena bungalow.

Instead, she has spent thousands of dollars bracing her chimney, strapping down her water heater and using plywood to shore up her home’s cripple walls, the short stud walls that lie between the foundation and the floor of some houses.

“The thing about insurance is that to use it, you have to have a loss,” she said. “I’d rather try to avoid the loss in the first place.’ ”

It’s a strategy that Hough thinks more Californians ought to consider -- especially because so many of them don’t carry quake insurance.

Despite dire warnings that Southern California is long overdue for the Big One, only about 1 in 8 Southland homeowners has quake insurance -- down from 1 in 3 homeowners a dozen years ago, according to the California Earthquake Authority.

Cost is one reason; high deductibles are another.

For a relatively new two-story home in Northridge, for example, buying $250,000 in coverage would cost a homeowner $625 a year through the California Earthquake Authority, the quasi-public agency created in 1996 to ensure the availability of quake insurance.

But a homeowner has to suffer more than $37,500 in structural losses before the policy will pay a penny. That’s because the standard policy has a 15% deductible. And many items, including dishes and decorative objects, are not covered at all.

“This is what you buy to ensure that you’re not living in the Staples Center,” said Nancy Kincaid, a spokeswoman for the earthquake agency. “It doesn’t pay for everything.”

Still, some consumer advocates maintain that now is the time to reconsider. Premiums were reduced 25% to 30% in most parts of California last year, according to the earthquake agency, largely because there hadn’t been a major quake that triggered huge claims since the Northridge one.

“With the price drop last year, it became a more reasonable choice,” said Doug Heller, executive director of the Foundation for Taxpayer and Consumer Rights in Santa Monica.

The group, which recently changed its position, advocates buying coverage. “The number of uninsured homes is a financial disaster in the making,” Heller said.

But quake coverage still isn’t cheap, and some people such as Hough believe that, given the high deductibles, their money is better spent on safeguards to help their homes ride out a quake with as little damage as possible.

Unsure whether you should buy quake insurance? Here are some factors to consider.

The stake in your home

If you don’t have much equity in your home or if it is worth less than you paid for it, there is less value to protect. People in this situation simply may decide to walk away if their homes are destroyed in a quake and let their property fall into foreclosure.

That happened plenty after the Northridge quake, when housing prices had fallen sharply after the 1989-to-1990 peak.

But if you have a lot of equity in your home, you stand to lose much more in a catastrophic quake.

“Your home is probably your single biggest asset,” said Kincaid of the California Earthquake Authority. “The question the homeowner needs to ask is, ‘How do I manage my risk?’ ”

Those who have plenty of other assets can choose to in effect self-insure, including setting aside some money each year to cover repairs. But they also have to be prepared to borrow against their home in the event of a disaster that exceeds the size of their repair fund.

Some people mistakenly think that the federal government will bail out homeowners in the event of a massive quake. But government assistance usually is in the form of loans, not grants.

“Are you in a position to cover hundreds of thousands of dollars in losses?” Allstate Insurance spokesman Rich Halberg asked. “A 15% deductible is a lot. But it’s nowhere near as much as 100%.”

Condition and location of your house

Some homes and locations are more at risk than others to be severely damaged in a quake. Hough said she would buy quake insurance if she lived near the beach or a riverbed, where the ground is prone to liquefaction.

“When you’re in the hills, for the most part, you’re better off because you are on rock,” she said. “If you are on soft sand, your risk is higher because the ground can shake like mad.”

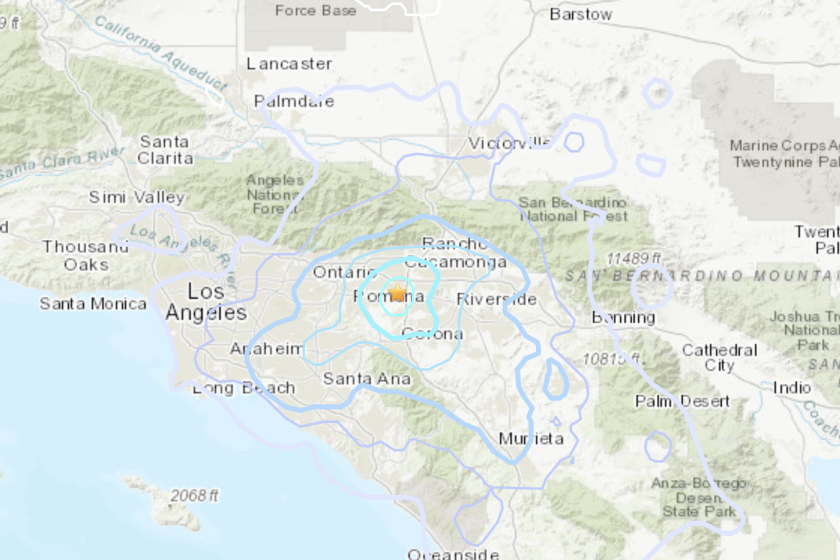

A website partly sponsored by the California Earthquake Authority and other public agencies, www.earthquakecountry.info provides maps of known fault lines and information about quake risks. One map, called Earthquake Shaking Potential in Southern California, shows regions near active, major faults.

Kincaid said quake insurance also made more sense for certain types of structures that are more susceptible to damage, such as brick or split-level homes. The split-levels built in the 1960s and ‘70s are particularly vulnerable to serious structural damage, she added.

Thus, if you own a split-level home on soft ground, you may want to consider quake insurance. And conversely, if you live in a small, wood-frame house in the foothills, you may decide that you’re willing to accept the risk of going without quake insurance.

Whether you buy quake insurance or not, however, experts say there are simple fixes that everyone should do, such as strapping down water heaters and bolting the home to the foundation. Spending even a few thousand dollars on such measures could save you tens of thousands -- and possibly save lives.

Comfort level with risk

If you stay awake at night worrying about the threat of an earthquake, then quake insurance may be good peace of mind. It certainly is for Jeff Klein.

Klein, who worked for the Los Angeles Times a decade ago, is now semiretired after selling his firm, magazine publisher 101 Communications, last year.

Back in 1991, when he purchased a home in a new Northridge development, he said, he had made what he thought was a reasonable decision to forgo the coverage.

“I grew up in Los Angeles and my conception was that you normally would not have enough damage to get over the deductible or, if you did, you’d be dead,” Klein said.

The Northridge quake proved him wrong. His home was knocked off the foundation, plate-glass windows shattered and several walls collapsed. He survived to pay for it.

“Having been through that, I don’t ever want to go through that hassle again,” he said.

April is Earthquake Preparedness Month, when Southern Californians can expect to be reminded that the Big One is overdue.

Indeed, quakes big enough to do significant damage strike about once every 30 years, Hough said. And the legendary Big One -- a potential slip along the massive San Andreas fault that has been dreaded for decades -- is projected to happen every 150 to 250 years, she added. The last such slip was 150 years ago.

To some, that might elevate the sense of risk. But not to Hough.

Saying that a quake is overdue implies that quakes occur on a regular schedule, she said. They don’t.

“People have said that the San Andreas is 10 months pregnant,” Hough said. “But to say it’s overdue [means] that you knew when it was due in the first place. And that’s more than we can say.”

To a degree, deciding whether to buy quake insurance is similar to deciding whether to buy long-term care insurance. It’s extremely difficult to handicap your chance of using it, yet it’s expensive enough to worry about throwing money down the drain.

“It’s not that easy to translate the information that we put out on earthquake hazards to information that people can use to make dollars-and-sense decisions about earthquake insurance,” Hough said. “Reasonable people can go either way.”

*

(BEGIN TEXT OF INFOBOX)

What you should know

After suffering unexpectedly high losses in the 1994 Northridge earthquake, most of the state’s biggest insurers dropped their quake coverage, saying they were unprepared for the scope of potential losses. That crisis led to the creation of the California Earthquake Authority, in which private insurers offer a standardized policy and help one another shoulder losses.

Cost: The value, location and type of home helps determine the cost. The quake agency offers a premium estimator at www.earthquakeauthority.com.

Deductible: Out-of-pocket costs with these policies are high. You have a choice of a 10% or a 15% deductible. If your house is insured for $500,000, coverage wouldn’t kick in until you suffered $50,000 in damage with a 10% deductible, or $75,000 with a 15% policy.

Contents: Personal property can be covered in amounts ranging from $5,000 to $100,000.

Exclusions: Swimming pools, patios, fences and detached structures are excluded, as are losses of china, glassware and artworks.

Limits: Coins, medals and currency are covered to a maximum of $250. There is a $1,000 limit for damage to computers and a $5,000 limit for damage to chimneys.

--

Source: Times research

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.