California lawmakers denounce Wells Fargo at hearing, call for statewide banking reform

More than a month after regulators announced a sweeping settlement against Wells Fargo & Co. over its creation of unauthorized customer accounts, lawmakers went after the bank again Tuesday and called for reforms that could rein in abusive practices by banks.

The hearing, called by the Assembly’s Banking Committee, lacked the outrage federal lawmakers displayed at Capitol Hill hearings on the issue. But Assembly members attacked Wells Fargo for harming its customers by allowing thousands of employees to open as many as 2 million unauthorized accounts over the last five years.

“Wells Fargo did wrong,” said Assemblyman Travis Allen (R-Huntington Beach), the committee’s vice chairman, at the hearing in Calabasas City Hall. “Clearly there was a problem. Millions of accounts were created that never should have been created. How did this happen in the first place, and how did it go on for so long?”

Before the hearing even got underway, Matt Dababneh (D-Encino), the committee’s chairman, said he would consider state legislation that would prevent Wells Fargo and other institutions from using arbitration clauses to shield themselves from lawsuits over unauthorized accounts.

Critics have said that Wells Fargo’s inclusion of the clauses in customer accounts kept the scandal hidden for years by steering cases out of court and into private arbitration — a move that was the subject of several pointed questions during Chief Executive John Stumpf’s recent appearances on Capitol Hill.

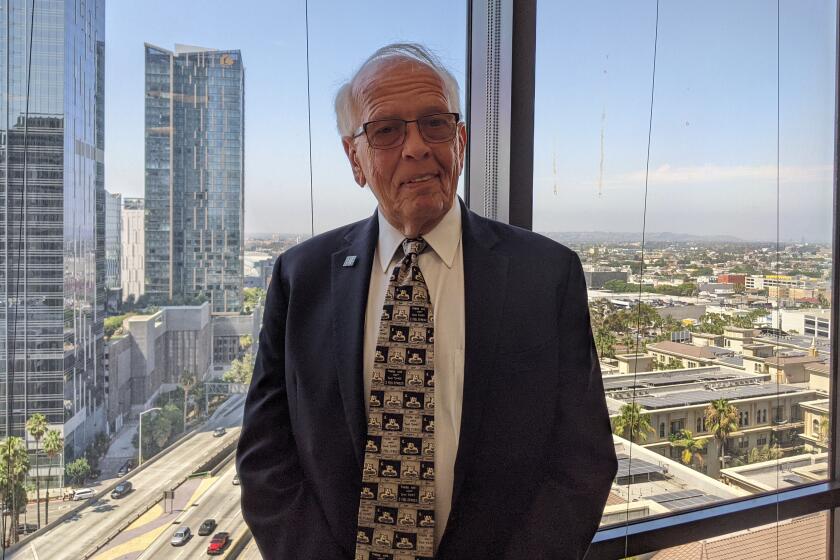

Rep. Brad Sherman (D-Porter Ranch), a member of the House Financial Services Committee, said Dababneh and other state lawmakers should pursue a state ban on the use of arbitration clauses in such instances. He added that while he is crafting federal legislation with the same aim, he believes California lawmakers may be able to act more quickly.

“I urge you to do this at the state level,” said Sherman, who attended the hearing. “I think consumers deserve their day in court.”

Stumpf was invited to the hearing but did not attend. In his place, the bank sent regional Wells Fargo executive David Galasso, who offered some additional details about what the bank is doing to reform its sales practices and disclosed more possible compensation for aggrieved customers.

The bank agreed last month to pay regulators $185 million to settle investigations into its sales practices. Those investigations and the bank’s own internal reports found that Wells Fargo fired 5,300 workers for creating the unauthorized accounts over the last five years.

As part of that settlement, the bank said it would provide rebates to customers who paid fees on unauthorized accounts, though those rebates have amounted to only about $2.6 million and have gone to about 100,000 account holders.

Galasso said the bank also has agreed to a settlement that will cover all customers affected by the more than 2 million potentially unauthorized accounts identified by regulators and an audit by consulting firm PricewaterhouseCoopers.

The deal will settle a federal class-action suit filed in San Francisco by Wells Fargo customers. Financial terms were not disclosed and it must still be approved by a judge.

Attorneys at law firm Keller Rohrback had announced on Sept. 8 — the same day Wells Fargo’s $185-million deal with regulators was disclosed — that it had reached a settlement in the case but it was not clear how many customers would participate in the settlement.

Galasso also said the bank has tightened up several practices, including barring accounts from being created using a Wells Fargo email address as the customer’s email address — something Dababneh said he was surprised to hear was allowed until a few years ago.

The executive also reiterated that Wells Fargo is reviewing accounts created as far back as 2009 — two years earlier than called for by the bank’s settlement with regulators. Still, there’s evidence Wells Fargo workers were creating unauthorized accounts well before 2009.

Vice News on Monday reported that a branch manager in Washington state spotted an unauthorized account created in 2005 and reported it to Wells Fargo’s head of community banking in early 2006.

Galasso said the creation of unauthorized accounts was not “representative of Wells Fargo’s culture” and that workers who created those accounts had “done something very wrong.”

Still, Galasso, like Stumpf, tried to downplay the severity of the accounts scandal, saying that he has met with hundreds of customers in the weeks since the settlement was announced and has heard no complaints about unauthorized accounts.

“I have yet to meet one customer who has come in and said, ‘I had an unauthorized account, please close it,’” Galasso said.

On Tuesday, though, he heard from a handful of affected — and angry — customers.

Earl Brooks of Calabasas told Galasso that a credit card account had been opened in his name without his authorization. When he went to close the account, he said bank workers encouraged him to keep the card, saying that closing the account could damage his credit score.

Philip Jones of Woodland Hills said unauthorized accounts were created for him in 2005 and again in 2007. Jones said Wells Fargo’s promise to pay customers back for any fees they paid on unauthorized accounts doesn’t acknowledge the time and trouble its customers have gone through as they’ve dealt with accounts they never wanted.

“You keep talking about making people whole, but making whole is a financial statement for you. It takes hours and hours of work. You can’t make me whole,” said Jones, who is no longer a Wells Fargo customer.

Tuesday’s hearing came amid growing demands from state and local officials for sanctions against Wells Fargo over the accounts scandal.

Last week, officials in Seattle and Chicago, as well as the state treasurer of Illinois, said they would cut off some business relationships with the bank. The week before, California Treasurer John Chiang announced sanctions of his own, including prohibiting the bank from underwriting certain state bond deals for the next year.

Earlier Tuesday, Los Angeles City Councilman Paul Koretz introduced a motion that calls for the city to cut business ties to banks that use predatory sales practices.

The motion was supported by the union-backed Committee for Better Banks, which wants all banks to eliminate sales goals. It calls for changes to the city’s Responsible Banking Ordinance, a 2012 law that requires banks to submit reports on their lending and charitable activities in Los Angeles.

For Wells Fargo, the loss of business from any state or city is a minor blow, representing the loss of perhaps a few million dollars in fees for a bank that brought in more than $22 billion in revenue in the second quarter of the year alone.

Follow me: @jrkoren

ALSO

See what’s killing haunted houses and other independent Halloween attractions

South Koreans live in ‘the Republic of Samsung,’ where the Galaxy Note 7 crisis feels personal

Obama wants to send humans to Mars by the 2030s with NASA, private company collaboration

UPDATES:

5:25 p.m.: This article was updated throughout with additional comments from Galasso, Assemblyman Matt Dababneh, Assemblyman Travis Allen and Rep. Brad Sherman.

1:35 p.m.: This article was updated with remarks from David Galasso, president of Well’s Fargo’s Northern and Central California regions, and Wells Fargo customers.

This article was originally published at 11:20 am.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.