What investment managers are saying about ‘Brexit’

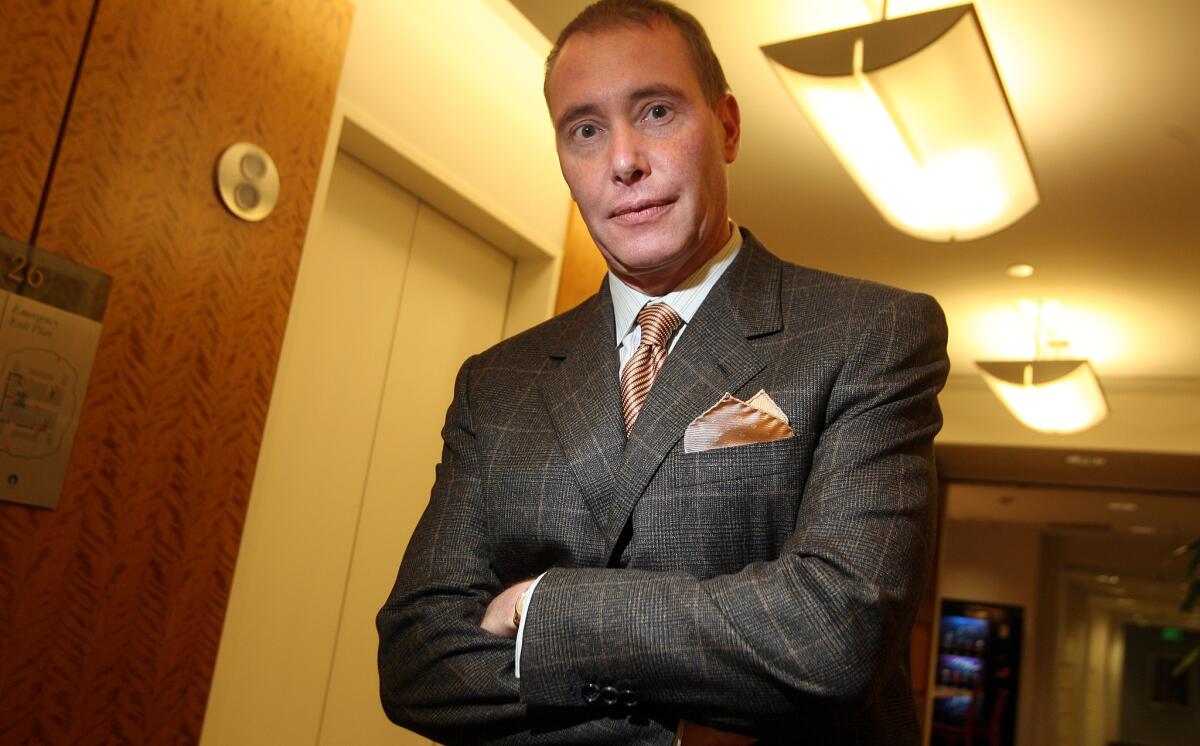

To star Los Angeles investor Jeffrey Gundlach, bull markets and bear markets aren’t about how much stocks have climbed or fallen, but about teamwork – whether players in the economy are working together.

“Bull markets are about cooperation,” Gundlach, chief executive of downtown L.A. money manager DoubleLine, told CNBC during an interview Friday. “That’s what makes societies thrive. If we don’t cooperate at all, we’re all out there in the woods with a spear chasing a squirrel.”

The landmark “Brexit” vote, he said, is evidence we’re living in an increasingly uncooperative world. That’s why he said he’s betting on gold, short-term bonds and other assets seen as safe havens, rather than on stocks.

Gundlach in February had said he expected the price of gold, then about $1,200 per ounce, would rise to $1,400 – a bet that looked prescient after gold climbed nearly 5% on Friday to $1,320, its highest point in two years.

He made that bet not because of the possibility of the Brexit, which he thought unlikely, but because he believed investors had lost confidence in the ability of central bankers to boost economic growth through monetary policy.

On Friday, though, he said Britons’ unexpected and unprecedented decision to leave the European Union is evidence of “a bear market in confidence” across the board.

Other investment managers, while acknowledging that the Brexit could hurt the global economy and affect markets in the short term, don’t see it as a reason to head for the exits, at least when it comes to the U.S. stock market.

Garrett D’Alessandro, chief executive of City National Rochdale, City National Bank’s wealth management business, said the domestic market, even accounting for a big sell-off on Friday, is holding its own.

The Dow Jones industrial average fell 3.4% on Friday, closing at 17,400. While that’s a big single-day drop, it brought the index back to where it was trading about a month ago – and well above where it’s been for most of the year.

“We’re not in the camp that believes we should have most of our money in fixed income,” D’Alessandro said. “The other day, the S&P 500 was near an all-time high. All those less optimistic investors have been in the wrong place.”

The market’s reaction to the Brexit vote likely has much less to do with any concrete consequences of the vote – Britain won’t exit the European Union for about two years – than with the uncertainty about what happens next and its effect on the global economy.

What will be the terms under which Britain leaves the union? What kind of new trade deals will the U.K. reach with other nations once it is on its own? Will Brexit spur other EU members to secede?

While those questions are weighing on investors’ minds now, they won’t be answered for years.

“The key point to remember is, this referendum is the beginning of a process, it’s not the end,” said Rob Lovelace, a portfolio manager at downtown L.A. mutual fund giant Capital Group, in a post on the company’s website Friday.

He went on to say that for long-term investors Friday’s market sell-off could be an opportunity to buy stocks at a discount.

But Bonnie Baha, a director at DoubleLine, which manages a $100-billion portfolio, cautioned that stocks haven’t dipped so much that they’re suddenly cheap. A lower price, she said, is a lower price, but not necessarily a good deal.

“We view this as a bit of a bear trap,” she said. “We don’t want to get suckered in.”

If investors don’t opt to buy on the dip or run for the door, they could instead choose to stand still. That’s the position pushed by Century City money management firm Advice Period, which makes a point of advising clients not to overreact to market swings.

The firm sent a note to clients Friday telling them they should stay the course.

“We believe in capitalism and have our sights set on the horizon, confident that all extreme swings in the market will ultimately revert to their mean,” the firm said, adding that markets often go through volatile periods that create “irrational exuberance and irrational fear.”

The firm closed the letter noting that its role “is to be our clients’ voice of reason and to dispassionately remind every investor to keep calm and carry on.”

Follow me: @jrkoren

MORE FROM BUSINESS

Faraday Future driverless cars to hit California highways

Uber is making surge pricing more transparent — but a little less obvious

You could be paid to post Snapchat photos and videos, patent filing suggests

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.