Ex-Wells Fargo mortgage banker is banned and fined for an alleged escrow fee scheme

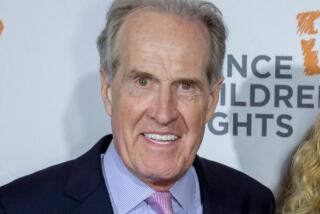

A former Wells Fargo & Co. mortgage banker in Beverly Hills has agreed to a one-year ban from the mortgage business and to pay an $85,000 fine to settle allegations that he orchestrated a scheme that resulted in some customers paying inflated fees.

The Consumer Financial Protection Bureau on Thursday announced it had reached the settlement with David Eghbali, a former top mortgage producer for Wells Fargo, who did not admit wrongdoing.

The CFPB alleges that Eghbali had an arrangement with New Millennium Escrow Inc. in Sherman Oaks through which the escrow firm undercharged some mortgage borrowers -- ones who might not have done a deal with Eghbali if they’d had to pay full price -- then made up the difference by overcharging others.

See more of our top stories on Facebook >>

The arrangement allowed Eghbali to close more loans, thus increasing his commission income, the CFPB said. According to the settlement, the misconduct took place from November 2013 to February 2015. Eghbali reports on his LinkedIn profile that he was one of Wells Fargo’s top producing mortgage bankers in 2013 and 2014, closing about $200 million in loans each year.

Wells Fargo spokesman Tom Goyda said the bank fired Eghbali last summer after “a thorough review that confirmed the improper activities.” The bank has also stopped working with New Millennium, he said.

Eghbali said in a statement provided by his attorney that he resigned from Wells Fargo and that “no customer was harmed by any action taken by me or by the relationships and negotiations I cultivated.” He added that he was bullied into the settlement, though he will abide by its terms.

“I am supporting my wife, two young children and my immigrant parents,” Eghbali said. “The extraordinary cost of fighting these allegations in prolonged litigation against such a powerful federal agency was not possible.”

SIGN UP for the free California Inc. business newsletter >>

Executives at New Millennium did not respond to requests for comment. Officials at Bank of America, where Eghbali had worked since departing Wells Fargo, declined to comment.

The CFPB did not allege Eghbali had committed any wrongdoing while at Bank of America.

MORE BUSINESS NEWS

Uber testing ‘upfront pricing’ in some cities to promote carpool option

California regulators approve battery storage to help avoid summer blackouts

Uber and Lyft drivers are safer than the average American driver, according to new report

Twitter: @jrkoren

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.