Why Quake Coverage Has Shrunk in California

California homeowners used to protect themselves against financial loss from earthquake in the same way they did against most other dangers: They bought a policy from a private insurer.

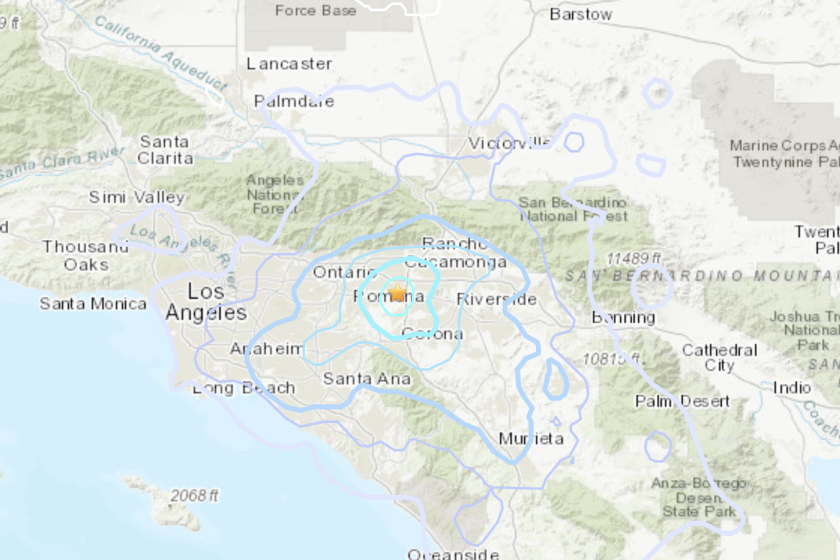

Then the 6.6-magnitude Northridge earthquake struck in 1994, collapsing apartment buildings, crumpling highways and convincing the insurance industry that it had, in the words of American Insurance Assn. vice president Ken L. Gibson, “an uninsurable risk on its hands.”

Since then, homeowners have paid more money for less protection to the state-created California Earthquake Authority, or have gone without such insurance.

The industry is still on the hook for some money in a future quake. If the CEA were to blow through its $2.1 billion in capital to pay claims, it could assess private insurers $2 billion. If the agency were to run through that sum, plus backup financing, it could assess another $1.45 billion.

But the $3.5 billion to $4 billion total that private insurers would have to bear is substantially less than the $12.5 billion they paid out after the Northridge quake and vastly less than the tens or perhaps hundreds of billions of dollars that experts say could be lost if the Big One hits. And the industry’s exposure is set to shrink in two years, when the CEA’s right to levy the first of the two assessments expires.

Most of the risks of loss in another quake are borne by the CEA and individuals.

Under a typical CEA policy, homeowners must pick up 15% of costs for rebuilding their homes. For a median-priced house in the state, that could amount to $30,000 or more. After that, what gets covered is the basic structure but little else. The policy provides only $5,000 for lost contents, and nothing for extras like detached garages or swimming pools. People can buy additional coverage from the agency.

The premium averages $700 a year but can range from a little more than $200 to more than $2,000, according to CEA policy director Nancy Kincaid.

These rates are set to decline an average of 22% on July 1, and state officials are hoping the reduction will convince more people to buy coverage. Only about 1 million of the state’s 6.5 million homeowners are now covered.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.