La Jolla

La Jolla Playhouse artistic director Des McAnuff testified against sections of President Reagan’s tax reform plan this week at a House Ways and Means Committee hearing in Washington. McAnuff singled out three areas of deductions he described as the performing arts industry’s “survival margin,” which the President’s proposal would eliminate.

McAnuff, who recently won a Tony Award for his direction of the musical “Big River: The Adventures of Huckleberry Finn,” asked committee members to reconsider the section of the tax reform plan that would repeal deductions for small charitable contributions. Cutting that deduction for taxpayers who do not itemize, McAnuff said, would cause a loss to the nonprofit sector of $6 billion.

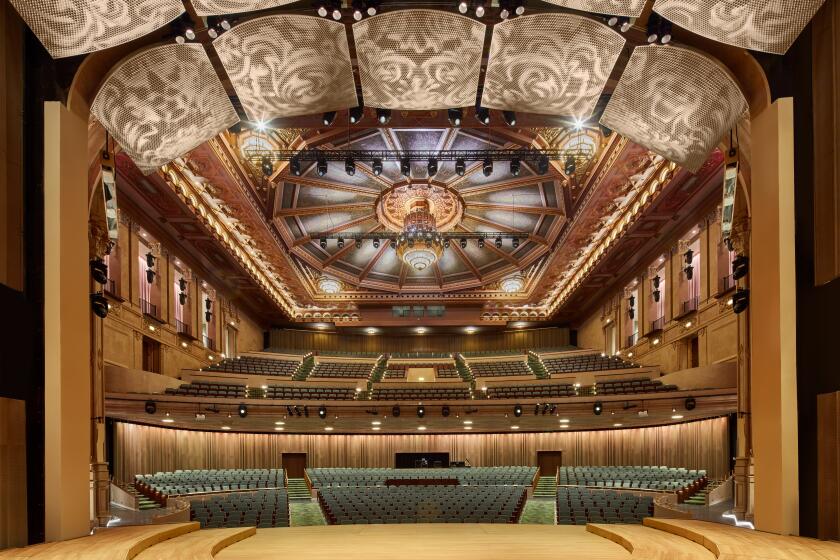

Shifting from small to large contributors, McAnuff used as an example local businessman Mandell Weiss’ gift of $1.2 million in appreciated stock, initially purchased by Weiss for $50,000. Weiss’ gift was the single major donation used in constructing the Mandell Weiss Center for the Performing Arts. “Under the President’s proposed tax plan,” McAnuff said in a prepared statement, “the appreciation of the stock would be taxable. Therefore Mr. Weiss’ generosity would have been discouraged by this Administration.”

McAnuff, who appeared before the committee along with actor Tony Randall and Bernadette Nolan, an Illinois arts official, questioned how the President’s call for increased corporate support for the performing arts could coexist with his tax reform plan calling for eliminating the cost of tickets as deductible business expenses for entertainment. The repeal of such deductions, McAnuff said, could “force our theater to become a forum that can be supported and attended only by the rich.”

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.