Earthquake Authority Scores ZIP in Explaining New Rates

Nevermind common sense. The California Earthquake Authority created shock waves of its own this month by approving an insurance rate structure that makes sense only in the spreadsheets of actuaries crunching numbers with secret mathematical formulas. The new rates, set to take effect Dec. 1, defy reasonable explanation and threaten to undermine public faith in an agency established to right an insurance industry knocked out by the Northridge earthquake.

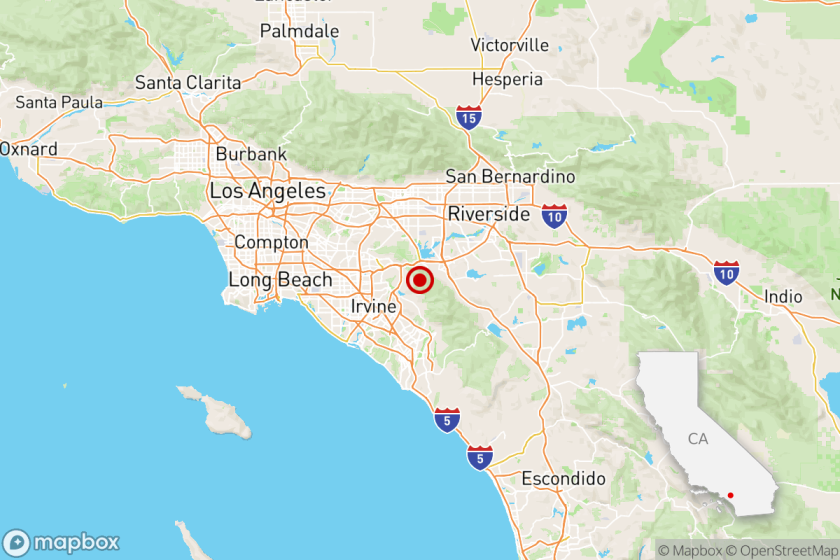

The San Fernando Valley would take a particularly hard hit under the new rate structure. Residents could expect to pay 40% more for insurance than the rest of the city. It makes sense, at first glance, given that two major earthquakes have struck the Valley in the past 30 years. Yet residents of Palmdale, which sits atop the San Andreas fault, would pay much less. So would San Fernando and Sylmar residents. For instance, the owner of a house in the Valley could pay $1,540 per year in premiums. The same house could be covered for $540 in Sylmar, $960 in Hollywood and $360 in Palm Springs.

The dividing lines? ZIP Codes that split neighborhoods into arbitrary risk zones. No one disputes that residents who live in high-risk communities should pay more. But it’s nonsensical for neighbors to pay drastically different rates because they live on different sides of imaginary lines. Earthquakes don’t differentiate between 91344 and 91321 the way actuarial tables do.

Reacting to the flood of criticism to the rates, Insurance Commissioner Chuck Quackenbush vowed to review them and said he might reject or modify the rates before December. The current structure appears unworkable and unfair. It needs aggressive, nonpolitical review. Quackenbush could start by explaining to residents in a nontechnical way the rationale and computations behind the numbers. They need to make sense--and not just to an insurance adjuster’s balance sheet.

We still believe national plans to cover natural disaster make more sense than state-by-state efforts that can be wiped out by a single catastrophe. We still question the benefits to consumers of the Earthquake Authority, which does more to protect the insurers than the insured. But for now, that’s what’s here. So it’s up to Quackenbush to make it work. First step: Make the rate structure sensible.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.