Why ‘Frozen’ and ‘Star Wars’ matter so much to toy makers this Black Friday

As this summer wound down, Hasbro Inc. was feverishly ramping up for the winter holidays.

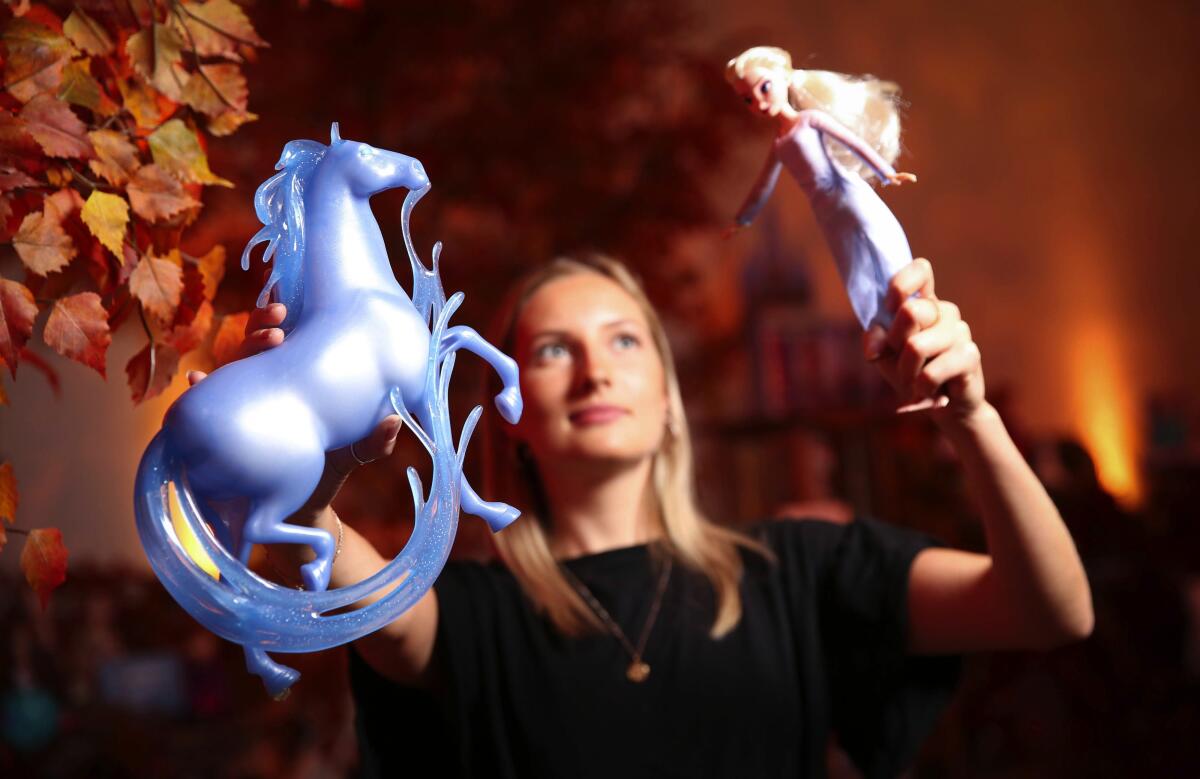

The toy maker added air-freight services and shifted its warehousing operations to get toys based on two new Walt Disney Co. movies, “Frozen 2” and “Star Wars: The Rise of Skywalker,” to retailers in time for the holiday shopping season.

The toy launches were “critically important,” and the company hustled to “ensure shelves were stocked” ahead of the opening of “Frozen 2” in theaters last Friday and the “Star Wars” opening Dec. 20, Hasbro Chief Executive Brian Goldner told analysts last month.

Hasbro’s effort illustrates the central role movies and TV shows play in shaping which dolls, action figures and other toys hit the shelves. But licensing of others’ intellectual property, or IP, is now spreading beyond films and TV to include toys tied to video games, home video streaming, music, YouTube and other platforms that are increasingly part of kids’ free time in the digital age.

“We’ll continue to see a proliferation of licensing in the toy industry based on the content kids are watching,” said Juli Lennett, vice president for toys at the research firm NPD Group. “There are so many different places where kids can go now” for entertainment.

Conversely, the toy makers also are licensing their popular in-house toys to film studios and other entertainment platforms to bolster sales and otherwise generate more revenue.

Mattel Inc. has a live-action Barbie film in the works. There have been Lego movies. Hasbro is paying $4 billion for the studio Entertainment One, and Hasbro teamed with Paramount Pictures a year ago on the movie “Bumblebee,” based on the Transformers character. Spin Master, the Canadian company that makes Hatchimals and “Paw Patrol” toys, has produced six TV series around its brands in the last decade, including “Paw Patrol” on Nickelodeon.

Mattel Chief Executive Ynon Kreiz repeatedly has talked about transforming the El Segundo firm into an “IP-driven” toy company whose strategy includes licensing Barbie, Hot Wheels and its other popular brands to others while also licensing outside IPs.

Case in point: Kreiz has said its toys based on “Jurassic World” from Universal Pictures “exceeded all expectations in 2018.” Mattel also has licensing deals with Sanrio’s Hello Kitty and Disney’s Pixar Studios, including the “Toy Story” and “Cars” franchises, among others.

“They realize that building these IPs brings immediate brand recognition, builds licensing revenue and is essential to help a toy company grow,” said Jim Silver, chief executive of TTPM, a toy review and research website.

Hasbro, Mattel and others also keep designing new toys they hope will catch fire, including some that merge physical toys with the digital world. Mattel, for instance, this year rolled out Hot Wheels ID, which enables kids to use an app to track how their Hot Wheels cars perform, along with a new line of gender-inclusive dolls called Creatable World.

MGA Entertainment Inc. in Chatsworth, the privately held creator of the popular L.O.L. Surprise! dolls, takes a different route, preferring to create its own toys while eschewing making toys based on movies and other outside IPs.

But MGA aggressively promotes its toys on digital media to attract kids and their parents. L.O.L. Surprise! has a YouTube channel with 1.2 million subscribers, and fans can watch L.O.L. Surprise! on Amazon Prime’s streaming service. There also are teasers on YouTube for a new MGA toy doll, Na Na Na Surprise, due for release Dec. 1.

“We understand how to create a teaser campaign to create that fandom” for a toy, said Hailey Wu Sullivan, MGA’s chief marketing officer.

All of the toy makers’ various strategies are playing out in the face of two overarching trends.

First, although toy makers and some analysts reject the oft-repeated notion that kids are ditching toys for tablets, smartphones and streaming video at ever-younger ages, they do agree that those technologies heavily influence what toys will be popular and how those toys are marketed.

“Kids are now so influenced by entertainment” they consume not just in theaters and on TV, but on a variety of platforms such as streaming, video games, YouTube and elsewhere on the internet, Silver said. “All these IPs on different platforms greatly affect purchases” of toys, he said.

For instance, two popular toy lines are based on video games: Jazwares’ “Fortnite” and Lego’s “Minecraft.”

Second, U.S. toy sales overall have been relatively flat for years, ranging from $20 billion to $22 billion, according to NPD. That puts pressure on the toy makers to have hit products — including products based on movies and other outside IPs, or by licensing their own IPs to outsiders — to take market share from competitors because the total market isn’t growing much.

Yet the industry’s consistent sales also point up that although technology has changed how kids spend their leisure hours, it hasn’t severely disrupted overall demand for non-electronic toys. Barbie remains a $1-billion business. Monopoly and Uno games are having strong years. L.O.L. Surprise! dolls have been one of the top-selling toys since their debut three years ago.

Sales of conventional toys such as dolls and action figures also reflect some parents pushing back against their kids’ growing use of tablets and smartphones.

“We’ve seen it in our research; parents are very conflicted with children and technology,” Lennett said. “They have greater concerns about technology than before, including the solitary nature of technology,” and they’re seeking toys that are “important to the social, emotional and physical development of kids,” she said.

L.O.L. Surprise! exemplifies both sides of the changes swirling around the industry. The toys feature several layers to unwrap — with each layer having its own surprise — and finally there’s a small, wide-eyed plastic doll at the center.

Yet this physical doll “was born on the internet” because “we were watching what kids were watching, and they loved unboxing,” that is, watching videos of kids taking toys out of their packaging, Sullivan said. “We delivered what they wanted without them asking explicitly what they wanted.”

Toys based outside of IPs — movies, TV and other content sources, or what the companies call their “partner brands” — amount to less than 25% of the total sales at Hasbro and Mattel. But those toys still accounted for $1.7 billion in combined sales for the two companies last year, and thus they remain key to their growth.

In the case of movies, the toys get a sales bump not only when the movies are released in theaters, but also when the films enter the home video and streaming markets. “Frozen 2” and the new “Star Wars” movie are expected to reach those markets next spring. In the case of “Frozen 2,” that will benefit not only Hasbro, but also other toy makers such as Lego and Jakks Pacific Inc. in Santa Monica that also are licensees.

That’s when kids will “be binge-watching” those movies and other favorite programs, and then “they get connected to the content and the characters they’re watching,” Lennett said. “The next step is they’ll buy a toy of one of these licensed characters.”

Deborah Thomas, Hasbro’s chief financial officer, told the analysts last month that when it’s making toys tied to “movie releases coming so late in the year, we tend to see the benefit of that continuing into the next year.”

The toy makers need the benefits because they’re grappling with a variety of problems.

Mattel, for example, has suffered from falling sales at its Fisher-Price and American Doll brands while also operating with heavy debt and operating costs.

Hasbro posted disappointing third-quarter results on Oct. 22 — and its stock plunged 17% that day — in part because the U.S. tariffs on Chinese imports disrupted retailers’ orders and Hasbro’s supply chain in the period.

Lego also has struggled. Excluding currency fluctuations, its sales fell 7% in 2017 but rebounded 7% last year, and the company has been trying to integrate its lineup of familiar block toys with more technology. Lego also heavily relies on its outside IP, with toys based on Disney characters, Harry Potter, Batman, Spider-Man and others.

But one problem largely is behind all those problems: the demise of Toys R Us, which liquidated last year after filing for bankruptcy. Its failure was a huge disruption for toy makers as they scrambled to place their goods with other retailers and was one reason why U.S. retail sales of toys slipped 2% last year to $21.6 billion, according to NPD.

Sales fell another 5.5% in the first nine months of this year, NPD said. But it’s the fourth quarter, with the holidays, that is critical for the toy industry, and NPD said it expected an unspecified fourth-quarter gain that would enable overall 2019 sales to show an increase, even though there are six fewer shopping days between Thanksgiving and Christmas this year compared with 2018.