‘Dell Tax Maneuver’ could galvanize efforts to tweak Prop. 13

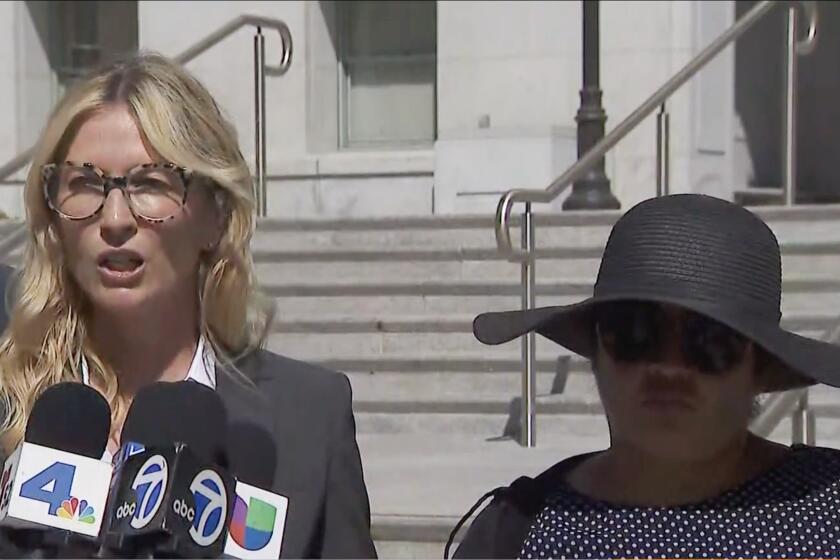

Stephanie Nordlinger, who lives in a modest Baldwin Hills tract home, has been reading with interest the news stories about computer magnate Michael Dell and his low, low property taxes.

Last week, the Times reported that Dell has saved more than a million dollars a year in taxes on a landmark Santa Monica hotel by exploiting a gaping legal loophole in the rules that govern how Proposition 13 is applied. By bringing his wife and two investment advisors into the 2006 deal for the Fairmont Miramar Hotel, my colleagues Jason Felch and Jack Dolan reported, Dell has so far been able to keep his taxes based on the hotel’s 1999 assessed value of $86 million, rather than the $200 million he paid.

“It’s not fair for those guys to keep the same property tax forever,” said Nordlinger, an attorney who is still practicing at 72. “Prop. 13 was never intended by the public for that.”

Nordlinger is well aware of the inequities that Californians enshrined in their Constitution in 1978. Disgusted by the state Legislature’s refusal to grant tax relief, even though the state had a burgeoning budget surplus, voters overwhelmingly passed Proposition 13, the most famous American tax revolt since the Boston Tea Party.

Ten years after Proposition 13 passed, Nordlinger bought her home for $170,000. She noted that her $1,701 property tax bill was about five times that of her neighbors, who had owned their homes longer.

So she sued the county assessor. It was not about money; she was happy to pay her bill. She hoped to persuade the court that California’s property tax scheme was fundamentally unfair.

Her neighbors were not pleased. She even got a half-hearted death threat. (“I was on the phone with an AP reporter, and I had call waiting. This man made a threat, but I told him I didn’t have time to talk because I had to get back to the AP.”)

The U.S. Supreme Court took her case, and, as those of you who just paid your April tax bills probably sense, she lost. The margin was a whopping 8-1. But even the justices who upheld Proposition 13 found the system “distasteful and unwise.”

Still, they ruled, California had a compelling interest in keeping neighborhoods stable, and the Proposition 13 tax scheme, in which taxes are based on 1% of a property’s purchase price and can rise no more than 2% a year, was a way to achieve that.

(Nordlinger preferred the dissent of Justice John Paul Stevens, who said the formula created a medieval situation favoring land-owning “squires” who “voted themselves a tremendous windfall.”)

Two decades later, Proposition 13 remains popular with voters even as the state’s once-glorious public institutions have crumbled.

Sitting in her small living room amid stacks of books and magazines, Nordlinger said, “If we want first-rate schools, if we want to have reasonable charges for higher education, streets without potholes, police, fire, parks, public health, social welfare, courts, taxes are in fact the price of civilization.”

Suddenly, though, the Dell Tax Maneuver has crystallized a problem that many liberal activists have been complaining about for years: the property tax burden has unfairly shifted onto the shoulders of residential property owners. Owners of commercial property, they say, no longer pay their fair share because they’ve been able to do the Dell, avoiding reassessments when properties change hands.

Lenny Goldberg, a longtime Proposition 13 foe who runs the California Tax Reform Assn., had one word for the timing of the Dell story: “Fabulous.”

But closing that loophole will be tough. Assemblyman Tom Ammiano has proposed such a measure. Even if it makes its way to the full Legislature, it will require a two-thirds vote to pass.

Anyway, Goldberg said, he has his sights set on a bigger plum: the regular reassessment of commercial properties, regardless of ownership changes. “The heart of the matter is that companies that own huge swaths of California since 1975 are paying taxes based on really, really outmoded values,” Goldberg said. “That’s the kind of thing we need to expose.”

He’s focusing on Chevron, the San Ramon-based energy giant.

Even Jonathan Coupal of the Howard Jarvis Taxpayers Assn., which is dedicated to the preservation of Proposition 13, said the Dell situation is “egregious.” But the case is still the subject of a court battle, he noted, and until the matter is resolved, any discussion of tweaking the way taxes are assessed “is premature.”

Expect a tooth-and-nail fight over proposals to change how commercial properties are assessed. His group has battled Assembly efforts to even study the issue. “California is already a very high-tax state,” he said. “Someone is going to have to make a hell of a compelling argument for why we need higher property tax rates.”

He’s right, and outrageous cases like Dell’s are probably the only way Californians, who have batted down the idea of splitting the commercial and residential rolls before, will put a stop to the shenanigans that commercial property owners have engaged in for years.

But there is also a new twist in this argument — that new businesses, the lifeblood of economic growth, are unfairly penalized. “Our assumption is that the current commercial property tax is unfair, deficit-inducing and is uncompetitive economically,” said Jennifer Ito, a USC urban planner who is studying the issue. “Newer industries and start-ups are shouldering more of the burden.”

In the 21 years that have passed since Nordlinger lost her case, home prices have spiked. Her tax bill is $3,347, far less than that of her next-door neighbors, who paid $520,000 for their home at the market’s peak.

Nordlinger still thinks Proposition 13 is a bad law. At the very least, she said, the commercial property loophole should be closed.

“You have to pay taxes to have services,” she said. “And if you don’t, you are going to live in a Third World country.”

Or perhaps a medieval situation, with landowning squires who vote themselves windfalls.

Oh, wait.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.