Another Wall Street firm seems set to buy its way out of a legal jam

When is a crime not a crime? Apparently when it happens on Wall Street.

Ever since the financial meltdown of 2007, prosecutors and market regulators have struggled with how to handle evidence of a wide range of chicanery by Wall Street financial firms and banking giants — most of which are flourishing again, by the way, while American workers continue to struggle with high unemployment, high underemployment and stagnant wages. Some cases have been brought, but the federal government almost invariably lets the offending bank or firm off with a fine, and no admission of guilt.

It appears that’s about to happen again. Morgan Stanley said this week that it has a preliminary agreement with the Securities and Exchange Commission to pay a $275-million fine to end an investigation of its subprime mortgage business (the SEC has yet to accept it). Oh, and it won’t have to admit that it did anything wrong. And since it didn’t do anything wrong, no one in the firm was guilty of anything.

How neat and tidy. And how obscene.

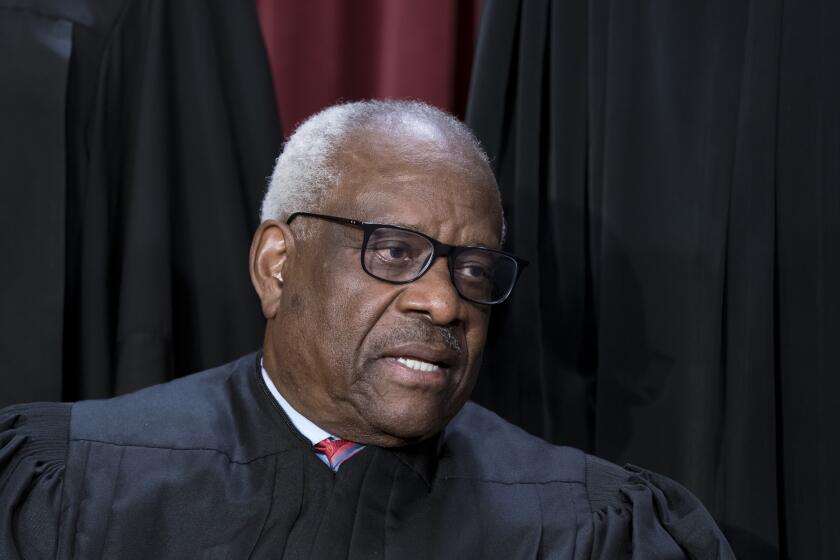

Jed S. Rakoff, a U.S. District Court judge in Manhattan and the former chief of the U.S. attorney’s Business and Securities Fraud Prosecutions Unit, last month excoriated the federal government for its lack of aggression in pursuing Wall Street fraudsters, a missive that bears revisiting. In his essay in the New York Review of Books, Rakoff accused federal overseers of failing to act even in light of the Financial Crisis Inquiry Commission’s findings that fraud likely was a driving factor behind the mortgage crisis.

There are (thin) explanations for the failure to act, including a fear of further cratering the economy by going after “too big to fail” financial institutions. And in the wake of the 9/11 attacks, Rakoff reports, investigative manpower was shifted from white-collar crime to terrorism.

But there also has been a troubling psychological shift in which the government, rather than trying to punish criminals, seeks instead to change corporate behavior, Rakoff wrote. That has given rise to these negotiated plea deals in which massively rich banks pay some cash to make a problem go away — cash that otherwise might go to shareholders (odd they aren’t screaming about this). And no one is held accountable. From Rakoff’s article:

Although it is supposedly justified because it prevents future crimes, I suggest that the future deterrent value of successfully prosecuting individuals far outweighs the prophylactic benefits of imposing internal compliance measures that are often little more than window-dressing. Just going after the company is also both technically and morally suspect. It is technically suspect because, under the law, you should not indict or threaten to indict a company unless you can prove beyond a reasonable doubt that some managerial agent of the company committed the alleged crime; and if you can prove that, why not indict the manager? And from a moral standpoint, punishing a company and its many innocent employees and shareholders for the crimes committed by some unprosecuted individuals seems contrary to elementary notions of moral responsibility.

These criticisms take on special relevance, however, in the instance of investigations growing out of the financial crisis, because, as noted, the Department of Justice’s position, until at least recently, is that going after the suspect institutions poses too great a risk to the nation’s economic recovery. So you don’t go after the companies, at least not criminally, because they are too big to jail; and you don’t go after the individuals, because that would involve the kind of years-long investigations that you no longer have the experience or the resources to pursue.

In conclusion, I want to stress again that I do not claim that the financial crisis that is still causing so many of us so much pain and despondency was the product, in whole or in part, of fraudulent misconduct. But if it was — as various governmental authorities have asserted it was — then the failure of the government to bring to justice those responsible for such colossal fraud bespeaks weaknesses in our prosecutorial system that need to be addressed.

Yes, it does, and not just from a moral or civic standpoint. How can you expect people to have faith in a system — financial or legal — when it seems so gamed?

ALSO:

Chuck Hagel’s nuclear exemption

Another healthcare crisis: Closing hospitals

For women, guns in the home prove especially deadly

Follow Scott Martelle on Twitter @smartelle

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.