Sam Bankman-Fried will be sentenced Thursday for his crypto fraud. Throw the book at him

- Share via

Based on the conflicting pre-sentencing reports submitted to the judge who will sentence Sam Bankman-Fried on Thursday on seven fraud counts, you might think this is a complicated case.

After all, the submissions paint drastically different pictures of Bankman-Fried. His lawyers say, in effect, that there are no victims in the case, because no one lost any money in the collapse of his FTX cryptocurrency exchange.

If there’s a victim here, they say, it’s Sam. The federal prosecutors cast him “as a depraved super-villain” in order to promote “a medieval view of punishment to reach what amounts to a death-in-prison sentencing recommendation.”

Prison has afforded Sam few opportunities to do good in the world.

— Barbara Fried, Sam Bankman-Fried’s mother, asks that he be given a lenient sentence

The prosecutors, indeed, describe Bankman-Fried as anything but an innocent. “He stole money from customers who entrusted it to him,” they write; “he lied to investors; he sent fabricated documents to lenders; he pumped millions of dollars in illegal donations into our political system; and he bribed foreign officials.”

Federal sentencing guidelines would warrant a maximum sentence of more than 100 years.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Bankman-Fried asserts that a prison sentence of 5¼ to 6½ years would do the trick of punishing him for his misdeeds and returning him to society so he can do more good; the government says a sentence of 40 to 50 years is necessary to protect the public and deter him and others from committing similar crimes.

To federal Judge Lewis A. Kaplan of New York has fallen the task of cutting a path through these jarringly incompatible pictures.

A few things may have helped him find the way. One is that as the trial judge, he already got a ground-level view of Bankman-Fried’s character. That happened in August, when Kaplan received evidence that Bankman-Fried had engaged in witness-tampering while awaiting trial (his attorneys argued that his actions were within the 1st Amendment). He revoked Bankman-Fried’s bail and sent him to wait out the pre-trial period in jail.

Kaplan has had more help from John Ray III, who took over as chief executive of FTX when it declared bankruptcy on Nov. 11, 2022, and from more than 100 statements from victims of the fraud.

More on that in a moment. First, a primer on Bankman-Fried and FTX.

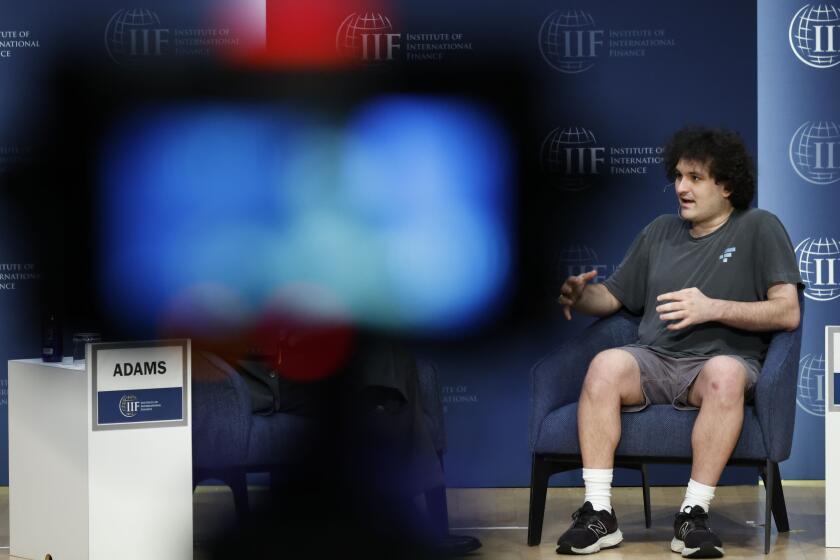

Youthful, engagingly shaggy and barely 30, Bankman-Fried emerged in 2021 and 2022 as a cryptocurrency guru who, almost uniquely in a market known for rip-offs, knew how to do things right and proper. He told congressional committees, financial pundits and — most critically — investors and clients that his FTX exchange was rigorously audited and operated by rules and practices that kept customer funds absolutely secure.

Hiltzik: Sam Bankman-Fried’s seven guilty verdicts expose crypto as a swindle through and through

Sam Bankman-Fried gambled with a cryptocurrency scam and lost. His guilty verdicts make the rest of us winners.

None of that was true. FTX’s internal accounting was so slipshod that its executives and traders had no real idea of how much money they had or where it was; the crypto tokens it issued were valued at its whim; and Bankman-Fried raided customer accounts to cover losses at his related enterprises.

He was enabled to do all this because the value of crypto as an asset is nebulous in the extreme. The market itself is fraudulent. As I wrote last year, Bankman-Fried exploited the vacuity of crypto by slathering it over with what sounded like profundities but were vacuous at their core. He could not have done so if there actually was anything genuine about crypto — his claims would have been weighed against market realities.

What is amazing about this case is how many people got snowed. Members of Congress hung on his words and gleefully accepted his campaign donations. FTX cut deals to place its name and logo on Miami’s pro basketball arena and the uniforms of Major League Baseball’s umpires, and paid up for a glitzy commercial during the 2022 Super Bowl, starring Larry David.

The author Michael Lewis wrote a slavishly promotional book about him that has been shown, if not a work of fiction, then a description of a fictional world in which Bankman-Fried actually was a successful entrepreneur.

Through it all, Bankman-Fried portrayed himself as a humanitarian with global aspirations, infused with a philosophy of charitable giving known as “effective altruism.” Its theme was that penny-ante contributions to local charitable institutions was as nothing, compared with the moral imperative to make as much money as one could, and then give it away.

This sounded novel, but it was old wine in a new bottle, the laundering of wrongdoing through conspicuous displays of spiritual piety or good works.

On Nov. 2, a federal jury convicted Bankman-Fried on seven counts of fraud and conspiracy. After weeks of sometimes abstruse testimony, it took jurors only four hours to reach a verdict.

The ridiculous story of Sam Bankman-Fried, FTX and cryptocurrency generally is aired in two new books, but only one is worth reading and it’s not by bestselling author Michael Lewis.

That brings us back to the pre-sentencing reports. The main point of disagreement between Bankman-Fried and the government is the size of the loss suffered by FTX investors and customers. That’s unsurprising, because that’s the most important sentencing factor in federal financial fraud cases. The government’s estimate of more than $10 billion in losses is so large it exceeds the maximum figure cited as a guideline many times over.

Bankman-Fried’s attorneys say there are no losses. They quote a lawyer for FTX’s debtors as stating during a bankruptcy hearing that “customers and creditors ... are expected to get back all of their money.”

FTX, according to Bankman-Fried’s attorneys, “was solvent at the time of the bankruptcy petition. The money was there — not lost. The harm to customers, lenders, and investors is zero.”

The government and Ray, the experienced corporate rescuer who became the chief executive of FTX in the bankruptcy, say: “Not so fast.”

In his submission, Ray told the judge that every one of those statements about FTX’s solvency and the absence of losses is “categorically, callously, and demonstrably false.” The quote from the bankruptcy hearing transcript, he says, “ignores pages and pages of important commentary, qualifications, and caveats from that hearing” that make the debtors’ lawyer’s statement extremely conditional.

“Mr. Bankman-Fried’s victims will never be returned to the same economic position they would have been in today absent his colossal fraud,” Ray asserted. (Emphasis his.)

One reason that’s so is that the victims’ claims will be adjudicated based on the value of their crypto holdings at FTX as of the day of the bankruptcy filing, converted into dollars. They won’t be getting their bitcoins or other crypto tokens back. That’s a blow, because one bitcoin (to take one example) was worth $16,778 on the day of the bankruptcy, and more than $70,000 now. So they won’t profit from a fourfold increase in the value of bitcoin in the interim.

Hiltzik: How Sam Bankman-Fried exploited the ‘effective altruism’ fad to get rich and con the world

This would-be crypto trillionaire promised to give away his wealth, but did he ever really mean it?

Whether they will receive anything is still uncertain. No creditors have been reimbursed, in part because Ray is still trying to find all FTX’s assets and clawing back money that was paid out to Bankman-Fried’s associates, including his parents.

Ray plainly resents Bankman-Fried for trying to blame the bankruptcy team for frittering away FTX’s value and his claim that he tried to help Ray restructure the company but was rebuffed. In fact, Ray says, it’s only through his own team’s efforts that any residual value at all exists in FTX.

“Mr. Bankman-Fried continues to live a life of delusion,” Ray told the judge. “The ‘business’ he left ... was neither solvent nor safe. Vast sums of money were stolen by Mr. Bankman-Fried.” The booty was converted into “investments in Bahamas real estate, cryptocurrencies or speculative ventures.”

Not only that, Ray and the prosecutors say that far from helping with the restructuring, Bankman-Fried interfered with the government’s investigation and the bankruptcy recovery efforts. The prosecutors point to his witness tampering and accuse him of lying on the stand during his trial. Ray says he “actively worked to hinder the preservation of assets,” in part by transferring some FTX assets to the Bahamas and trying to gain access to FTX’s internal systems.

“Only by cutting off Mr. Bankman-Fried was the Chapter 11 team able to stop the bleeding,” Ray stated.

Customers of the bankrupt Celsius reveal how the cryptocurrency firm’s collapse upended their lives.

If there’s any question about the toll the FTX collapse had on its customers, the statements submitted to the court by victims should dispel it. As was the case with Celsius, a crypto exchange that went bust in 2022, the FTX customer statements tell tales of grievous loss and emotional torment.

Of his $4-million claim, one customer writes: “It was my life savings and now I am left with nothing, no assets, no home, no savings, no job. ... My family’s life has been irreparably damaged.”

Another writes, “Prior to this crime, I had invested years of hard work and dedication into building a better future for myself and my loved ones. ... The abrupt loss has shattered those dreams, leaving me feeling stripped of my youth and vitality. ... The burden of financial ruin weighs heavily on my shoulders, leading me to grapple with constant thoughts of suicide.”

That’s not the only picture painted for Judge Kaplan. In her letter to the judge, Bankman-Fried’s mother, Stanford law professor Barbara Fried, depicted her son as unrelentingly idealistic, as though that’s the quality that led him to commit a multibillion-dollar fraud.

“Sam’s desire to do good on a large scale never crowded out his concern for individuals,” she wrote. “Prison has afforded Sam few opportunities to do good in the world.”

There isn’t much to say about this, other than that if I were facing sentencing on seven fraud counts I would hope that my mother would write a letter in the same vein. (His father and brother also wrote letters pleading for leniency.)

The family argues that Bankman-Fried was a good-hearted soul who allowed his determination to make the world a better place somehow lead him astray. Is this portrayal trustworthy?

There are abundant signs that he felt empowered to pull the wool over the world’s eyes. Testimony at his trial suggested that his image as an altruist was at least partially a sham. Ray points to a list of publicity options Bankman-Fried considered after the bankruptcy filing. They included “Go on Tucker Carlsen [sic], come out as a republican.... Come out against the woke agenda.... Have Michael Lewis interview me on e.g. ABC.”

In other words, he was spinning. Crypto is the essence of spin in the financial markets, and while he was riding high, Bankman-Fried was the avatar of that spin. Judge Kaplan’s sentence Thursday will show how good he is at discerning spin from the truth. At age 79 and with 30 years on the federal bench, the record suggests he’s very good.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.