IRS targets political nonprofit groups, conservatives shriek

- Share via

Way too late to avert scandal, the Internal Revenue Service has set forth new guidelines defining political activities by nonprofits. These are activities for which donations aren’t eligible for tax exemptions or donor confidentiality.

What scandal, you ask? It’s not the bogus scandal about the IRS targeting “tea party” and “patriot” groups for special scrutiny. It’s the real scandal that these groups or any others were trying to get tax breaks and anonymity for political donations in the first place.

Unsurprisingly, conservative groups instantly put up a big squeal about the IRS rules; after all, they’re the ones who have exploited the murky old rules most assiduously. “These proposed new regulations put the 1st Amendment rights of Americans at even greater risk,” said Jay Sekulow, chief counsel for the conservative American Center for Law and Justice, a big defender of the right of political donors to masquerade as public-spirited philanthropists and remain anonymous to boot. But make no mistake: Organizations across the political spectrum flouted the law, and they were all in the wrong.

The IRS proposal would dispel the murkiness that allowed illicit, anonymous multimillion-dollar political contributions to fly under the radar. It would define “candidate-related political activity” in detail, and make clear that it’s not eligible for the tax exemption and anonymity granted to nonpolitical activities by so-called nonprofit “social welfare organizations,” known formally as 501(c)4’s.

The IRS rules still leave one important issue unresolved. That’s the question of how much political activity a “social welfare” C4 can engage in at all, and why the figure shouldn’t be zero. The agency awaits further comments on that question.

A bit of history is useful here. As we reported last year, political operatives loved 501(c)4’s as vehicles for political contributions for two reasons: Their income was tax exempt, and their donors could remain unidentified. The problem was that such organizations were supposed to be devoted primarily, if not exclusively, to “social welfare.”

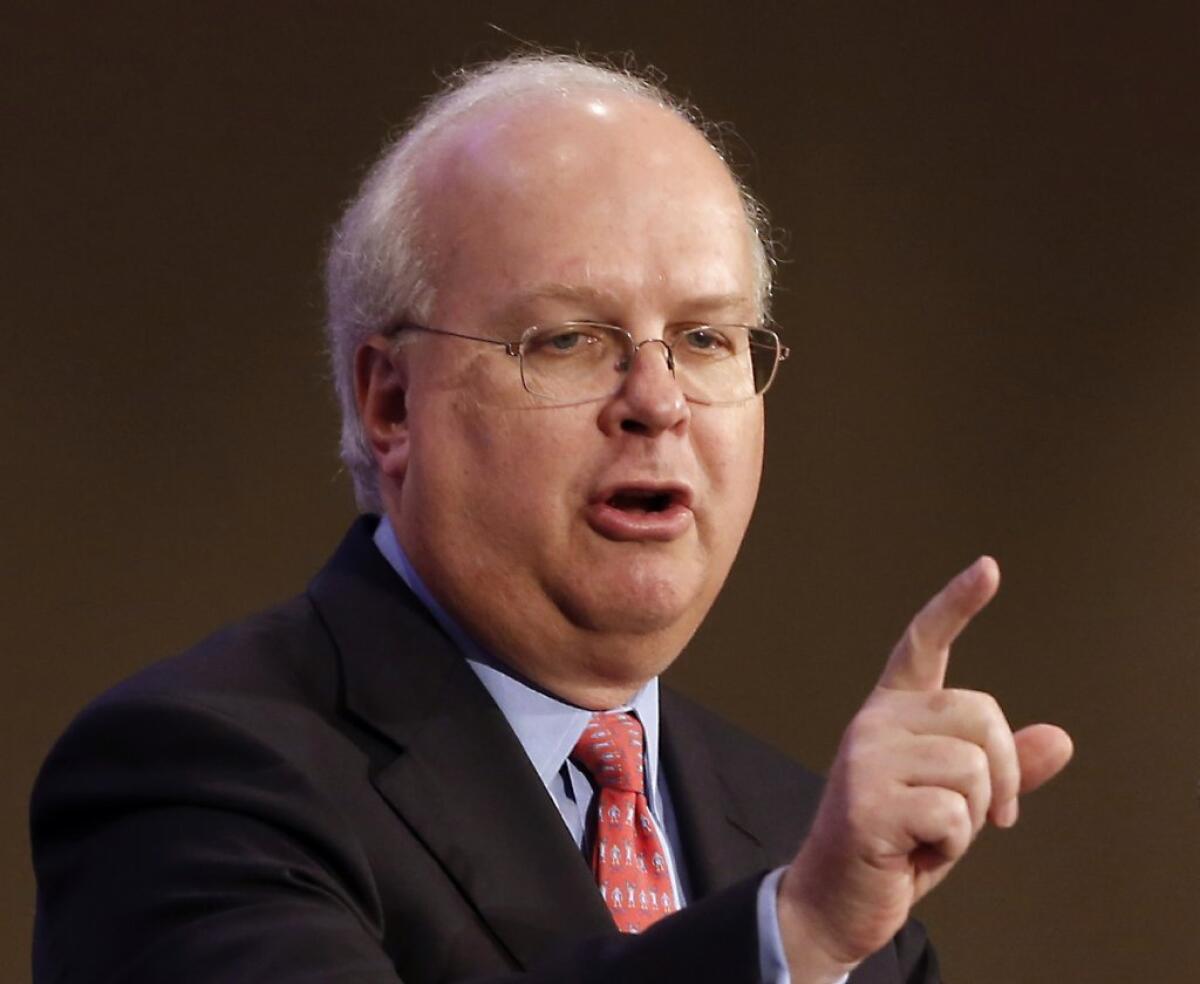

We observed in a second column that typical C4’s as envisioned by the IRS were religious groups; cultural, educational and veterans organizations; homeowners associations; and volunteer fire departments. Instead, C4 designation was claimed by organizations like Karl Rove’s Crossroads GPS, which spent nearly $86 million on political activity in 2012, according to ProPublica.

Over the years, the IRS had ruled that nonprofits could keep their C4 status as long as their political activities didn’t exceed 49% of their work. But the agency didn’t define political activity very clearly. It was left up to rank-and-file agents to figure out what side of the line an organization was on. Flash forward to the 2010 and 2012 elections, and the beleaguered troops tried to winnow out violators by screening for organizations with the terms “tea party,” “patriots” and, as it turned out, “progressive” and “green” in their names.

This led to the famous “IRS scandal,” a bogus claim by Republicans, especially Rep. Darrell Issa (R-Vista), that the Obama administration was “targeting” tea party groups for harassment. Despite Issa’s reputation for shooting first and asking questions never, this brouhaha held the stage in Washington for months -- even now it’s got holdout believers in the GOP.

The IRS guidelines, which are still subject to formal review, will do much to take guesswork out of the enforcement effort. They’d define “candidate-related political activity” as, among other things, “communications that expressly advocate for a clearly identified political candidate or candidates of a political party,” or that are made within 60 days of a general election or 30 days of a primary and “clearly identify a candidate or political party.”

Also included would be grants to PACs, Super PACS, and other political advocacy groups, and voter registration drives and “get-out-the-vote” drives.

It’s worth noting that none of these activities are considered illegal or barred -- so much for the claim that freedom of speech hangs in the balance. But they’re not tax-exempt, and henceforth no one should be able to pursue them and weasel around the campaign finance disclosure laws. The message finally is becoming clear: You want to spend money on politics, fine. You want to do it in secret by claiming to be a “social welfare” group, no dice.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.