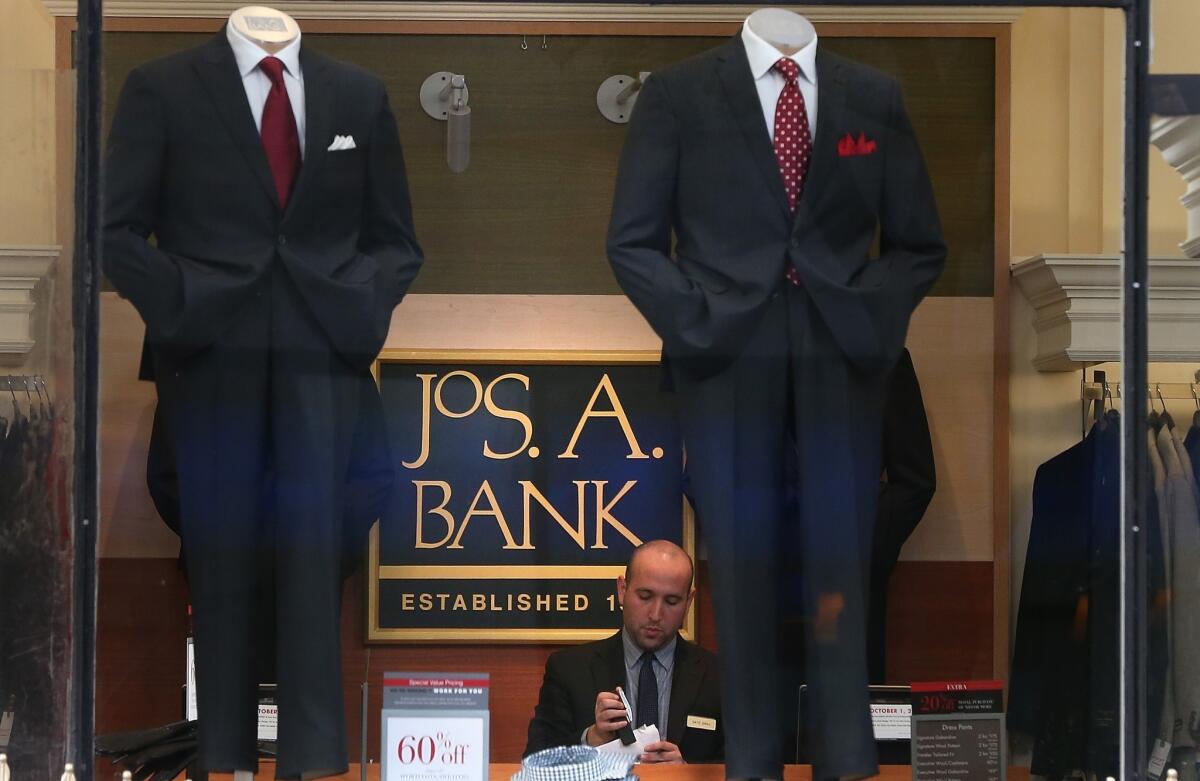

Jos. A. Bank rejects Men’s Wearhouse takeover offer

- Share via

Jos. A. Bank announced Monday it has rejected a late November takeover bid from rival Men’s Wearhouse, saying the offer undervalued the company.

“Our board undertook a thorough review and determined that the per share consideration in the proposal made to us by Men’s Wearhouse was simply not in the best interest of our shareholders,” said Robert N. Wildrick, Jos. A. Bank’s chairman.

The two retailers have in the past months been playing a game of cat-and-mouse as each company has tried to acquire the other.

In October, Jos. A. Bank Clothiers Inc. offered to buy Men’s Wearhouse for $2.3 billion, but the offer was rejected because Men’s Wearhouse executives believed the bid undervalued the company.

Then, in late November, Men’s Wearhouse turned the tables and offered to acquire Jos. A. Bank for $55 a share, for an estimated $1.2 billion. Men’s Wearhouse said Monday that represented a 45% premium over Jos A. Bank’s unaffected enterprise value and 32% over the company’s closing share price on Oct. 8, the day before Jos. A. Bank bid for Men’s Wearhouse.

In a statement, Men’s Wearhouse’s executives expressed surprise at the rejection.

“Given Jos. A. Bank’s repeated expressions of interest in engaging in good faith discussions about a possible combination with Men’s Wearhouse, we are surprised that Jos. A. Bank has rejected our proposal,” the company said in a statement.

Shares for both companies were down Monday after news of the rejected takeover proposal. Men’s Wearhouse shares were trading at $51.47, down $0.54, or 1.04%. Shares for Jos. A. Bank were down $0.12, or 0.21%, to $56.91.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.