Could ‘optimizing’ ads save this paper?

- Share via

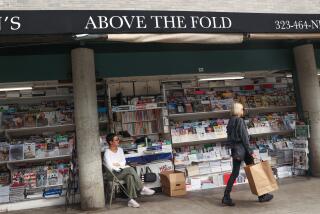

This promises to be the Silent Spring for big print media. Already this year we’ve lost the Rocky Mountain News and the Seattle Post-Intelligencer. Dozens of other papers have been driven to the brink by double-digit losses in circulation and print advertising revenue and an overburden of untenable corporate debt. My beloved L.A. Times, owned by the bankrupted Tribune Co., is bleeding reporters and editors from every orifice, despite the fact that the paper’s readership -- online, at least -- is through the roof.

Not surprisingly, the news release from the L.A.-based Rubicon Project promising to help newspapers “find money” online caught my eye, as a flotation device attracts the casual interest of a drowning man. With the Rubicon Project’s technology, says Frank Addante, the 32-year-old co-founder and chief executive, newspapers and other “premium news” outlets can increase their online revenue by an average of 60% a year.

Could this be, I wondered, daring to hope, the Secret -- the means by which newspapers finally “monetize” their content? Is this the online oxygen for our asthmatic industry?

Bernice, hold my calls.

Starting in 1997 in his dorm room at the Illinois Institute of Technology, Addante and a group of tech-savvy friends were pioneers in the ad network business (an ad network is a kind of brokerage, placing clients’ advertising on publishers’ websites). In 2007, Addante formed the Rubicon Project with the same cadre of Web veterans and $22 million in venture capital. The company opened the doors of its techno-hip West L.A. headquarters in April 2008 and since then has blown up to become the third-largest online advertising company in the world -- behind only Google and Yahoo -- as measured by reach, according to the online monitoring firm Quantcast. Rubicon processes more than 35 billion ads a month from 375 ad networks, placing them on more than 14,000 websites, including those of the Washington Post, Newsweek and USA Today (it is currently in discussions with Tribune Interactive).

“We want to be the Visa, the Nasdaq of online advertising,” Addante says. By which he means the one-stop shop for publications and ad networks, a network of networks handling ad placement, metrics and billing. “Google controls 22% of online advertising.” The rest, he says, is “up for grabs.”

Great. That’s awesome. Now how are you going to save my newspaper?

The firm specializes in an arcane technology called ad optimization, which addresses a major leak in the online rowboat: About three-quarters of ad inventory (places where ads could go on Web pages) goes unsold by publishers. To fill those spaces, publishers turn to ad networks, whose automated systems try to approximate the right kind of ad for the particular audience, based on the page content -- fishing-boat ads for “Field and Stream,” for instance -- the viewer’s geographic or demographic information, or his or her previous online behavior, what’s called the click-stream. The more cogent and relevant the ads are to the user, the better the return on investment for the advertiser.

But the ad network nervous system, apparently, is immature and rather slow-witted. There are more than 400 ad networks, and most specialize in a particular kind of advertising: cars, travel, hunting, gay life, Martha Stewart, sports, you name it. Publications can’t have relationships with them all, and so you get some weird pairings of content and advertising. During the recent row over California’s Proposition 8, for instance, readers of gay-themed websites were confronted with “Yes on Prop. 8” ads. They were not happy.

The problem of matching ads to page content is acute for general-interest newspapers: “The audience is constantly changing,” Addante says. If, for example, UNC advances in the NCAA tournament, more readers are likely to come from North Carolina. If there’s a shuttle launch, more space nerds. Another Joaquin Phoenix freak-out? More celeb-watchers.

Addante claims that Rubicon’s programming -- processing about 1 trillion rows of data daily -- is supple enough to adjust what the ad users see in real time, in a way that can keep up with the newspaper websites’ traffic volatility.

And sometimes stay ahead of it. For example, when the airliner landed in the Hudson River, traffic on New York newspapers’ websites skyrocketed. Addante’s team got an alert from the publishers and helped pour high-value ads onto those sites.

“We’ve really solved the technology problem,” says Addante, his right arm trussed up from a snowboarding accident. “It has a huge positive impact for our publishers.”

E.W. Scripps television began using Rubicon’s ad optimization service five months ago. “It’s gone well,” says Adam Symson, vice president of interactive. “It’s pretty solid product. . . . We’ve definitely seen a lift in revenue based on optimization.” Another benefit, Symson says, is that Rubicon helps keep cheesy and distasteful ads from getting placed into Scripps sites. “Keeping those kinds of ads out is a laborious process.”

Does it work? It all sounds good. Will it save newspapers? I haven’t the faintest, and part of me resists the proposition that great journalism can be saved only by some splashy Web programming articulated in a language I only half understand. And yet, none of the other schemes to make online content pay -- subscription walls, micro-payments, tip jars, “free-mium” content -- has amounted to a decent Christmas party.

In the short run, says Addante, newspapers and other news publishers are in for a beating. In the longer term, the good advertisers will seek out newspapers’ quality audiences, and online revenues will begin to replace those lost from the print side.

At least Addante hopes so. “I don’t want newspapers to die like radio.”

--