BP in talks to sell Alaska oil fields

- Share via

Seeking funds to pay for the biggest U.S. oil spill in history, BP is in talks to sell its Alaska oil fields and some other assets to Houston-based Apache Corp., two people familiar with the discussions said Sunday.

Apache, the largest independent U.S. oil company by market value, is negotiating for assets that include a share in BP’s Alaska business for a price of less than $12 billion, according to one of the people, who asked not to be identified because the discussions aren’t public.

“Apache is a very smart acquirer and that’s been part of their growth over many, many years,” said Philip Dodge, an analyst at Tuohy Brothers in New York.

Apache has bought BP assets before and is “a company that is very strong financially and liquid,” Dodge said.

BP scrapped its dividend and said last month it would sell some of its assets to raise $10 billion for cleanup costs, fines and legal damages from the Gulf of Mexico spill. The company has spent more than $3 billion on the spill and agreed to establish a $20-billion fund for damage claims.

Robert Dye, a spokesman for Apache, and Max McGahan, a BP spokesman, declined to comment.

The talks between BP and Apache were first reported by the London-based Times newspaper, which said the assets may be worth $12 billion.

Investors have sold BP’s stock over concerns that the company may struggle to cover the rising costs and fend off the political ramifications prompted by the April 20 drilling rig disaster, which killed 11 people and is spewing as much as 60,000 barrels of oil a day into the Gulf of Mexico. The company’s stock has fallen 44% as of July 9.

In 2003, Apache paid $1.3 billion for BP assets in the Gulf of Mexico and the North Sea.

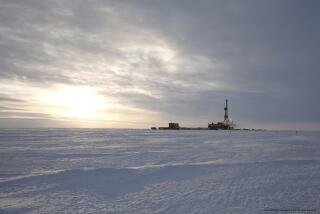

BP owns a 26% share in the Prudhoe Bay and neighboring fields in Alaska with Exxon Mobil Corp., ConocoPhillips and Chevron Corp. The Prudhoe Bay field, the largest in the U.S., came online in 1977 and can produce about 400,000 barrels of oil a day.

The field is averaging 234,772 barrels a day this month, according to Alaska state tax records. Its production is declining 10% a year, according to BP’s website. Because the field is more than 30 years old and output has been declining, Dodge said he would be surprised if Apache bought it.

“When Apache acquires, they always acquire something that has some growth possibilities to it,” he said.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.