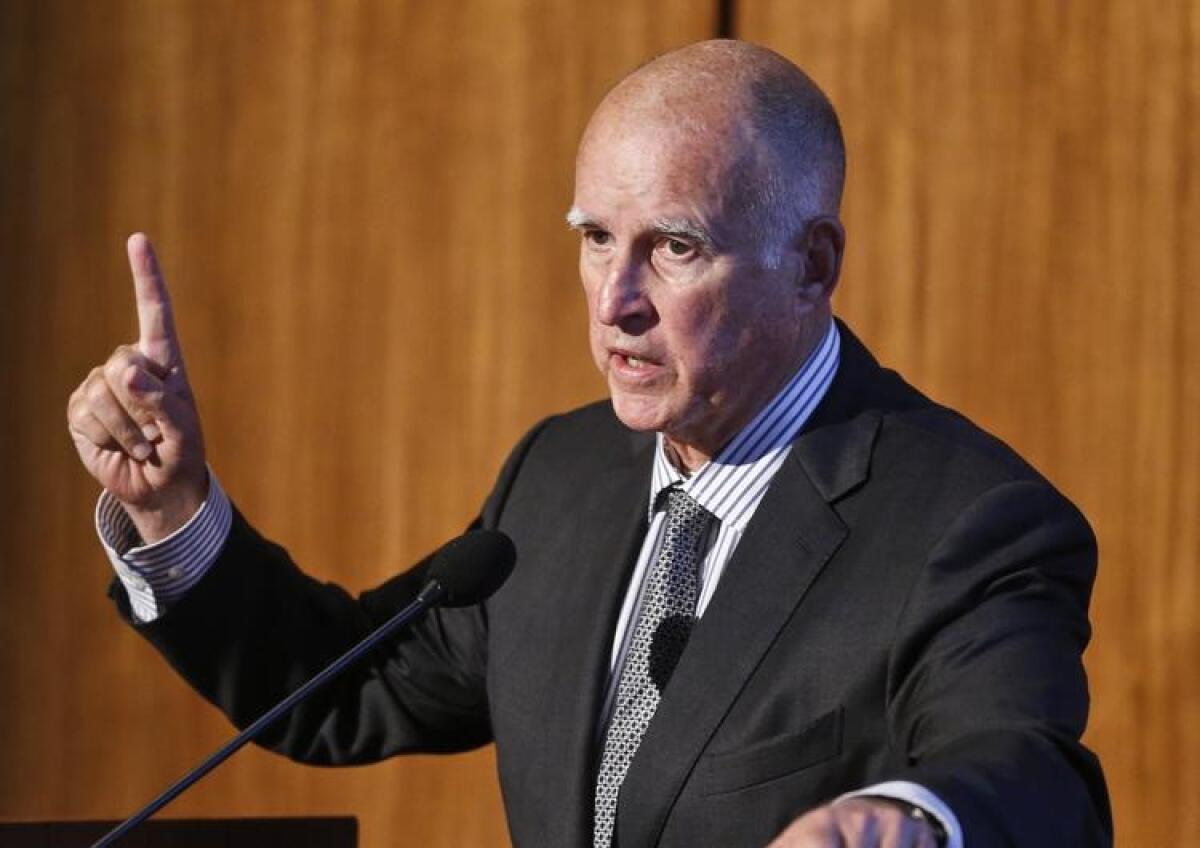

California offenders are no longer eligible for early release in the deaths of police officers

California offenders will no longer be eligible for early release if they have been convicted of murder in the death of a police officer.

Gov. Jerry Brown on Friday signed legislation that exempts offenders from consideration for compassionate or medical release.

Currently under the law, the secretary of the Department of Corrections and Rehabilitation and the Board of Parole Hearings determine whether a prisoner meets those provisions.

Offenders are typically recommended for early release if they have six months or less to live and would not pose a threat to public safety under court conditions or if a prisoner is permanently medically incapacitated.

Sen. Cathleen Galgiani (D-Stockton) has said she filed the legislation, SB 6, to target a group of offenders sentenced during a period in the 1970s, when California had neither a death penalty sentence nor a sentence of life without the possibility of parole. During that time, she said, people convicted in the deaths of police officers were sentenced to life with parole.

Opponents of the bill said the parole board was capable of screening the petitions to determine who is appropriate for release. They said medical parole was meant to decrease the financial strain of caring for medically incapacitated inmates.

Bill increasing penalties for possessing date-rape drugs becomes law without governor’s signature

In a rare move, Gov. Jerry Brown said Friday he was allowing a bill increasing penalties for possession of date-rape drugs to become law without his signature.

Brown normally signs bills he supports or vetoes them if he doesn’t, but bills can become law if the governor fails to act by Friday’s midnight deadline. The governor’s representatives declined to explain his decision, but Brown has in the past been reluctant to approve bills that added to prison overcrowding.

The measure by Sen. Cathleen Galgiani (D-Stockton) targets drugs that cause victims to become completely incapacitated, leaving them with no memory of their assault.

The bill restores the authority of county prosecutors to pursue felony charges against individuals caught with the most common date rape drugs and who have also demonstrated the intent to commit a sexual assault. It addresses a change in the authority that was included in Proposition 47, previously approved by voters.

“The issue of sexual assault has received increased attention in both state and national media recently as California’s inadequate sexual assault laws have been brought to light,” Galgiani said in a statement.

New law aims to help keep sexual assault survivors’ addresses private

Protections to keep domestic violence survivors’ addresses confidential will be standardized under a bill the governor signed Friday.

The new law will also apply to people who have been sexually assaulted or stalked and reproductive healthcare providers. It will prohibit people, businesses and associations from publishing the addresses of people protected under the law who have requested that their addresses be kept confidential.

The bill, authored by Assemblywoman Catharine Baker (R-San Ramon), will also require the California Secretary of State’s office to provide those protected under the law with information about how to keep their addresses private.

The law will take effect Jan. 1.

Workers in small businesses will not get mandatory parental leave, after veto by Gov. Jerry Brown

Gov. Jerry Brown refused on Friday to extend parental leave requirements to Californians who work for some of the state’s smallest businesses, saying he worried about the plan’s impact.

In his final bill actions for the year, Brown vetoed Senate Bill 654 and its mandate of six weeks of unpaid leave for mothers or fathers at businesses that employ between 20 and 49 workers.

Current job protections for workers with new children are focused on businesses of at least 50 employees. The bill would have given these employees access to the state’s paid family leave program, with subsidies that are paid for through worker paycheck deductions.

Brown’s veto message said that he was concerned about the “impact” of the leave proposal on small businesses, and cited potential liability issues that could be resolved through a modified proposal in 2017.

The bill’s author, state Sen. Hannah-Beth Jackson (D-Santa Barbara), said in a statement that “everyone deserves the basic right to take time off to care for a newborn.”

‘Yes to Prop 62’ releases new ads in campaign to abolish death penalty system broken ‘beyond repair’

Thirty-eight years ago, lawyer Ron Briggs and his father wrote the ballot initiative that brought the death penalty back to California. They worked tirelessly to get it passed, gathering petition signatures and mailing out literature.

But in a new online ad airing this weekend in support of Proposition 62, the November ballot measure that would abolish the practice, he tells viewers he made “a big mistake and you have been paying for it ever since.”

“I thought we’d save money,” he says in the ad. “Instead, we have wasted $5 billion on just 13 executions.”

The video is one of two commercials that will begin playing this weekend as paid content on Facebook to raise support for the proposition. Past efforts to end the death penalty in the state have tended to focus on moral arguments against state-sanctioned executions. This year, Prop 62 organizers said they also want to emphasize the cost to taxpayers’ pockets.

The second ad features a porcelain vase shattering on the floor as a voice says, “Sometimes something is so broken it just can’t be fixed.” It goes on to list what it calls the flaws in the state’s death penalty system: suspended executions, endless appeals and millions in legal fees.

Both Prop 62 videos tell viewers the measure will save the state $150 million a year.

But not all agree with its financial estimates. The proposition, which would replace capital punishment with life without parole, is one of two competing death penalty measures voters will weigh on the Nov. 8 ballot. Prop 66 aims to speed up the execution process by limiting the number of appeals that death row inmates can file and by expediting deadlines.

Prop. 66 supporters argue the Prop. 62 campaign has “wildly inflated” the costs of the death penalty system.

The “Yes on 62” campaign says it took its $5-billion estimate from a report by California’s Loyola Law School in 2011. But one of its authors told PolitiFact California that was the figure spent on the entire system since 1978 — not just the the cases of 13 death row inmates.

Briggs said he began to change his perceptions on the death penalty about a decade ago. “It is important for people to understand that 38 years ago we threw a pebble into the political pond, creating waves of unwanted effects,” he said.

This story has been updated with a comment from Briggs.

Democrat who lost in the primary says he will vote for Republican Rep. Steve Knight in heated House race

Lou Vince, an L.A. police lieutenant who finished third in the 25th Congressional District’s primary contest this June, crossed party lines Thursday and said he will vote for Republican Congressman Steve Knight over Democratic lawyer Bryan Caforio in the heated congressional race that national Democrats are targeting as a potential seat pick-up.

In a letter sent to reporters Thursday, Vince said while he wants Democrats to win back Congress, Caforio is new to the district and “isn’t a member of this community and certainly doesn’t reflect the values of our district.”

Vince, who said he was asked to drop out of the race by Democratic Party leaders when Caforio entered, complimented Knight for his military service and career with the Los Angeles Police Department.

“Steve Knight isn’t perfect — I’ve opposed him on issues like climate change and healthcare,” he said in the letter. “But I know Steve, I’ve known him for many years. While we may disagree on policy issues, he is a man of integrity and genuinely believes he is doing the right thing.”

In the letter, Vince accused Caforio of misrepresenting his legal career on the campaign trail and promoting “false accusations about my professional conduct as a police officer.”

During the primary campaign, L.A. Weekly and other outlets reported on a lawsuit filled by Cecil Miller, who claimed Vince and another officer, Timothy Gallick, beat him in front of his family after Miller ran over Vince’s foot during a traffic stop in 2000.

The suit alleged one of the officers held Miller up while the other punched him in the face before Vince also punched a passerby in the face, according to the suit.

The case was eventually settled by the Los Angeles City Council for $150,000 and the matter was sent to the Los Angeles Police Commission, according to city records. The commission asked the LAPD to review the incident, but Police Commission Executive Director Richard M. Tefanka said they never received a report back from the department.

Caforio’s campaign denied spreading information about the suit or the settlement, which was covered by local press in 2002.

In response to Vince’s letter to reporters, Caforio’s campaign released a statement from Maria Gutzeit, a Newhall Water District board member, who also ran for the seat but dropped out and endorsed Caforio.

“After multiple failed campaigns, it’s disappointing that Lou Vince is standing with an extremist like Steve Knight, who is against a woman’s right to choose even in cases of rape, incest or when the life of the mother is at risk, and would be another vote for the Trump agenda,” she said.

Will denim be California’s official state fabric? A decision looms

Distributing secret recordings like those in Planned Parenthood case now a crime in California

Distributing secret recordings involving healthcare conversations will become a crime in California in 2017, under a new law inspired by the high-profile case involving videos of Planned Parenthood employees discussing abortion procedures.

Gov. Jerry Brown’s signature on Assembly Bill 1671 came after last-minute changes to the bill seeking to ensure journalists wouldn’t be prosecuted for the use of video, audio or transcripts they are given but did not help to record.

Existing law focuses on the illegal nature of the recording itself, not what happens to any copies of the recording.

Planned Parenthood, a sponsor of AB 1671, argued that the new law is necessary in the wake of the controversial videos taped by David Daleiden and other anti-abortion activists that purport to show Planned Parenthood employees illegally trafficking in fetal tissue.

The organization, which has not been found guilty of any wrongdoing, has insisted that the videos were manipulated and sparked a number of threats made to their medical providers and clinics.

In an emailed statement, Daleiden said the conversations recorded were not confidential. “California’s existing recording law and the new distribution provision are simply inapplicable to our work,” he said.

News organizations including the California Newspapers Publishers Assn. had opposed earlier versions of AB 1671. Late amendments sought to assure that only those involved in actually making the recording are subject to criminal prosecution for distributing it — not those, including reporters, who may receive it from another source.

“Gov. Brown sent a clear message to anti-abortion extremists that you cannot break the law in California or you will be held accountable,” said Kathy Kneer, president of Planned Parenthood Affiliates of California, in a statement on the signing of AB 1671.

Update 3:45 p.m. This story has been updated with comment from David Daleiden.

More large electronic billboards are possible for downtown Los Angeles after governor’s action

More electronic billboards could be allowed in downtown Los Angeles under a new law signed Friday by Gov. Jerry Brown that community activists charge will add to visual blight in the city core.

The controversial bill allows developers to erect several giant electronic billboards around the $1-billion Metropolis high-rise project in downtown Los Angeles as long as they also are allowed by the city.

The measure is opposed by Dennis Hathaway, president of the Coalition to Ban Billboard Blight, who said it will create an atmosphere of flashing, changing electronic signs like Times Square in New York City and cause a dangerous distraction for motorists on nearby streets and the 110 Freeway. He also said it would create an eyesore.

“I’m really disappointed,” Hathaway said. “Having big, multistory advertisements for things like beer and Coca-Cola is not the highest and best use of the visual environment.”

He also said the law sets a bad precedent for allowing a developer to get legislators to grant exemptions from state sign laws limiting billboards near freeways.

Assemblyman Miguel Santiago (D-Los Angeles) said his measure is aimed at helping the economic revitalization of a downtown neighborhood. The measure is needed to provide some financial incentive for developers to revitalize the city core now that redevelopment agencies have all been shut down, the lawmaker added.

Billboards can provide extra revenue to help make developments more profitable, he said. The bill provides exemption from the Outdoor Advertising Act for an area bounded by West 8th Street on the northeast, South Figueroa Street on the southeast, Interstate 10 on the southwest, and State Route 110 on the northwest, and to a nearby area on the westerly side of State Route 110 bounded by West 8th Place, James M. Wood Boulevard and Golden Avenue.

“I’m hoping it will spark up the much-needed revenue to make development happen in downtown Los Angeles and create thousands of jobs and hopefully become more of a world city,” Santiago said Friday, adding it could help the area targeted to become “an anchor like we saw with L.A. Live.”

Santiago said the city of Los Angeles, which will have final say on any signage, has lost $5 billion in economic development over the last four years alone because of the lack of hotel rooms and an outdated Los Angeles Convention Center.

The Los Angeles Metropolis project, which includes 350 hotel rooms, is a 6.3-acre, $1-billion development adjacent to LA Live that is expected to bring $156.7 million in tax revenue into the city over the next 25 years, he said.

Brown also signed a bill exempting two existing advertising billboards along Interstate 405 in Inglewood from the Outdoor Advertising Act restrictions on changeable, electronic signs through Jan. 1, 2023.

Stronger equal-pay protections for women and people of color coming soon in California

Equal-pay laws in California will get tougher under two bills Gov. Jerry Brown signed Friday.

The two new laws will strengthen wage-equity protections for women and people of color.

One will prohibit employers from paying women less than male colleagues based on prior salary. The other will bar employers from paying workers doing “substantially similar” jobs different wages based on their race or ethnicity.

The announcement comes less than a year after California lawmakers passed one of the toughest equal-pay bills in the country. That law applied the “substantially similar” provision to protect against gender-based wage discrimination.

The bills signed Friday take effect Jan. 1.

California toughens laws against rape after Brown signs bills inspired by Brock Turner case

Gov. Jerry Brown on Friday signed legislation that expands the legal definition of rape and imposes new mandatory minimum sentences on some sexual assault offenders -- measures inspired amid national outcry over the sexual assault case of former Sta

Gov. Jerry Brown on Friday signed legislation that expands the legal definition of rape and imposes new mandatory minimum sentences on some sexual assault offenders -- measures inspired amid national outcry over the sexual assault case of former Stanford swimmer Brock Turner.

The decision comes as heated debate has raged this year over the mishandling of sexual assault investigations on U.S. college campuses by police agencies and courts. But increasing punishment for sex offenders posed a challenge for Brown, as the state has been undertaking a broader effort to move away from a focus on prison sentences.

In a message released with his signature, Brown said he was generally opposed to adding more mandatory minimum sentences.

“Nevertheless, I am signing AB 2888, because I believe it brings a measure of parity to sentencing for criminal acts that are substantially similar,” he said.

Assembly Bill 2888, authored by Assemblyman Evan Low (D-Campbell) and Assemblyman Bill Dodd (D-Napa), will prohibit judges from giving convicted offenders probation when they sexually assault someone who is unconscious or intoxicated.

Assembly Bill 701 by Assemblywomen Cristina Garcia (D-Bell Gardens) and Susan Talamantes Eggman (D-Stockton), will expand the legal definition of rape so it includes all forms of nonconsensual sexual assault.

Currently under the law, those convicted of rape using additional physical force must serve prison time. But offenders, like Turner, convicted of sexually assaulting someone who is unconscious or incapable of giving consent because of intoxication, can receive a lesser sentence based on a judge’s discretion.

Rape has previously been defined as “an act of sexual intercourse” under certain conditions of force, duress or lack of consent. Other types of sexual assault, like penetration by a foreign object, were categorized as separate offenses.

The laws go into effect on Jan. 1, 2017.

Gov. Jerry Brown makes it crystal clear: He really doesn’t like ranked-choice voting

An effort to expand the use of ranked-choice voting in California, in which voters choose second- and third-choice candidates, was struck down by Gov. Jerry Brown this week with a pretty simple message.

He just doesn’t like it.

“Ranked choice voting is overly complicated and confusing,” wrote Brown in his veto message on Thursday.

The system is currently only in use in a handful of Bay Area elections, most notably used in cities such as San Francisco and Oakland.

Senate Bill 1288 would have allowed a number of California cities, counties and school districts to switch to the system that asks voters to rank their top candidate preferences.

The candidates receiving the most votes then move on to successive “rounds” where ballots that picked a now defeated candidate as the top choice are then redistributed based on the voters’ next preference.

Brown certainly knows about ranked-choice voting as a former Oakland mayor and, until recently, an Alameda County resident. His veto message seemed not only a succinct rejection of SB 1288, but ranked-choice voting in general.

“At a time when we want to encourage more voter participation, we need to keep voting simple,” he wrote in his veto message. “I believe it deprives voters of genuinely informed choice.”

Few new rules on the use of drones as governor rejects ‘piecemeal’ approach to regulation

In a win for lobbying efforts in a budding industry, California has made it through another year with few limits on drones in its skies.

Gov. Jerry Brown on Thursday signed legislation that protects emergency responders and volunteers from liability should they damage a drone in the course of their work. But he vetoed the last four pending drone bills, saying he found it “more prudent to explore a more comprehensive approach” to the regulation of unmanned aircraft systems.

As drones have multiplied in number and category, lawmakers in the 2016 legislative session had attempted to come up with a comprehensive approach. But drone manufacturers and associations boosted their politicking, successfully beating back several bills they said would create a patchwork of laws that vary by state and hinder innovation.

Of the bills Brown vetoed, one would have banned the use of drones in state parks without permission. Another would have made the use of drones unlawful during illegal activities such as violating a protective order, interfering with emergency response personnel or facilitating the delivery of contraband to jails.

In messages released with his veto signature, Brown said current laws were sufficient to prosecute those crimes, while authority fell to the appropriate parks and wildlife departments to develop their own regulatory approach on their properties.

Brown also rejected a bill mandating that drones be sold with a copy of FAA rules and that those with GPS technology must be turned off near airports, sensitive infrastructure or fires.

To that proposal, Brown said it created “significant regulatory confusion by creating a patchwork of federal, state and local restrictions on airspace.”

“Piecemeal is not the way to go,” he said.

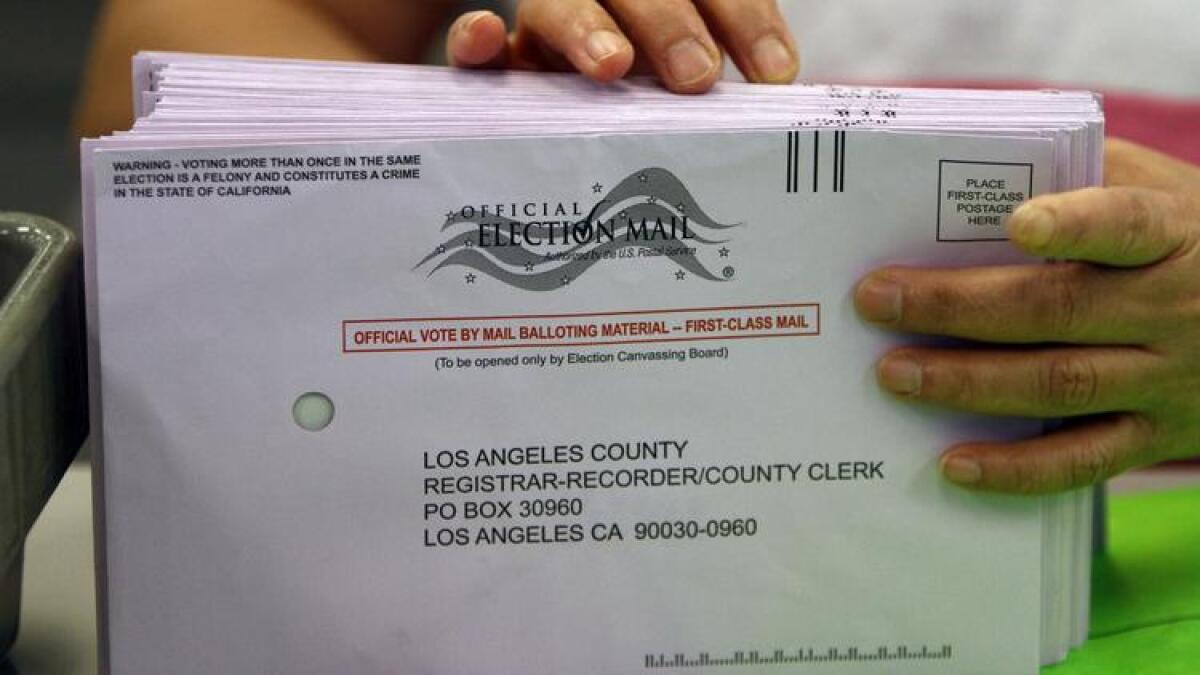

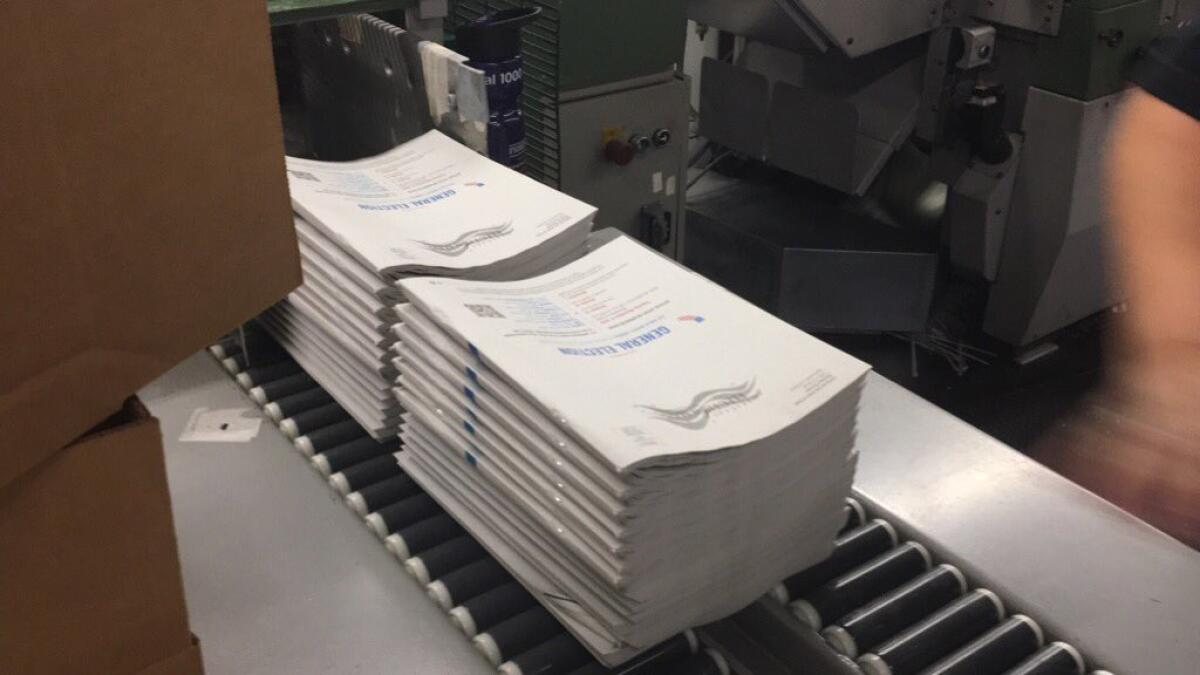

California is removing all limits on who can drop off your ballot on election day

Californians will be able to legally hand off their sealed ballot to anyone to mail or deliver in person under a new law signed Thursday.

Assembly Bill 1921, written by Assemblywoman Lorena Gonzalez (D-San Diego), removes language in state election law that limits the delivery of a voter’s ballot to close family or household members.

It also repeals, starting in local elections in 2017 and the next statewide election in 2018, the current ban on a volunteer campaign worker from gathering as many ballots as possible from voters for delivery to elections officials. The only restriction is that a campaign official cannot be paid to gather and deliver ballots.

While other states also have more liberal laws on who can deliver a voter’s ballot, those states usually place a limit on how many ballots can be delivered by a single person. The law signed by Gov. Jerry Brown places no such restrictions.

Supporters of the new law said that limits on who could deliver a voter’s ballot were an unnecessary obstacle in an era when millions more Californians are choosing to cast their ballots by mail.

Single-user restrooms to become ‘gender neutral’ in California

Single-user bathrooms in public buildings in California will soon become “gender neutral” so anyone can use any restroom, a result of legislation signed Thursday by Gov. Jerry Brown.

Assemblyman Phil Ting (D-San Francisco) said his bill moves California in the opposite direction of some states that restricted the ability of transgender people to choose which bathrooms to use.

“California is charting a new course for equality,” Ting said in a statement. “Restricting access to single-user restrooms by gender defies common sense and disproportionately burdens the LGBT community, women, and parents or caretakers of dependents of the opposite gender.”

He noted that 19 states this year have considered restricting access to restrooms, locker rooms and other facilities based on the user’s biological sex.

The new law in California was championed by Equality California, a gay rights group that cited a 2013 study by the UCLA Williams Institute that found 70% of transgender and gender non-conforming people face serious threats, including verbal harassment, when using gender-specific restrooms.

“This law is a simple measure that will make everyone’s lives easier,” added Kris Hayashi, executive director of the Transgender Law Center.

The law takes effect March 1, 2017, to allow businesses time to change restroom signs and otherwise comply.

More Californians will vote by mail and fewer at polling places under a new law

California voters may be asked to cast more of their ballots by mail as soon as 2018 under a sweeping law signed Thursday, one that would eliminate thousands of neighborhood polling places.

Gov. Jerry Brown’s signature on Senate Bill 450 sets in motion a major remodeling of the state’s election operations, inspired by a similar system in Colorado. Counties that opt to implement the new system will open community “vote centers” in the weeks before election day that offer last-minute registration and limited in-person voting.

Those counties will also have more places to drop off completed ballots.

“This landmark law will provide voters more options for when, where, and how they cast a ballot,” said Secretary of State Alex Padilla in a written statement.

But the move away from polling places could some as a surprise to Californians who have spent decades voting in their neighborhoods. A report released two weeks ago by UC Davis’ California Civic Engagement Project found the “vote center” model raised fears with some African Americans about voter suppression and voting access.

Supporters of the new law say voter education efforts will be key to making it work.

The changes to election operations will come in two stages: 14 counties will be able to move toward less in-person voting in 2018, and the remaining counties will be allowed to opt in to the new system in 2020. Counties that implement the new system will have to mail ballots to all registered voters, though Los Angeles County will not have to do so until 2024.

When are marijuana users dangerous drivers? Gov. Brown approves study to find out

Gov. Jerry Brown on Thursday signed a series of bills preparing California for a new era of marijuana regulation, including one launching a study of the effects of cannabis on motor skills.

Brown also approved measures preserving small medical marijuana growing operations from bigger competitors and allowing cannabis dispensaries to pay taxes and fees in cash.

However, Brown vetoed bills that would have allowed 135 cannabis dispensaries to operate in Los Angeles without city licenses as well as provided a tax amnesty to medical cannabis dispensaries that owe back taxes,

The governor’s decisions follow his approval last year of a new system of regulating and licensing the growth, distribution and sale of medical marijuana beginning in 2018.

The governor’s action Thursday also comes as California voters are set in November to consider an initiative that would legalize the recreational use of marijuana.

Assemblyman Ken Cooley (D-Rancho Cordova) authored the measure calling for a University of California study of marijuana’s physical impacts.

“This bill addresses the issue of the lingering effects of medical marijuana on motorists, which is a very important piece for public safety,” Cooley said. “A lot of medical marijuana issues affect the person using it, but when they are on the roads everyone is affected.”

Police agencies have struggled with enforcing laws against driving while impaired after using marijuana because there is not the same amount of research as exists with the effects of alcohol.

“Law enforcement needs the best informed understanding of those effects in order to deal with suspected cases of drugged driving from marijuana,” Cooley said.

The measure also sets standards for processing marijuana that, if met, will allow medical cannabis manufacturers to operate without threat of state law enforcement action.

Brown also approved a bill that will allow medical pot businesses to pay the state with cash and not face steep penalties that currently exist.

The bill was proposed because marijuana possession and sale is still illegal under federal law, so banks will not accept business from medical marijuana dispensaries. That makes it impossible to write checks or do electronic transfers to pay taxes and fees to the state.

The governor also signed a measure aimed at protecting small medical marijuana farms by creating a special state license for “cottage” operations of less than 5,000 square feet.

However the governor vetoed a measure that would have exempted 135 marijuana stores in Los Angeles from a requirement that they get a city license. The stores were grandfathered in when voters approved a ballot measure in 2013.

He noted the measure conflicts with state law requiring dispensaries to get licenses from both the state and the city.

“This bill is inconsistent with dual licensing requirement established last year by the Medical Cannabis Regulation and Safety Act,” Brown wrote in his veto message.

He also nixed a bill that would have provided tax amnesty to hundreds of dispensaries throughout California that are believed to be delinquent on about $106 million in back taxes.

“While increasing tax compliance among medical marijuana businesses is important, it is premature to create a tax amnesty before the regulations that link enforcement to licenses are promulgated,” Brown wrote in the veto message.

California now subject to tighter rules for taking property from those who haven’t been convicted of a crime

California will now have much stricter rules for when police can seize citizens’ cash, cars and other property under legislation signed Thursday by Gov. Jerry Brown.

The measure, SB 443 from Sen. Holly Mitchell (D-Los Angeles), now requires a criminal conviction before law enforcement can permanently take from a suspect assets valued under $40,000, ending what supporters have said is a practice that incentivized officers to target low-income residents to pad their police budgets.

A more wide-ranging bill from Mitchell failed last year amid significant concern from law enforcement organizations that a requirement to obtain a criminal conviction before the permanent seizure of any property would harm police’s ability to target high-level drug dealers. After Mitchell agreed to the $40,000-threshold for a criminal conviction, major law enforcement groups dropped their opposition to the measure and the bill easily cleared the Legislature with bipartisan support last month.

California is now one of 18 states that have tightened similar laws regarding what’s known as “civil asset forfeiture” in the last two years, according to the libertarian Institute for Justice, which tracks asset forfeiture across the country. Other states have banned the practice entirely, but California’s new policy for permanent seizures of property is among the strongest in the country, the organization said.

More California communities could see public financing of campaigns under a law signed by Gov. Brown

More cities and counties will be able to offer public funds for political campaigns under a law signed Thursday by Gov. Jerry Brown.

Brown’s signature on Senate Bill 1107 makes public financing an option, though it does not require any local government to participate.

The bill was a major goal of watchdog groups critical of the influence of money in politics. They have suggested that the communities that allow limited public funds can then match those dollars with requirements for candidates to seek out small donations, ones that come from diverse parts of a community instead of a handful of big donors.

“California’s leaders are hearing from voters who are fed up with playing second fiddle to wealthy special interests,” Kathay Feng, executive director of California Common Cause, said in a written statement. “SB 1107 gives Californians new options to amplify the voices of everyday voters in election campaigns.”

While a few California cities already offer some form of public financing for campaigns, dozens more were banned from doing so under a 1988 ballot measure. The new law removes that ban.

Californians will soon be allowed to take selfies with their completed ballots

Ballot selfies soon will be legal in California under a law the governor signed Thursday that permits voters to photograph their completed ballots.

Residents hoping to take a selfie with their vote in the upcoming presidential election are out of luck, however. The bill will go into effect Jan. 1, after the national election in November.

The first time Californians will be able to exercise their new right will be in local elections next year.

Supporters of the bill have said it protects Californians’ rights to engage in political speech.

For now, Californians are still prohibited from showing others their ballots after they have marked them, although the bill’s author, Marc Levine (D-San Rafael), told the Los Angeles Times in January that no Californian has ever been prosecuted for taking a ballot selfie.

For Kamala Harris’ Senate campaign, the state Democratic Party’s endorsement has been a jackpot

In California, it pays to be the state Democratic Party’s endorsed candidate.

The California Democratic Party has spent more than $500,000 supporting Democratic state Atty. Gen. Kamala Harris for U.S. Senate, and forked over another $100,000 for campaign materials promoting her bid.

Harris overwhelmingly won the state party’s endorsement in February, and now the party is all in to make sure she wins in November.

Her rival, Orange County Rep. Loretta Sanchez, is getting nothing from the state party even though, like Harris, she’s a Democrat.

The party help for Harris could tip the balance in a race where both candidates have had a hard time raising money for their campaigns.

Nanette Barragán scores endorsement from Bernie Sanders-affiliated group in south L.A. County congressional race

Another day, another endorsement for former Hermosa Beach City Councilwoman Nanette Barragán in the race to replace outgoing Rep. Janice Hahn (D-San Pedro) in the 44th Congressional District.

Barragán, who is running against state Sen. Isadore Hall III (D-Compton), scored the endorsement of Our Revolution, a political 501(c)(4) nonprofit that sprung up after Vermont Sen. Bernie Sanders’ failed presidential bid to support down-ballot, progressive candidates.

Hall beat Barragán in June’s crowded primary election, with 40% of the vote to Barragán’s 20%.

But Barragán’s strategy of hitting Hall for his ties with special interests in the oil, alcohol and tobacco industries has helped her win a number of endorsements from progressive and environmental groups.

“Nanette Diaz Barragán understands there’s nothing more important than the health of our families and community,” the group writes in its endorsement. “That’s why she stood up to the big oil companies and helped win the fight to keep them from oil-drilling in our neighborhoods and off our beaches.”

This week, Barragán has been endorsed by the Progressive Change Campaign Committee and the Torrance newspaper the Daily Breeze, which covers the South Bay cities of Los Angeles County.

Both candidates were running low on cash as of their last filings with the Federal Election Commission: Hall had $132,836 in the bank, and Barragán had $127,775.

Our Revolution has already dabbled in a number of races around California including the crowded race to replace longtime Berkeley Mayor Tom Bates.

The group has also endorsed Eloise Reyes, who is challenging Assemblywoman Cheryl R. Brown (D-San Bernardino) — another intra-party race in which one of the candidates, Brown, has been criticized for accepting campaign contributions from oil companies.

More transparency is coming to California’s scandal-ridden energy regulator, and Gov. Brown has pledged more action

Changes to increase the transparency of communications between the state’s energy regulator and the industries it oversees are now law after Gov. Jerry Brown signed five measures designed to restructure the California Public Utilities Commission.

Most notably, Brown signed a bill from Sen. Mark Leno (D-San Francisco) that would open up some details of private meetings between industry and PUC executives — a response to numerous concerns about an overly cozy relationship after the 2010 San Bruno natural gas pipeline explosion and the circumstances surrounding the 2013 closure of the San Onofre nuclear power plant in Southern California.

“The reforms approved by the governor today will ensure commissioners disclose their private meetings with utility executives and will result in heavy penalties for those who violate the rules,” Leno said in a release.

The bills signed Thursday were part of an overhaul of the agency first announced in June by Brown and legislative leaders. But major components of that deal failed to pass the Legislature this year, and fingers have been pointed at Brown-appointed PUC President Michael Picker, who had last-minute hang-ups over parts of the legislation, Democratic leaders who failed to bring the bills up for a vote and Republican leaders who refused to waive legislative rules to allow a last-second decision on the package.

In his bill-signing message, Brown announced that he would ask the PUC to directly implement changes called for in many pieces of legislation that did not pass the Legislature. Those changes include appointing an ethics ombudsman, transferring some oversight over Uber, Lyft and other ride-hailing companies out of the PUC’s control and studying whether telecommunications regulations should be transferred to a different agency.

“These important reforms cannot wait another year,” Brown said.

The governor also said that he would continue to work with the Legislature next year to pass into law all parts of the overhaul that failed.

“The governor continues to support the entire package of reforms announced in June, and it’s disappointing all the legislation did not get to his desk,” Brown spokesman Evan Westrup said.

Four California Democrats headed to Israel for Shimon Peres’ funeral

House Minority Leader Nancy Pelosi (D-San Francisco) and Reps. Susan Davis (D-San Diego), Adam Schiff (D-Burbank) and Alan Lowenthal (D-Long Beach) are on their way to Israel to attend the funeral of former Israeli President Shimon Peres.

The California members were asked to join President Obama and a delegation of U.S. officials at the Friday funeral in Jerusalem, according to the White House.

Peres, a Nobel Peace laureate and creator of Israel’s nuclear program, died Tuesday following a stroke. He was 93.

During House votes Wednesday, members huddled to tell personal stories about Peres as they waited to sign a book of condolences for his family.

Flags were flown at half-staff in Washington on Thursday to honor Peres.

Gov. Brown takes another step in developing system to provide early warning of earthquakes

Gov. Jerry Brown on Thursday signed a bill that continues the move toward the development of a statewide early warning system for earthquakes.

The measure creates a California Earthquake Early Warning Program and Advisory Board within the California governor’s Office of Emergency Services to work on the system.

The measure requires the Earthquake Early Warning Program business plan to be developed and submitted to the Legislature by Feb. 1, 2018.

“We’ve seen the devastation earthquakes have caused in California,” Brown said in a statement. “This keeps us on track to build a statewide warning system that can potentially save lives.”

Three years ago, Brown approved a bill that required the creation of a statewide earthquake warning system by a partnership between the state and the private sector.

And this year, Brown directed that $10 million in the budget go to Cal OES to further expand the state’s earthquake early warning system prototype, called ShakeAlert.

The latest bill was authored by Sen. Jerry Hill (D-San Mateo).

“The early earthquake warning system will help save lives,” Hill said Thursday. “In emergencies, every second counts and the urgent alerts that will be sent by the warning system can help prevent devastating and life-threatening missteps.”

Gun-control advocate and shooting victim Gabrielle Giffords endorses Kamala Harris for U.S. Senate

State Atty. Gen. Kamala Harris receives an endorsement from Gabby Giffords and her husband, Mark E. Kelly, in her run for U.S. Senate.

Gun-control advocate and former U.S. Rep. Gabrielle “Gabby” Giffords, who was shot during a 2011 outdoor appearance in her Arizona district, on Thursday endorsed state Atty. Gen. Kamala Harris in California’s U.S. Senate race.

Giffords announced her endorsement of Harris during a morning news conference in Beverly Hills. Her husband, retired Navy Capt. Mark E. Kelly, a former space shuttle astronaut, also endorsed Harris.

Six people were killed and 12 others wounded in the Tucson shooting rampage that left Giffords severely injured. Giffords retired from Congress following the shooting and with Kelly founded Americans for Responsible Solutions, a political action committee that advocates for increased gun control.

Giffords’ assailant, Jared Loughner, had been diagnosed with paranoid schizophrenia. He was sentenced to life in prison in November 2012.

The Harris campaign has criticized her rival in the Senate race, U.S. Rep. Loretta Sanchez (D-Orange), for voting in favor of legislation in 2005 that shielded the gun industry from liability for the criminal or negligent acts of gun owners with certain exceptions.

The law, the Protection of Lawful Commerce in Arms Act, was approved by Congress and signed by President George W. Bush. The bill superseded existing laws in California and other states that allowed victims of gun violence to sue gun makers and dealers.

The Brady Campaign to Prevent Gun Violence also has endorsed Harris in the Senate race, and the group’s president, Dan Gross, referred to the 2005 vote by Sanchez when the endorsement was announced.

Harris also has faced criticism on the gun issue, however. The state auditor as recently as 2015 criticized the state Department of Justice, overseen by Harris, for delays in determining whether potentially dangerous people own guns in violation of state law. The backlog posed a “continued risk to public safety,” according to an auditor’s report.

The Justice Department cross-references databases to find people who legally purchased guns before they became ineligible under state law because of a severe mental illness or their criminal history. Californians on the banned list have their guns confiscated by law enforcement authorities.

“No endorsement can hide Kamala Harris’ failed record to keep guns away from criminals and people with mental illness putting public safety at risk,” Sanchez campaign spokesman Luis Vizciano said in a statement released Thursday afternoon.

After Thursday’s press conference, Harris was asked about her position on Proposition 63, which would require background checks on people purchasing ammunition, outlaw ammunition magazines that hold more than 10 rounds and provide a process for taking guns away from Californians convicted of felonies.

Harris said because her office is responsible for writing the title and summary voters see on the ballot she was not taking a position on the proposition.

She said she is in favor of expanded gun safety laws like universal background checks, however.

“It is just reasonable to say that we want to know if someone has been convicted of a serious or violent felony before we let them purchase a lethal weapon,” she said.

Harris also declined to comment about Wells Fargo & Co., which was sanctioned by state Treasurer John Chiang Wednesday over the bank’s fake accounts scandal.

“I cannot talk about any of our investigations,” she said.

Why California’s U.S. Senate candidates are on their own as the national Democratic Party sits the race out

On paper California’s U.S. Senate race looks like it would draw a lot of national attention and interest, but because it is between two Democrats, the national party isn’t playing a role.

Still, that doesn’t mean sitting senators aren’t weighing in on who they want to work with: Nineteen of 44 sitting Democrats and three retired senators have contributed to the campaign of Atty. Gen. Kamala Harris, only one has also donated to Rep. Loretta Sanchez (D-Orange).

The state will cover $250 million in costs if L.A.’s Olympics bid goes over budget

California will provide up to $250 million in guarantees should the city of Los Angeles go over budget in its bid to host the 2024 Summer Olympic Games and Paralympic Games under legislation Gov. Jerry Brown signed Thursday morning.

The decision comes as the Los Angeles City Council is weighing its latest bid to host the games amid questions about its cost and the city’s liability should financial estimates prove low. The legislation, authored by Senate President Pro Tem Kevin de León (D-Los Angeles), will provide a financial backstop from the state in case of a budget shortfall. Bid leaders have estimated the Games could cost more than $6 billion, but believe sponsorships, broadcasting rights and other revenue streams will more than cover the price tag.

Paris and Budapest are competing with Los Angeles to host the Games, and the International Olympic Committee will choose a host city next September.

Santa Barbara TV station threatens legal action after GOP congressional candidate uses news clip in attack ad

The owner of a Santa Barbara TV news station is threatening legal action against a Republican congressional candidate after his campaign released an attack ad featuring a 10-second clip from the station’s newscast.

KEYT-TV General Manager Mark Danielson wrote a letter to Republican Justin Fareed’s campaign Wednesday saying the station had “not authorized or consented to any such use of its copyright protected news content in this political advertisement.”

The ad features news anchor C.J. Ward reporting on a comment Democratic Santa Barbara County Supervisor Salud Carbajal made this month referring to the city of Lompoc as the “armpit” of the coastal county.

“In addition to being a violation of law, the use of KEYT’s news content and the voice and likeness of its anchor also undermines the trust KEYT has built with its viewers,” Danielson wrote in the letter. “Maintaining the objectivity of its news operations is of the utmost importance to KEYT.”

The letter demands that Fareed’s campaign “cease and desist from the unauthorized use” of the station’s content and the voice and likeness of Ward, or “KEYT may take appropriate legal action to protect its rights.”

Danielson said the station was not taking a position in the heated race between Fareed, a 28-year-old former U.S. House staffer, and Carbajal.

The race to replace outgoing Rep. Lois Capps (D-Santa Barbara) has become one of the most expensive in the U.S. thanks to a number of attack ads funded by super PACs affiliated with both parties.

On Thursday, Fareed campaign manager Christiana Purves responded to the letter saying, “Our campaign is well within its legal right to use footage of a news broadcast outlining Carbajal’s offensive comments.”

Purves shared a letter sent by attorney Charles H. Bell Jr., a Sacramento attorney who has represented California Republicans in high profile legal disputes, to the station Thursday. Bell writes: “The use of a brief segment of your news report, which does not use KEYT’s trademark or logo, constitutes a ‘fair use’ of copyrighted material for political purposes expressly permitted by copyright law and case law.”

This post was updated at 12:20 with a comment from Fareed campaign manager Christiana Purves.

Sarah Silverman and other comedians launch a voter registration tour, thanks to Tom Steyer

California billionaire and climate change activist Tom Steyer is taking his quest to register young voters to California college campuses, and he is bringing some famous friends along.

Steyer’s environmental advocacy group Next Gen Climate is partnering with digital entertainment studio Funny or Die on a free comedy tour dubbed “Jokes for Votes” that doubles as voter registration drive.

The tour will feature a rotating group of comedians including Sarah Silverman, Reggie Watts, Kumail Nanjiani, Demetri Martin, Baron Vaughn, James Adomian, Kate Berlant and Taylor Tomlinson.

The tour’s first stop is Thursday night at East Los Angeles City College. (Get your tickets here). The other announced dates on the tour are:

- Oct. 6 at Sonoma State

- Oct. 9 at San Diego State

- Oct. 10 at UC Riverside

- Oct. 14 at Cal State Northridge

- Oct. 17 at Cal State L.A.

- Oct. 21 at Humboldt State

- Oct. 23 at UC Berkeley

“We believe comedy is the political art form of this generation,” said Brad Jenkins, managing director of Funny or Die’s office in Washington. “This historic comedy tour is what Funny Or Die does best -- we reach young people where they are, on their terms, and inspire them to action.”

Steyer, who is said to be considering a run for California governor, launched a $25-million effort to register young voters through his super PAC Next Gen Climate Action earlier this year.

Californians may soon be asked: ‘A glass of Pinot Noir with that perm?’

Californians who go in for a haircut or hairstyling may soon be offered a complimentary glass of beer or wine after Gov. Jerry Brown on Wednesday signed a bill to allow the perk.

The new law, which takes effect Jan. 1, allows beauty salons and barbershops to serve up to 12 ounces of beer or six ounces of wine at no charge without a special license or permit.

The measure is the idea of Assesmblyman Tom Daly (D-Anaheim), who said some of the state’s 41,830 beauty salons and barbershops already offer alcoholic beverages, but may not have a license from the state Department of Alcoholic Beverage Control and could get in trouble.

The bill was supported by Drybar Holdings, which has 18 beauty salons in California, but has been told by state officials that it needs an alcohol license to serve spirits.

The bill has faced some opposition from people who question whether the department can monitor thousands of new businesses serving alcohol to make sure those serving the wine and drinking it are at least 21 years old.

The complimentary spirits can only be offered until 10 p.m.

Daly believes the issue is “one of those areas of law which needs to be updated to reflect modern realities,” spokesman David Miller recently told the Los Angeles Times.

Feinstein, Boxer and Becerra want Congress to recognize Vin Scully

Sens. Dianne Feinstein and Barbara Boxer and Rep. Xavier Becerra want Congress to recognize the voice of the Dodgers.

The trio introduced a resolution Wednesday to honor Vin Scully, who has called more than 9,000 Dodgers games since he joined the broadcast team for the Brooklyn Dodgers in 1950. (He moved cross-country when the team relocated to Los Angeles.)

Scully will announce his final game on Saturday in San Francisco, and the accolades have poured in.

Becerra (D-Los Angeles), a Dodgers and Giants fan, called Scully a legend and an icon.

“It will be an emotional day hearing him call his last game for the Dodgers on Oct. 2. But like a favorite song, we’ll never forget the sound of the melodic voice of the great Vin Scully,” he said in a statement.

Boxer said he’s part of the nation’s memory.

“During so many iconic moments in baseball history — like when Sandy Koufax pitched a perfect game and when Hank Aaron broke the home run record — it was Vin Scully’s voice that we all heard,” she said in a statement.

Feinstein said it’s impossible to not admire Scully (even though she’s a Giants fan).

“Vin really is the heart and soul of the Dodgers — and of Los Angeles. The average professional baseball career lasts around five years, and managers are long in the tooth after a decade. Vin Scully, on the other hand, has devoted 67 years of his life to the Dodgers,” she said in a statement.

A day after her rival is criticized for missing votes while campaigning, Kamala Harris campaigns on a workday

Felons guilty of minor drug and property crimes will get more time to have convictions downgraded to misdemeanors

Californians with felony convictions for some minor drug and property crimes will now have more time to ask that their convictions be changed to misdemeanors.

Gov. Jerry Brown signed legislation Wednesday that removed the three-year time limit on felons asking for their crimes to be reclassified under the rules approved by voters as Proposition 47.

The 2014 ballot measure made misdemeanors out of a series of nonviolent crimes. And it allowed ex-offenders to have their felony convictions reduced as long as they didn’t have a record of violent crimes. Some law enforcement officials believe that Proposition 47 has had mixed success in meeting its stated goals.

But what the new time frame should be for reconsidering prior felonies has been a separate issue.

The author of the new law, state Sen. Shirley Weber (D-San Diego), argued that the current three-year window was unfair and also likely to clog the court system with a rush of cases.

The new law extends the deadline five more years, and even longer if a former offender is able to show good cause.

Stricter background checks and DUI rules coming for Uber and Lyft drivers through laws signed by Gov. Brown

Uber, Lyft and other drivers for ride-hailing companies will face greater restrictions under new legislation signed Wednesday by Gov. Jerry Brown.

Drivers will be subject to stricter background checks and face tighter rules on driving under the influence through legislation authored by Assemblymen Jim Cooper (D-Elk Grove) and Katcho Achadjian (R-San Luis Obispo).

Under one law, ride-hailing companies no longer can hire drivers who are registered sex offenders, have been convicted of violent felonies or, within the last seven years, have a driving-under-the-influence conviction. The companies will face fines of up to $5,000 for violating the rules. The second law prohibits drivers from having a blood-alcohol level of 0.04 or higher compared to the current level of 0.08 for non-commercial drivers.

Brown also signed legislation from Assemblyman Mike Gatto (D-Glendale) making it easier for potential drivers to work for the companies. The new law allows potential drivers to rent cars to work for Uber, Lyft and the other companies.

That effort, which has been part of expansion plans for Uber and Lyft, is currently allowed, but the industry’s regulator, the California Public Utilities Commission, was weighing whether to limit it. The new law ensures the rental practices will continue.

Brown also vetoed a bill from Assemblyman Evan Low (D-Campbell) to create a statewide taxi commission in an effort to level regulations between taxis and the looser rules surrounding ride-hailing companies.

In a veto message, Brown said the state shouldn’t shoulder the responsibility of regulating the taxi industry.

“I do not believe that such a massive change is justified,” Brown wrote.

Gov. Brown approves citizens redistricting commission for L.A. County Board of Supervisors

Despite opposition from the Los Angeles County Board of Supervisors, Gov. Jerry Brown on Wednesday approved a bill that will create a citizens redistricting commission to redraw the panel’s district lines after the next U.S. Census.

State Sen. Ricardo Lara (D-Bell Gardens) said his measure would result in a 14-member, independent, bipartisan group drawing new district maps that are fair and more representative of the county’s diversity.

“With this new law, we will ensure that the people of Los Angeles County have a greater representative voice in their county’s political process,” Lara said in a statement.

Brown took the action despite a veto request sent to him this month by Hilda L. Solis, chairwoman of the Los Angeles County Board, on behalf of the panel.

“This measure is unnecessary because Los Angeles County already has a redistricting process in place that provides fair and effective representation on the Board of Supervisors to all County residents,” Solis wrote. “The argument that SB 958 is needed has no basis because Los Angeles County is in full compliance with all Federal and State redistricting Requirements.”

The county’s plan allowed the board to appoint a redistricting committee that could recommend district maps. The new law allows the commission, whose members will be drawn in a process excluding the board, to adopt a redistricting plan without board action.

The members of the commission would be randomly selected in 2020 by the county Auditor-Controller from a pool of applicants whose eligibility will be determined by the Los Angeles County Registrar-Recorder/County Clerk.

The measure also was opposed by Alan Clayton, a redistricting consultant who has advised politicians in the past. He said by appointing members to the commission based on voter registration in the county, it would give Democrats up to 10 of the seats, allowing them to create a partisan redistricting plan,

“Once you have a significant lead in voter registration over others, you can control redistricting,” Clayton said.

Brown declined to comment on why he signed the bill.

Statute of limitations for rape eliminated in California after Gov. Brown signs bill prompted by Cosby allegations

California has ended its statute of limitations for rape cases after Gov. Jerry Brown on Wednesday signed legislation filed in the wake of sexual assault allegations against comedian Bill Cosby.

Senate Bill 813, filed by State Sen. Connie Leyva (D-Chino) amends the penal code so that some sex crimes, including rape, forcible sodomy and molestation of a child, can be be prosecuted, regardless of how long ago the crime occurred.

Leyva lauded Brown’s decision, saying it told every rape and sexual assault victim in the state “that they matter.”

“It shows victims and survivors that California stands behind them, that we see rape as a serious crime, that victims can come forward and that justice now has no time limit,” she said.

The new law will affect only sex crimes that occur next year or later and offenses for which the statute of limitations has not expired by Jan. 1.

In California, the statute of limitations for rape is 10 years unless new DNA evidence emerges later. Sex crimes against minors must be prosecuted before the alleged victim turns 40.

It’s unclear how many additional prosecutions a longer deadline or the abolition of any time limit might bring. And several advocacy groups and associations argued the bill was among those that would disproportionately affect poor and minority defendants with little or no representation.

But supporters said the new law would help victims who are often reluctant to report the abuse to police until many years later. Rape and sexual assault are typically committed by someone victims know, making it difficult to speak out, lawyers and advocates said. Many victims also often experience shame, fear and extreme anxiety and don’t come forward until they have the confidence or a support system later in life.

The legislation was signed as Cosby, who has said his relationships with his accusers were consensual, is facing trial in Pennsylvania on three felony counts of aggravated indecent assault.

But Betsy Butler, executive director of the California Women’s Law Center, said advocates have been pushing for such legislation long before women spoke out against Cosby.

“It is exciting for victims, and it puts perpetrators on notice,” she said.

Sex offenders will have to disclose email addresses, user names under new law

Sex offenders will soon have to report their email addresses, user names and other Internet identifiers to police under a bill Governor Jerry Brown signed Wednesday.

The bill, authored by state Sen. Ben Hueso (D-San Diego), will apply to people convicted on or after Jan. 1, 2017 of Internet-related sex crimes.

Law enforcement can use the information only to investigate a sex crime, kidnapping or human trafficking. Offenders will have 30 days to report new or modified addresses and usernames.

The bill amends parts of California law enacted in 2012 when voters passed Proposition 35, an anti sex-trafficking law.

Proposition 35 passed by statewide ballot with more than 80% of the vote. It increased punishments for human traffickers and expanded the definition of human trafficking to include the creation and distribution of child pornography.

In 2014, a federal court sided with a challenge to the law that argued parts of Proposition 35 violated sex offenders’ constitutional rights. The court gave California until the end of this year to fix flaws it found in the law.

“We have learned that the internet has become extremely popular for sex crimes,” Hueso said in a statement last month when the Legislature passed the bill. “We must take action to protect our children and take this growing problem very seriously.”

More incentives for developers to build low-income housing through bill signed by Gov. Brown

Governor vetoes bill to mandate parking after street sweeping, prevent tickets at broken meters

Gov. Jerry Brown vetoed a bill Wednesday that would have required communities to reopen parking immediately after street-sweeping.

The bill also would have prevented residents from getting ticketed if they parked next to a broken meter for up to two hours.

In his veto message Brown said the bill would have hindered municipalities from performing regular road maintenance and would have confused drivers about when they were allowed to park in certain areas.

Felons in county jails to be allowed to vote in California elections

Despite widespread opposition from law enforcement, Gov. Jerry Brown on Wednesday signed a bill that will allow thousands of felons in county jails to vote in California elections as part of an effort to speed their transition back into society.

Through a representative, Brown declined to comment on the bill by Assemblywoman Shirley Weber (D-San Diego), who said it would reduce the likelihood of convicts committing new crimes.

“Civic participation can be a critical component of re-entry and has been linked to reduced recidivism,” Weber said when the bill was introduced.

On Wednesday, Weber said California is setting an example at a time when other state’s are trying to limit voting rights.

“I wrote AB 2466 because I want to send a message to the nation that California will not stand for discrimination in voting,” Weber said Wednesday after the bill was signed.

Sen. Patricia Bates (R-Laguna Niguel) criticized the approval of the legislation, which takes effect Jan. 1.

Bates said the new law will undermine the integrity of elections by allowing people in jail to decide close contest.

“It is very disappointing that felons still serving their sentences behind bars will now be able to vote since Governor Brown failed to veto this really bad bill,” Bates said in a statement.

However, the action was praised Wednesday by Daniel Zingale, senior vice president of The California Endowment, a private, statewide health foundation.

“California is stronger and healthier when more people participate in the electoral process,” he said. “Mass disenfranchisement for minor offenses is a tragic legacy of the Jim Crow era that disproportionately affects and diminishes the power of communities of color.”

The measure is opposed by the California State Sheriffs’ Assn. the California Police Chiefs Assn., which argued the state should not be restoring a right traditionally lost when people commit serious crimes until after they leave incarceration.

“We believe that there have to be consequences to your action, and the consequences of being a convicted felon are that you can’t vote and you can’t possess firearms,” said Kern County Sheriff Donny Youngblood, president of the California State Sheriffs’ Assn.

Updated at 1:45 pm to include new comments from Assemblywoman Weber, Sen. Bates and advocate Daniel Zingale.

Smoking is still OK at California state parks and beaches after Gov. Jerry Brown vetoes a proposed ban

Gov. Jerry Brown on Wednesday vetoed a bill that would have banned smoking in California’s 270 parks and beaches, saying it was too broad and punishing.

Sen. Marty Block (D-San Diego) authored the bill with the aim of reducing the health impacts of secondhand smoke on parkgoers, cutting litter from cigarette butts and eliminating a cause of wildfires.

Those cited for violations, including disposing of the remains of cigarettes and cigars, would have faced fines of up to $250. Brown said the bill went too far.

“The complete prohibition in all parks and beaches is too broad,” he wrote in his veto message. “A more measured — and less punitive — approach might be warranted.”

The veto came a day after Brown also decided not to sign a bill that would have banned smoking on state college campuses.

However, earlier this year, Brown signed some sweeping anti-tobacco measures that included raising the smoking age from 18 to 21 and banning the use of electronic cigarettes in public places where smoking is prohibited.

Democrat in heated House race picks up endorsement from California nurses union

Democratic lawyer Bryan Caforio nabbed endorsements from California’s powerful nurses union Wednesday and its national affiliate as he joined striking nurses on a picket line outside Antelope Valley Hospital.

Caforio is challenging freshman Rep. Steve Knight in California’s 25th Congressional District, a contested tossup race that will play a role in both parties’ hopes for control of the House.

Caforio has been consistently hitting Knight on his firm opposition to abortion.

“We find it outrageous Rep. Steve Knight would cut funding for Planned Parenthood, which allows registered nurses the opportunity to provide critical health care to millions of women and families,” John Michael De La Cerda, a registered nurse at Antelope Valley Hospital, said in a statement.

The issue could help Caforio in the increasingly swing district, which includes Antelope Valley west to Santa Clarita and Simi Valley.

The district was once solidly Republican, but Democrats now have a single percentage point lead over Republicans among registered voters. About a fifth of voters in the district have no party preference, according to the secretary of state.

Ready to rumble? Proponents of Prop. 61 drug pricing measure challenge pharmaceutical companies to a debate

For weeks now, voters have been deluged on TV and cable networks with ads for and against Proposition 61, the November ballot measure aimed at lowering drug prices for state agencies.

On Wednesday, supporters of the measure added a full-page advertisement in the San Francisco Chronicle, challenging their opposition to a televised debate on the issue.

The ad features headshots of eight pharmaceutical company chief executives, calling them “overpaid, heartless big shots” and daring them to a televised debate on Oct. 29.

Roger Salazar, a spokesman for the Yes on 61 campaign, says his group has already purchased 30 minutes of airtime on various stations statewide, including in San Francisco, Los Angeles and Sacramento.

Michael Weinstein, president of the AIDS Healthcare Foundation, which is helping bankroll the measure, said last week he would debate the CEOs “anywhere, any time.”

“The public deserves to know who’s bankrolling the No on 61 side and what their motivations might be,” Salazar said. “We are asking them to put up the CEOs of these organizations to come out and debate the measure themselves.”

“We’ve been doing public debates with Weinstein and with others from the Yes on 61 campaign, up and down the state, for months,” said Kathy Fairbanks, spokeswoman for the No on 61 campaign.

No other California ballot measure in recent memory has been the subject of a statewide televised debate. Voters, however, support the idea: In a 2013 survey by the Public Policy Institute of California, 75% of adults — and 76% of likely voters — said they supported the idea of having proponents and opponents of ballot initiatives debate on TV.

Salazar said that if there is no debate, the time could be converted to a series of TV spots instead.

In two separate polls recently, including the USC/Los Angeles Times Dornsife poll, voters say they would vote for Proposition 61 by a 3-to-1 margin.

Wells Fargo loses some of its state business following controversy over sales practices

Olympic medalist featured in new ads against gun-control initiative Proposition 63

Six-time Olympic shooting medalist Kim Rhode is featured in a second wave of video ads by the campaign against Proposition 63 that argue the gun-control initiative will hurt competitive and sports shooters and women.

The three, 35-second web ads are scheduled to be posted late Wednesday by the Coalition for Civil Liberties, a campaign committee formed by the California Rifle and Pistol Assn., which is the official state affiliate of the National Rifle Assn.

The ads attack an initiative by Lt. Gov. Gavin Newsom that would require background checks and the keeping of sales records for people purchasing ammunition, outlaw ammunition magazines that hold more than 10 rounds and provide a process for taking guns away from Californians convicted of felonies.

Rhode, a Southern California native, says in one ad that she has to fire 800 rounds of ammunition each day to keep up her accuracy.

”If Gavin Newsom has his way, it’ll make it incredibly hard to keep up my skills,” said Rhode, whose bronze for skeet shooting last month in the Rio de Janeiro Olympics was her sixth medal.

She does not elaborate on how the initiative would affect her shooting, but Jaren Grenell, a spokesman for the “No on 63” campaign said the measure will inconvenience competitive shooters by requiring them to jump through bureaucratic hoops to keep their ammo supply stocked.

Proposition 63 spokesman Dan Newman said the initiative does not limit the amount of ammunition anyone can buy and exempts people from background checks for ammo purchases made at shooting and target ranges, unless they take the bullets away from the range.

All three ads say Proposition 63 takes away rights of gun owners.

“It’s a fact: Harsh gun laws like Proposition 63 are not the answer,” Rhode says in her ad. “They only hurt law-abiding people and do nothing to stop terrorists. Proposition 63 takes away the rights of tens of thousands of gun owners across California.”

The other two ads feature sport shooter Chris Cheng and Tiffany Cheuvront, a coalition member identified in the ad as a “civil liberties advocate” who says the initiative is bad for women.

“California would never put limits on women making choices for our bodies so why would we allow limits on protecting our bodies?” Cheuvront asks in one ad.

Cheng says in his ad that not all gun owners are white and straight, that there are minority and gay gun owners also.

“Proposition 63 takes away my rights and turns sports shooting into a crime,” he says.

Grenell said many sports shooters use large-capacity magazines.

Outside spending on November’s legislative races nears the $5 million mark

Following a trend that began in the months prior to June’s statewide primary, contributions to independent committees seeking races for the Legislature have now blossomed to more than $4.8 million.

Campaign finance records compiled by the nonpartisan Target Book, which tracks legislative races, shows as few as 10 individual races attracting the lion’s share of the money raised by independent expenditure committees.

The race leading the list of independent expenditures at more than $1 million is for an open Assembly seat in the communities east of San Francisco, where two Democrats — Mae Torlakson and Concord Councilman Tim Grayson — are locked in what’s become a proxy war over state education reform.

Torlakson is the wife of state Supt. of Public Instruction Tom Torlakson.

The outside money in the race is almost equal to what Mae Torlakson and Grayson, combined, have raised in their own campaign accounts. A more complete look at spending on all legislative races will be reported by campaigns later this week.

Those committees have been allowed to raise and spend money in unlimited sums for more than 15 years, as long as they don’t coordinate their activities with the actual legislative candidates. California’s wide berth given to independent expenditures was a precursor to the explosion of similar spending in national campaigns.

In the primary season, the Target Book analysis reports more than $29 million was spent by independent committees on legislative races.

Retiring Carmel Democrat Rep. Sam Farr hailed on House floor

Just months are left before Rep. Sam Farr (D-Carmel) heads home from Washington for the last time, and the salutes to his 23-year-long House career have begun.

On Wednesday, Rep. Earl Blumenauer (D-Ore.) spent a few moments on the House floor speaking about Farr’s accomplishments.

Reps. Lois Capps (D-Santa Barbara) and Janice Hahn (D-Los Angeles) are also leaving Congress in January, and Democratic Sen. Barbara Boxer is retiring from her post. Rep. Loretta Sanchez (D-Orange) is vacating her House seat to run for the U.S. Senate.

Republican Justin Fareed hit with Trump-focused attack ad in Santa Barbara congressional race

Santa Barbara television viewers will see a new political attack ad courtesy of the Democratic super PAC House Majority PAC, part of a $328,000 TV blitz against Republican candidate Justin Fareed, a former Capitol Hill staffer running to replace outgoing Democratic Rep. Lois Capps.

The new ad released Wednesday is the third attack ad to hit Fareed over his support for Donald Trump and his statement during a May debate that he favored a House investigation into Planned Parenthood.

“While it’s shocking that Justin Fareed supports a candidate for president who has made so many offensive statements about women and who actually believes in punishing women who exercise their right to choose, it’s also entirely unsurprising,” said House Majority PAC Executive Director Alixandria Lapp in a statement.

The ad is similar to one released Tuesday by Fareed’s Democratic opponent, Santa Barbara County Supervisor Salud Carbajal, that highlighted Fareed’s opposition to federal funding for abortion services.

Asked by the Santa Barbara Independent if he supported efforts to halt federal funding for Planned Parenthood, a campaign representative said Fareed “does not believe that abortions through Planned Parenthood should be funded at the federal level.”

“Desperate times call for desperate measures. While Justin Fareed discusses important issues to the Central Coast like our water crisis, Carbajal pulls out lies and dirty tricks from the worn-out playbook of career politicians,” Fareed campaign manager Christiana Purves said in a statement.

Fareed’s campaign took issue with the claims made in ads by both Carbajal and the super PAC that he supports letting “insurance companies charge women more” for healthcare.

The claim, made in all three ads, cites a February interview with a Central Coast TV station in which Fareed said he supported repealing the Affordable Care Act.

Fareed does support repealing President Obama’s signature piece of legislation and, his campaign points out, replacing it with “market driven solutions” that “protect patients with pre-existing conditions.”

The contest is among the most expensive House races in the country thanks to these ads. Democrats have a six-point voter registration advantage in the district.

Local paper endorses Nanette Barragán over state Sen. Isadore Hall in South Bay congressional race

The Daily Breeze, the newspaper that covers the South Bay cities of Los Angeles County, endorsed former Hermosa Beach City Councilwoman Nanette Barragán over state Sen. Isadore Hall III (D-Compton) for Congress in a editorial Tuesday.

Both are Democrats vying to replace Rep. Janice Hahn (D-Los Angeles), who is running for a seat on the Los Angeles County Board of Supervisors.

The editorial said that although “neither candidate is without faults,” Barragán “strikes us as a principled candidate with a consistent agenda.”

The primary campaign took on a harsh tone with Barragán hitting Hall for his ties with special interests in the oil, alcohol and tobacco industries.

Hall, who served on the Compton school board and City Council before moving to the statehouse, is backed by Gov. Jerry Brown, Lt. Gov. Gavin Newsom and former Los Angeles Mayor Antonio Villaraigosa.

Employers in California can no longer ask about juvenile crimes

No more mandatory minimum sentences for some prostitution crimes in California

Gov. Jerry Brown on Tuesday signed legislation that repeals mandatory minimum sentences for certain prostitution crimes, continuing a bold push to help victims forced into the sex trade.

But Brown, who has been vocal against tough-on-crime policies, rejected other bills that increased consequences for sex buyers, saying current laws are sufficient.

Among the bills he signed was Senate Bill 1129 by Bill Monning (D-Carmel), which allows judges the discretion to impose appropriate sentences for engaging in or soliciting prostitution.

He also approved SB 420 by Senate Minority Leader Robert Huff (R-San Dimas), which recasts the crime of prostitution so the statute differentiates between people getting paid for sex, and the people who are paying for it.

By redefining the statute, supporters said, authorities will be able to eventually minimize repercussions for victims and increase them for sex buyers.

But for now, Brown rejected lawmakers’ efforts to increase consequences for buyers, vetoing a bill by Assemblywoman Susan Talamantes Eggman (D-Stockton) that would allow authorities to impound a vehicle used by buyers to solicit prostitution.

He also turned down a bill similar to Huff’s, which was authored by Assemblywoman Lorena Gonzalez (D-San Diego) and tried to go further by imposing a minimum period in county jail for solicitation by buyers.

“I believe the existing law provides sufficient flexibility in punishing these crimes appropriately based on circumstance,” Brown said in a signing message.

‘Doctor shopping’ targeted in new law signed by Gov. Brown to curb epidemic of opioid overdose deaths