Trustee Gets $4.75 Million : J. David & Co. Insurer Agrees to Settlement

- Share via

An insurance company that in 1983 issued a $10 million bond protecting J. David & Co. against fraud has agreed to settle the policy by paying $4.75 million to the trustee now in charge of the bankrupt La Jolla investment firm.

The agreement between Federal Insurance Co. of New Jersey and trustee Louis Metzger was filed Friday in U.S. Bankruptcy Court.

The settlement also allows the insurance firm to file lawsuits on Metzger’s behalf to recover funds from “third parties” connected to J. David. The agreement requires Metzger to deliver to Federal Insurance all files, records and other documents relating to J. David’s outside accountants, attorneys, stockbrokers and other outside individuals and firms.

Mentioned specifically are the law firms of Wiles, Circuit & Tremblay and Rogers & Wells, which handled much of J. David’s legal work, including foreign currency trading activity, the so-called interbank.

Metzger will receive 25% of any funds recovered from J. David-related lawsuits eventually filed by the insurance company. When the insurance company’s share of the lawsuit monies reaches $4.75 million--equal to the amount it paid out to Metzger--the proceeds will be split 50/50 between the trustee and the company.

The settlement was complicated because Federal Insurance, a subsidiary of Chubb & Sons Insurance Cos., had a “strong legal defense” against paying off the bond, according to a source close to the case.

“You can’t bond yourself against fraud, as Dominelli did, and then steal from yourself,” said the source.

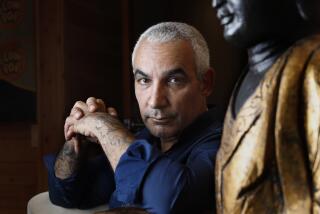

Jailed financier J. David (Jerry) Dominelli’s expected guilty pleas next Thursday to two counts of mail fraud, one count of bankruptcy fraud and a tax violation charge made the insurance settlement case even more complicated.

The insurance company’s position was that “Dominelli misrepresented and committed a fraud when he took the policy out” on March 8, 1983, said another source familiar with the settlement. “They know that Dominelli is going to plead guilty to fraud.”

A tentative settlement was first reached last November, but legal bargaining by both sides continued for four months. A final agreement was hammered out Thursday.

The agreement, which still requires approval by U.S. District Judge J. Lawrence Irving, is “very favorable to the estate,” said Metzger.

Not only will Metzger add $4.75 million to the nearly $11 million he has retrieved by selling J. David assets, but he also will be spared the expense of seeking restitution against potentially culpable third parties. He will still share in those proceeds, however.

The $4.75 million payment to Metzger is due 10 days after Irving’s approval of the agreement.

Metzger retains his rights to other bankruptcy claims, including preference payments made to J. David investors in the 90 days prior to the firm’s Feb. 13, 1984, forced bankruptcy.

Metzger has estimated that between $25 million and $30 million was paid out by J. David in that 90-day period--funds he is now trying to recover from investors.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.